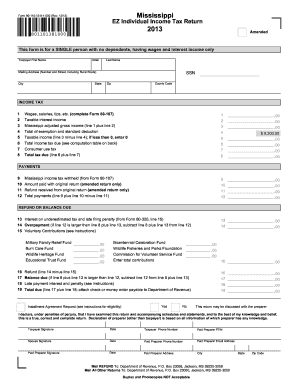

1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form is for a SINGLE Person with No Dependents, Having 2018

What is the 1213 Print Form EZ Individual Income Tax Return?

The 1213 Print Form EZ Individual Income Tax Return is a simplified tax form specifically designed for single individuals who do not have dependents. This form is applicable for taxpayers who earn income solely from wages and interest. It allows eligible individuals to report their income and calculate their tax liability in an efficient manner. This form is particularly useful for those looking to file their taxes without the complexities associated with more detailed forms.

How to Obtain the 1213 Print Form EZ Individual Income Tax Return

To obtain the 1213 Print Form EZ Individual Income Tax Return, individuals can visit the official IRS website, where they can find downloadable PDF versions of the form. Additionally, local IRS offices may provide physical copies. It is important to ensure that the correct version of the form is being used, especially if amendments are necessary.

Steps to Complete the 1213 Print Form EZ Individual Income Tax Return

Completing the 1213 Print Form EZ involves several key steps:

- Begin by entering your personal information, including your first name, middle initial, last name, and mailing address.

- Report your total wages and interest income accurately in the designated fields.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the completed form either electronically or by mail, following the specified guidelines.

Legal Use of the 1213 Print Form EZ Individual Income Tax Return

The 1213 Print Form EZ is legally recognized by the IRS for filing individual income taxes. It is essential for taxpayers to use this form correctly to avoid any legal issues or penalties. Filing the form accurately ensures compliance with federal tax regulations and helps maintain good standing with the IRS.

Key Elements of the 1213 Print Form EZ Individual Income Tax Return

Important elements of the 1213 Print Form EZ include:

- Taxpayer identification details: This includes the taxpayer's name and mailing address.

- Income reporting sections: These sections require detailed entries for wages and interest income.

- Tax calculation area: This part helps determine the total tax owed based on the reported income.

- Signature line: A crucial element where the taxpayer certifies the accuracy of the information provided.

Filing Deadlines and Important Dates

Filing deadlines for the 1213 Print Form EZ are typically aligned with the annual tax filing schedule set by the IRS. Generally, individual income tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable for taxpayers to keep track of any changes in deadlines to ensure timely filing.

Quick guide on how to complete 1213 print form ez individual income tax return 801101381000 amended this form is for a single person with no dependents having

Prepare 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It serves as a suitable eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your paperwork quickly and without complications. Manage 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having with ease

- Obtain 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having and click Get Form to initiate the process.

- Take advantage of the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Recheck the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Edit and eSign 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1213 print form ez individual income tax return 801101381000 amended this form is for a single person with no dependents having

Create this form in 5 minutes!

How to create an eSignature for the 1213 print form ez individual income tax return 801101381000 amended this form is for a single person with no dependents having

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

The 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended is a simplified tax form designed for single individuals with no dependents. It is specifically tailored for taxpayers who have wages and interest income only, making it easier to file your taxes accurately and efficiently.

-

Who should use the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

This form is ideal for single taxpayers without dependents who earn income solely from wages and interest. If you meet these criteria, using the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended can streamline your tax filing process.

-

How can I access the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

You can easily access the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended through the airSlate SignNow platform. Simply log in or create an account, and you will find the form available for download and completion.

-

Is there a cost associated with using the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

Using the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended through airSlate SignNow is part of our cost-effective solution for document management. Pricing may vary based on your subscription plan, but we strive to offer affordable options for all users.

-

What features does airSlate SignNow offer for the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

airSlate SignNow provides a range of features for the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended, including eSigning, document sharing, and secure storage. These features enhance your ability to manage your tax documents efficiently and securely.

-

Can I integrate the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, making it easy to incorporate the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended into your existing workflow. This integration helps streamline your tax preparation process.

-

What are the benefits of using the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended?

The primary benefits of using the 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended include simplified filing, reduced errors, and faster processing times. By utilizing this form, you can ensure that your tax return is accurate and submitted promptly.

Get more for 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having

- Ar affidavit form

- Yardi manual form

- Ncb online form

- Debarment form

- Paternity form ny

- Nyc parking permits for people with disabilities renewal on line form

- Certification by broker welcome to nycgov city of new nyc form

- 10 health screening questionnaire templates in pdf doc 30 questionnaire examples in pdf google docs 29 questionnaire examples form

Find out other 1213 Print Form EZ Individual Income Tax Return 801101381000 Amended This Form Is For A SINGLE Person With No Dependents, Having

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word