Form 1730, Wage and Benefits Plan Employee Compensation 1730 PDF

What is the Form 1730?

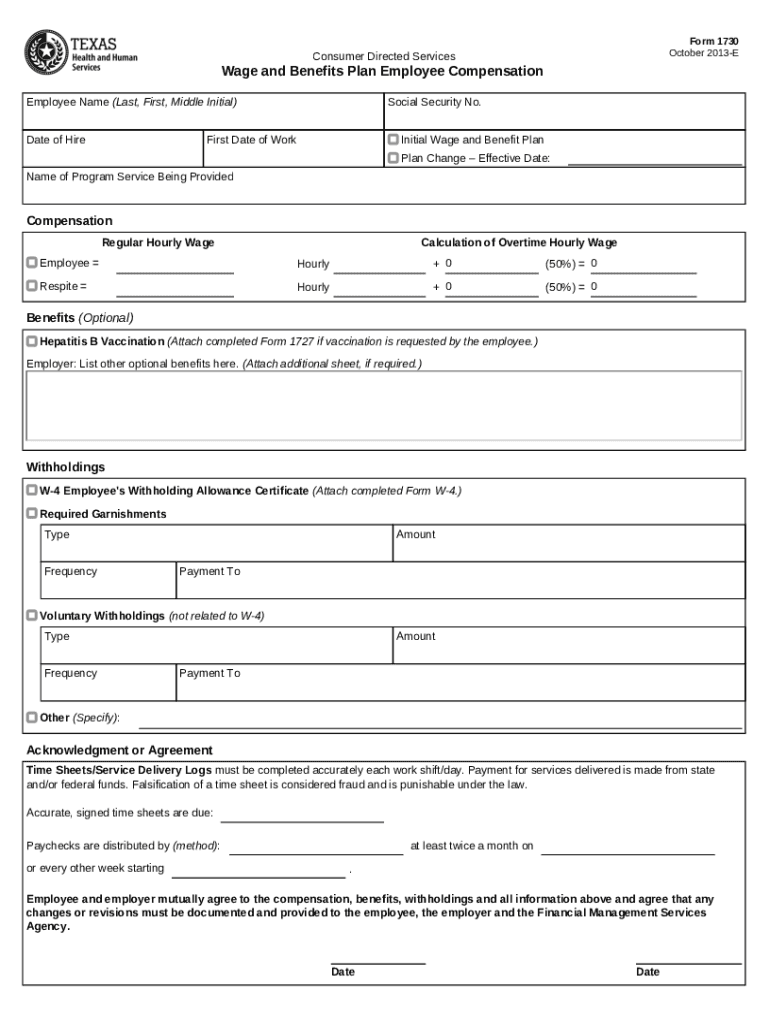

The Form 1730, also known as the Wage and Benefits Plan Employee Compensation 1730, is a document used primarily in Texas for reporting employee compensation and benefits. This form is essential for employers to ensure compliance with state regulations regarding employee wages and benefits. It serves as a formal declaration of the compensation structure for employees, detailing wages, benefits, and any applicable deductions. Understanding this form is crucial for both employers and employees to maintain transparency and adherence to legal requirements.

How to Use the Form 1730

Using the Form 1730 involves several steps to ensure accurate completion and submission. First, employers must gather all relevant information regarding employee compensation, including wages, benefits, and any deductions. Next, the form should be filled out carefully, ensuring all sections are completed with accurate data. Once the form is filled, it must be submitted to the appropriate state agency. Employers should retain a copy for their records to ensure compliance and facilitate any future audits or inquiries.

Steps to Complete the Form 1730

Completing the Form 1730 requires attention to detail. Here are the steps to follow:

- Gather all necessary employee information, including names, positions, and compensation details.

- Access the latest version of the Form 1730, ensuring it is the correct document for the reporting period.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the designated state agency by the specified deadline.

Key Elements of the Form 1730

The Form 1730 includes several key elements that must be accurately reported. These elements typically consist of:

- Employee identification details, including name and social security number.

- Details of compensation, including base salary, bonuses, and other forms of remuneration.

- Information about benefits provided, such as health insurance, retirement plans, and other perks.

- Any deductions that may apply to the employee's compensation.

Legal Use of the Form 1730

The legal use of the Form 1730 is essential for compliance with state labor laws. Employers are required to submit this form to report accurate compensation data, which helps ensure that employees receive fair wages and benefits as mandated by law. Failure to properly complete and submit the form can result in penalties and legal repercussions for employers. It is important for businesses to stay informed about any changes in regulations that may affect the use of this form.

State-Specific Rules for the Form 1730

In Texas, the Form 1730 is subject to specific state regulations that govern employee compensation and benefits. Employers must adhere to these rules to ensure compliance. This includes understanding the reporting requirements, deadlines for submission, and any updates to the form itself. It is advisable for employers to consult with legal or HR professionals to stay updated on any changes in state laws that may impact the use of the Form 1730.

Quick guide on how to complete form 1730 wage and benefits plan employee compensation 1730 pdf

Complete Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to acquire the right form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf with ease

- Obtain Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and hit the Done button to save your updates.

- Select your preferred method of sharing your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, lengthy form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1730 wage and benefits plan employee compensation 1730 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1730 form and why is it important?

The 1730 form is a crucial document used for various business transactions, ensuring compliance and proper record-keeping. Understanding its significance can help streamline your processes and avoid potential legal issues. With airSlate SignNow, you can easily create, send, and eSign your 1730 form efficiently.

-

How does airSlate SignNow simplify the process of handling a 1730 form?

airSlate SignNow offers an intuitive platform that allows users to create and manage their 1730 form with ease. The solution provides templates, automated workflows, and eSignature capabilities, making it simple to complete and send documents securely. This streamlines your workflow and saves valuable time.

-

What are the pricing options for using airSlate SignNow for a 1730 form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from various subscription tiers that provide access to features specifically designed for managing documents like the 1730 form. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other software for managing the 1730 form?

Yes, airSlate SignNow supports integrations with numerous third-party applications, enhancing your ability to manage the 1730 form seamlessly. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect with them to streamline your document workflows.

-

What features does airSlate SignNow offer for eSigning a 1730 form?

airSlate SignNow provides robust eSigning features that ensure your 1730 form is signed securely and legally. Users can add signature fields, set signing orders, and track the status of their documents in real-time. This enhances the efficiency of your signing process.

-

Is airSlate SignNow secure for handling sensitive 1730 forms?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication measures to protect your 1730 form and other sensitive documents. You can trust that your information is safe while using our platform.

-

How can airSlate SignNow help with the compliance of the 1730 form?

Using airSlate SignNow ensures that your 1730 form is compliant with industry regulations and standards. Our platform provides audit trails and secure storage, making it easier to maintain compliance and access necessary documentation when needed.

Get more for Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf

- Landlord authorisation letterpdf bahamas electricity corporation form

- Summer 2016 enrollment application esf summer camps form

- Medical records request form gainesville obgyn

- 2016 hacemos scholarship program applicant appraisalacademic record form as part of your application upload this completed form

- Honoree acceptance form honoree acceptance form listify

- Paml federal drug testing custody and control form 110 w

- Parentage amp allocation petition illinois legal aid online illinoislegalaid form

- Fl 341d 2016 2019 form

Find out other Form 1730, Wage And Benefits Plan Employee Compensation 1730 pdf

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself