Ohio it 501 Form

What is the Ohio IT 501?

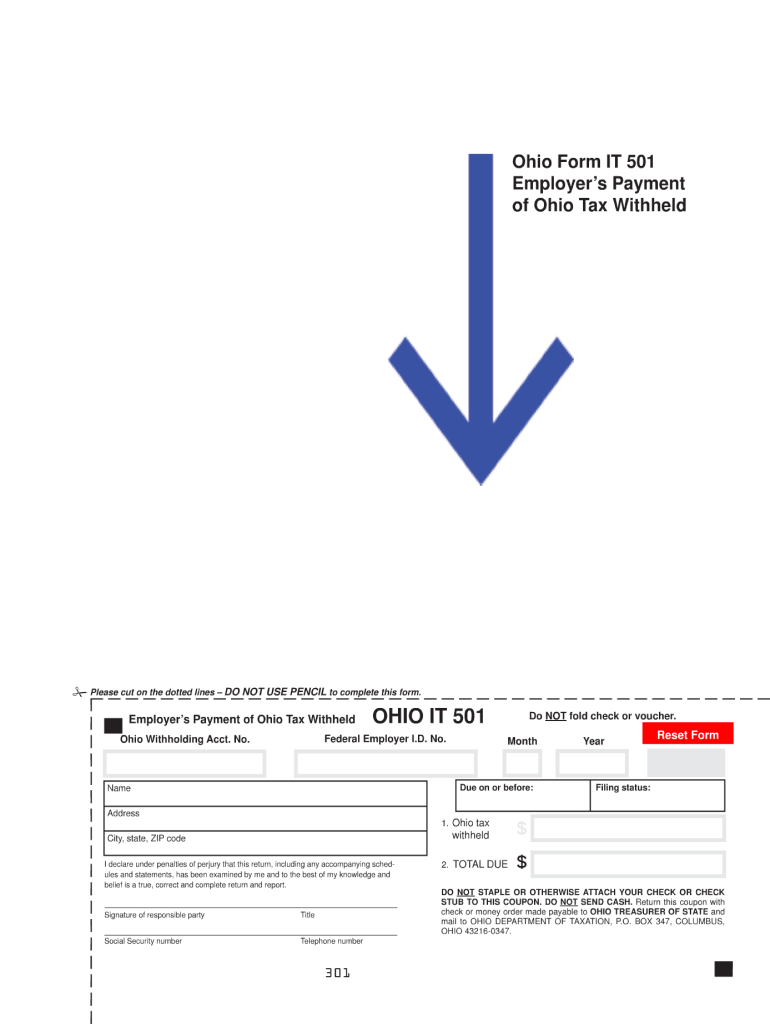

The Ohio IT 501 is a state tax form used by individuals and businesses to report and remit income tax withholding. This form is essential for employers who need to submit withheld taxes to the state of Ohio. The Ohio IT 501 form is designed to ensure compliance with state tax laws and to facilitate the accurate reporting of income tax withheld from employee wages. It is crucial for maintaining proper tax records and fulfilling state obligations.

How to use the Ohio IT 501

To use the Ohio IT 501, employers must first gather the necessary information regarding their employees' wages and the amount of tax withheld. The form can be completed online or printed for manual submission. Employers should ensure that all fields are accurately filled out, including the total amount of tax withheld and any applicable payment details. Once completed, the form can be submitted electronically or mailed to the appropriate state tax authority.

Steps to complete the Ohio IT 501

Completing the Ohio IT 501 involves several key steps:

- Gather employee wage information and withholding amounts.

- Access the Ohio IT 501 form, either online or in a printable format.

- Fill in the required fields, ensuring accuracy in all reported amounts.

- Review the completed form for any errors or omissions.

- Submit the form electronically or mail it to the designated state tax office.

Legal use of the Ohio IT 501

The Ohio IT 501 must be used in accordance with state tax regulations. Employers are legally required to submit this form to report income tax withholding accurately. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand the legal implications of using the Ohio IT 501 to ensure they meet all state requirements.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Ohio IT 501 to avoid penalties. Typically, the form should be submitted on a quarterly basis, with due dates falling on the last day of the month following the end of each quarter. It is important for employers to stay informed about these deadlines to ensure timely submission and compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Ohio IT 501 can be submitted through various methods to accommodate different preferences. Employers can choose to file the form online through the Ohio Department of Taxation's website, which offers a streamlined process. Alternatively, the completed form can be printed and mailed directly to the appropriate tax office. In-person submissions may also be possible at designated tax offices, providing flexibility for employers in meeting their filing obligations.

Quick guide on how to complete it 501 form

Your assistance manual on how to prepare your Ohio It 501

If you’re seeking to learn how to finalize and submit your Ohio It 501, here are some brief guidelines to streamline tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, create, and finalize your income tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust details when necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Ohio It 501 in moments:

- Create your account and start editing PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Ohio It 501 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if applicable).

- Review your document and rectify any errors.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please remember that submitting paper forms may lead to more mistakes and delayed refunds. Certainly, prior to e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How much does it cost to start a 501(c)3 in NYC?

According to the Department of State, Division of Corporations, State Records, and UCC for New York, you must pay the statutory filing fee of $75 (as of July 2017) along with a small fee to check name availability.Filling out your non-profit forms accurately is very, very important. Ultimately, what you put in your documents may affect whether you are (or will remain) tax-exempt. Now, with that being said, your state documents aren’t the only documents you must complete. You must also fill out an Application for Recognition of Exemption with the IRS. Some non-profits are eligible to fill out a streamlined version, but you should talk with an attorney or tax professional to determine which one you should complete.You may also be required to obtain certain permits or licenses in New York (at either the city or the state level). This depends on what your non-profit will do or sell in order to raise money. Without the right permits or licenses, your non-profit could be shut down.You also need to write bylaws and appoint directors to the non-profit. Directors are important and should be chosen with care. They make important business and financial decisions for your non-profit. They will also officially adopt the bylaws at the first board meeting. The bylaws explain how the non-profit will be ran.Because non-profits must remain in compliance with state and federal law, it’s a good idea to first speak with an attorney and maybe even consider allowing the attorney to fill out the documents. It’s really worth the price since the tax-exempt status of the non-profit can be affected by a mistake. If you’d like to speak with an experienced attorney, check out LawTrades. Our legal marketplace has helped connect many entrepreneurs with experienced, non-profit attorneys to get them up and running. Hope you give us a try!

-

How long does it take to file for a 501(C) or non-profit status and how much will it cost to do so?

It will take about 3 weeks to 1 year, and will cost a minimum of $275 if you do it entirely by yourself.Step 1: Creating the Nonprofit OrganizationThe first step is creating the nonprofit organization that will serve as the underlying 501(c) entity. The nonprofit organization generally can be an unincorporated association, a corporation or a trust.Trusts and unincorporated associations are created by contract, and so if you draft it yourself, there are no government fees involved. The time taken will depend on how long you take to draft and execute the necessary documents. If you are really really determined, you could get it done in a day or two.Corporations are creatures formed under the auspices of the laws of a particular state, and states charge a filing fee to establish a corporation. The time taken depends on the state. Many states have expedited processing where they will form the corporation in 24 hours. There also needs to be certain governing documents, and if you are really really determined, you could get it done in a day or two.Step 2: Obtaining a Tax-IDThere is no government fee for obtaining an employment identification number (EIN), which is the tax ID number for the nonprofit organization. So again, if you do it yourself, it is free. If you have a current social security number or individual tax identification number, this can be done online in under 5 minutes.Step 3: Obtaining Recognition of 501(c) StatusThe filing fee for form 1023-EZ is $275 (the short-form 501c3 application). The filing fee for all others is $600. Time taken for 1023-EZ is usually between 2 weeks to 6 weeks. Time taken for the rest is usually anywhere from 6 months to a year.Additionally, in certain categories, 501(c) status could be “self-declared.” For example, 501(c)(4)s, and 501(c)(3)s that are houses of worship or with income under $5,000. However, there are many risks involved in doing so.

-

I am a minor in Maryland. How do I start a nonprofit organization? My mom is helping me.

Here's a good summary of what's involved in Maryland: How to Form a Maryland Nonprofit Corporation | Nolo.com. The big problem you're going to run into is that all the incorporators of the corporation need to be over 18. Assuming your mother is willing to serve as an incorporator in your stead. You also need $170. The form is pretty simple to fill out, and importantly has the boilerplate text that the feds require. Fill out the form, pay your money, and you're a Maryland non-profit corporation. Well, you need to create bylaws, and such, but there are copy-and-paste samples out there you can use to create one from.Unfortunately, registering with the state gets you pretty close to bupkis. If you want to solicit funds from the public and have the be tax-exempt (and not have the donations be taxable income from the perspective of the feds and Maryland), you need to snag a federal 501(c)3 status, and that's a much more involved process involving more filing fees and more forms (and probably a lawyer, unless you really know what you're doing.) It took us nearly a year and a lot of back-and-forth with the IRS to get our 501(c)3, although things have evidently loosened up quick a bit since the scandals of a few years ago.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 501 form

How to generate an eSignature for the It 501 Form in the online mode

How to make an eSignature for the It 501 Form in Google Chrome

How to create an eSignature for signing the It 501 Form in Gmail

How to generate an electronic signature for the It 501 Form from your smartphone

How to make an eSignature for the It 501 Form on iOS devices

How to make an electronic signature for the It 501 Form on Android OS

People also ask

-

What is Ohio IT 501 and how does it relate to airSlate SignNow?

Ohio IT 501 refers to the digital transformation initiatives within Ohio that encourage businesses to adopt technology solutions like airSlate SignNow. By utilizing Ohio IT 501 compliant solutions, companies can streamline their document signing processes, improve efficiency, and ensure compliance with state regulations.

-

How much does airSlate SignNow cost for businesses in Ohio?

The pricing for airSlate SignNow varies based on the plan you choose. For businesses in Ohio, we offer flexible pricing options that cater to different needs, making it an affordable choice under the Ohio IT 501 initiative. You can explore our pricing plans on our website to find the best fit for your organization.

-

What features does airSlate SignNow offer for Ohio businesses?

airSlate SignNow provides a range of features that align with the needs of businesses in Ohio, including customizable templates, real-time tracking, and advanced security options. These features help companies streamline their document workflows while adhering to Ohio IT 501 guidelines for digital transactions.

-

How can airSlate SignNow enhance productivity for Ohio-based companies?

By utilizing airSlate SignNow, Ohio-based companies can signNowly enhance productivity through faster document turnaround times and reduced paper usage. The solution is designed to simplify the eSignature process, allowing teams to focus on core business activities while staying compliant with Ohio IT 501.

-

Does airSlate SignNow integrate with other software commonly used in Ohio?

Yes, airSlate SignNow seamlessly integrates with various software commonly used by Ohio businesses, including CRM systems, project management tools, and more. This flexibility ensures that organizations can maintain their existing workflows while benefiting from the efficiencies of Ohio IT 501 compliant eSigning.

-

Is airSlate SignNow secure and compliant with Ohio regulations?

Absolutely! airSlate SignNow is built with security in mind and complies with various regulations, including those specific to Ohio. Our platform ensures that your documents are protected while enabling compliance with Ohio IT 501 requirements for digital signatures.

-

What are the benefits of using airSlate SignNow for eSigning in Ohio?

The benefits of using airSlate SignNow in Ohio include faster processing times, enhanced security, and cost savings for businesses. By aligning with Ohio IT 501 standards, airSlate SignNow helps organizations modernize their operations and deliver a better experience to their clients and stakeholders.

Get more for Ohio It 501

- Local road and street finance bquestionnaireb the gdot dot ga form

- Guest billing form

- Lead consumer notice cws tceq form 20680a tceq texas

- Form for health center

- Anti bias classroom observation checklist environmental form

- Express screen printing work order form

- 2016 student release form

- Self certification form 1 7 days booths recruitment booths co

Find out other Ohio It 501

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document