Importer Self Assessment Handbook 2017-2026

Understanding the Utah Change Commerce Form

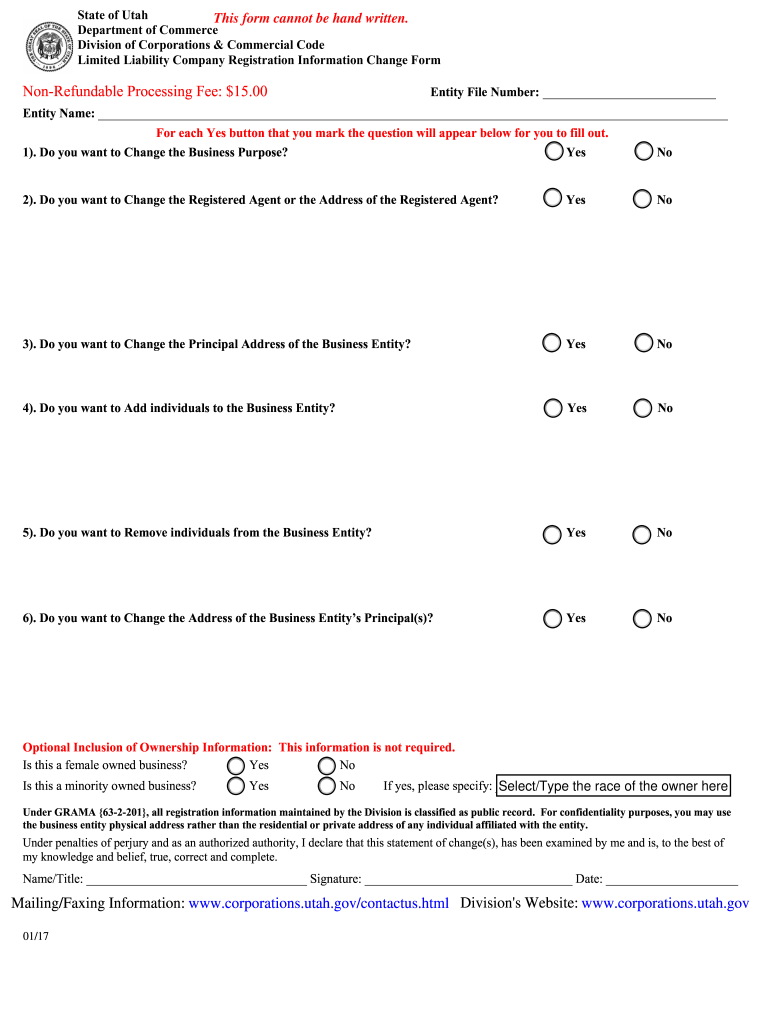

The Utah change commerce form is essential for businesses looking to update their registration information with the state. This form allows companies to submit necessary changes, ensuring compliance with local regulations. It is crucial for maintaining accurate records, which can affect everything from tax obligations to legal standing. Understanding the specific requirements and implications of this form can help businesses navigate the regulatory landscape effectively.

Steps to Complete the Utah Change Commerce Form

Completing the Utah change commerce form involves several key steps:

- Gather necessary information, including your business's current registration details and the specific changes you wish to make.

- Access the form, which can typically be found on the state's official website or through authorized platforms.

- Carefully fill out the form, ensuring all fields are completed accurately to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form either online or via mail, depending on the options provided by the state.

Required Documents for Submission

When submitting the Utah change commerce form, certain documents may be required to support your application. These can include:

- Proof of identity for the business owner or authorized representative.

- Documentation that verifies the changes being made, such as amendments to operating agreements or partnership agreements.

- Any applicable fees associated with the filing process.

Ensuring you have all necessary documents ready can streamline the submission process and reduce the likelihood of complications.

Legal Considerations for the Utah Change Commerce Form

Filing the Utah change commerce form correctly is vital for legal compliance. Inaccuracies or incomplete submissions can lead to penalties or delays in processing. It is important to be aware of the following legal considerations:

- The form must be submitted in accordance with state deadlines to avoid late fees.

- Changes must comply with both state and federal regulations governing business operations.

- Failure to update registration information can result in the loss of good standing for your business.

Form Submission Methods

The Utah change commerce form can typically be submitted through various methods, allowing flexibility for businesses. Common submission methods include:

- Online submission through the state’s business portal, which is often the fastest option.

- Mailing a physical copy of the form to the appropriate state office.

- In-person submission at designated state offices, which may be necessary for certain types of changes.

Penalties for Non-Compliance

Failure to file the Utah change commerce form or submitting incorrect information can lead to significant penalties. These may include:

- Monetary fines imposed by the state.

- Potential legal action against the business for non-compliance.

- Loss of business privileges or licenses if the registration is not kept current.

Understanding these risks emphasizes the importance of timely and accurate submissions.

Quick guide on how to complete limited liability company registration information change form

Handle Importer Self Assessment Handbook anytime, anywhere

Your daily organizational procedures may require extra attention when working with state-specific business documents. Reclaim your work hours and reduce the printing costs linked to document-centric processes with airSlate SignNow. airSlate SignNow provides a wide range of ready-made business documents, including Importer Self Assessment Handbook, which you can utilize and distribute among your business associates. Administer your Importer Self Assessment Handbook effortlessly with robust editing and eSignature tools and send it straight to your recipients.

How to acquire Importer Self Assessment Handbook in a few simple steps:

- Select a form pertinent to your state.

- Click Learn More to access the document and verify its accuracy.

- Choose Get Form to commence working with it.

- Importer Self Assessment Handbook will open automatically in the editor. No further actions are required.

- Utilize airSlate SignNow’s advanced editing features to complete or alter the form.

- Select the Sign feature to create your signature and electronically sign your document.

- When you are finished, simply click Done, save changes, and access your document.

- Share the form via email or SMS, or opt for a link-to-fill option with collaborators or allow them to download the documents.

airSlate SignNow signNowly conserves your time managing Importer Self Assessment Handbook and enables you to locate essential documents in a single location. A comprehensive library of forms is organized and designed to address critical business functions essential for your enterprise. The sophisticated editor reduces the chance of errors, as you can effortlessly correct mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your daily business activities.

Create this form in 5 minutes or less

Find and fill out the correct limited liability company registration information change form

FAQs

-

How do I change a limited partnership to limited company in UK?

The two are incompatible so you need to dissolve the partnership first then open a new limited liability company.Dissolving a limited partnershipYou can dissolve your limited partnership for any number of reasons - for example financial reasons, business purposes or personal disagreements. For limited partnerships, the dissolution must be handled by the general partners unless the court decides otherwise.A limited partnership cannot be dissolved through any of the following circumstances:a limited partner giving notice - unless there is a previous agreement between the partnersa limited partner offering his share as security for a debt - unless there is a previous agreement between the partnersthe death or bankruptcy of a limited partnera limited partner is considered a 'person of unsound mind' - unless their share cannot be determinedNotifying Companies HouseThe general partners are responsible for filing Forms LP5 and LP6 at Companies House even if accountants or other professionals have helped in their preparation.The Limited Partnerships Act 1907 provides for the levying of penalties for failing to send the required forms to the Registrar.There is no specific requirement for you to notify Companies House when dissolving a limited partnership. However, if you do notify Companies House of the dissolution of your limited partnership by filling in a form LP6, it will be accepted in good faith but the name will still remain on the index of live company names.How to set up a limited companyAside from the sole trader route, the limited liability company is the most popular business structure in the UK.With a limited company, the liability of company directors is ‘limited’ in that the company’s finances are separate from the personal finances of the business owner. This is not the case for those who run their business as a sole trader (self employed).Limited company shareholders are not responsible for any debts run up by the business, although banks may ask company directors to provide loan guarantees for commercial loans or credit taken out in the company’s name. If you want to set up a limited company right away, you can do this easily online. Registering a new limited company – the company formation processCompanies House is the regulatory body for the registration of all limited companies in the UK, and maintains the registry of companies.Before you can start a business as a limited company, the company itself has to be registered with Companies House.Registering a new company is a relatively simple process. You can either do this yourself, ask your accountant to do it for you, or do it all through a company formations agent.The most popular option is to use a company formation agent. They allow you to complete the entire registration process online, and it can all be completed in a matter of hours.Documents you will need to complete to register a limited companyWhen you are registering a new limited company, the following documents have to be completed and returned to Companies House:Memorandum of Association – this includes the names and addresses of the subscribers who are forming the limited company.Articles of Association – outlines the directors’ powers, and any shareholders’ rights, etc.Form IN01 – contains details of the director(s), company secretary (optional), details of any shareholders, and details of the share capital (if it is a company limited by shares).Company formation agents will have ready-made copies of these documents.The Companies House website provides detailed guidance and FAQ’s which describe all aspects and requirements of the registration process, including the limitations imposed on company names, and the payment required to complete the registration process.Types of limited companyPrivate Limited Companies, the most typical set up for small UK businesses cannot offer shares to the public, but may have any number of shareholders.Each limited company must have at least one director. Following the implementation of the Companies Act 2006, having a company secretary is no longer a legal requirement, although you may wish to appoint one.Unlike limited liability companies, public limited companies (PLCs) are allowed to offer their shares to the public in order to raise funds. A PLC must have at least 2 directors to make management decisions, and a company secretary.Requirements of Limited CompaniesThere are some high level requirements which all limited companies must fulfil:The company must be registered at Companies HouseThe company’s annual accounts must be filed at Companies HouseAn Annual Return (Form AR01) must be completed each year to ensure Companies House records the most up-to-date information about the company. This is subject to a modest annual fee.HMRC must be informed if the company has any profits or taxable income on an annual basis.Every limited company must complete an annual corporation tax return. Any liabilities must be paid within 9 months of the company year end.All company employees must pay income tax and National Insurance Contributions (NICs)

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

How can I change CA firms if I filled out an articleship form in February but did not submit it to the ICAI? Can the principal have restrictions in registration?

If the article ship registration has not been done, the principal can generally not restrict you.However, if there are any serious mis conduct on your end, then he can place his views to the Institute, so that the Institute can take appropriate action in such a way that you are not enrolled as an articled clerk under ICAI rules. But this is very rare, and exceptional circumstances.In general, and if you have conducted yourselves professionally, then there is no need to worry.

Create this form in 5 minutes!

How to create an eSignature for the limited liability company registration information change form

How to make an eSignature for your Limited Liability Company Registration Information Change Form online

How to create an eSignature for your Limited Liability Company Registration Information Change Form in Google Chrome

How to create an eSignature for putting it on the Limited Liability Company Registration Information Change Form in Gmail

How to make an electronic signature for the Limited Liability Company Registration Information Change Form right from your smart phone

How to make an electronic signature for the Limited Liability Company Registration Information Change Form on iOS

How to create an electronic signature for the Limited Liability Company Registration Information Change Form on Android devices

People also ask

-

What is the Importer Self Assessment Handbook?

The Importer Self Assessment Handbook is a comprehensive guide designed to help importers understand their responsibilities and improve compliance with customs regulations. By following this handbook, businesses can streamline their import processes and mitigate risks associated with non-compliance.

-

How can the Importer Self Assessment Handbook benefit my business?

Using the Importer Self Assessment Handbook can signNowly enhance your business's import efficiency by providing clear guidelines on best practices. This handbook helps you identify areas for improvement, ultimately leading to cost savings and a smoother import experience.

-

Is the Importer Self Assessment Handbook suitable for small businesses?

Absolutely! The Importer Self Assessment Handbook is tailored for businesses of all sizes, including small enterprises. Its straightforward approach ensures that even smaller operations can effectively navigate the complexities of import regulations and compliance.

-

What features are included in the Importer Self Assessment Handbook?

The Importer Self Assessment Handbook includes detailed checklists, compliance tips, and case studies that illustrate successful import strategies. These features are designed to provide practical insights and actionable steps for improving your import practices.

-

How much does the Importer Self Assessment Handbook cost?

Pricing for the Importer Self Assessment Handbook varies based on the format and any additional resources you may choose. However, it is designed to be a cost-effective solution that offers signNow value in terms of compliance and efficiency.

-

Can the Importer Self Assessment Handbook be integrated with other tools?

Yes, the Importer Self Assessment Handbook can be easily integrated with various business management tools to enhance its utility. This integration allows for seamless tracking of compliance efforts and helps ensure that your import processes are well-documented.

-

What type of support is available for users of the Importer Self Assessment Handbook?

Users of the Importer Self Assessment Handbook can access extensive support resources, including customer service and online forums. These resources are designed to help you effectively implement the strategies outlined in the handbook and resolve any queries you may encounter.

Get more for Importer Self Assessment Handbook

- Ppd form 20334450

- Unitron earmold order form 214307548

- Exxonmobil aetna flexible spend form

- Kyleena skyla bayer request form

- Virginia dmas 225 form

- Bis business information sheet city of chicago cityofchicago

- Form it 613 claim for environmental remediation insurance credit tax year

- General labor contract template form

Find out other Importer Self Assessment Handbook

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form