Ma 355 7004 2020-2026

What is the MA

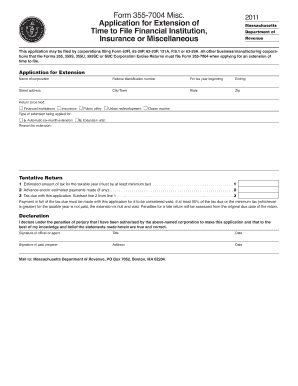

The MA is a specific form used in Massachusetts for tax purposes. This form is primarily utilized by businesses to report their income and calculate their tax obligations. It is essential for ensuring compliance with state tax laws and regulations. Understanding the purpose and requirements of the MA is crucial for any business operating within the state.

How to obtain the MA

To obtain the MA, businesses can visit the Massachusetts Department of Revenue website. The form is available for download in a PDF format, which can be printed and filled out manually. Additionally, businesses can inquire at local tax offices or consult with tax professionals for assistance in acquiring the form. It is advisable to ensure that you are using the most current version of the form for accurate reporting.

Steps to complete the MA

Completing the MA involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all sections are completed.

- Calculate the total income and applicable deductions as per the guidelines.

- Review the completed form for accuracy before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the MA

The MA is legally mandated for businesses operating in Massachusetts. Proper use of this form is essential for compliance with state tax laws. Failing to submit the form or providing inaccurate information can result in penalties or legal repercussions. It is important for businesses to understand their obligations regarding this form and to seek legal advice if needed.

Filing Deadlines / Important Dates

Filing deadlines for the MA are critical for compliance. Typically, the form must be submitted by the due date for the business's tax return. It is important to check for any updates or changes to deadlines each tax year, as they may vary. Marking these dates on a calendar can help ensure timely submission and avoid potential penalties.

Required Documents

When completing the MA, several documents are required to support the information reported. These may include:

- Income statements, such as profit and loss statements.

- Expense documentation, including receipts and invoices.

- Previous tax returns for reference.

- Any other relevant financial records that substantiate the claims made on the form.

Form Submission Methods

The MA can be submitted through various methods. Businesses may choose to file the form online via the Massachusetts Department of Revenue's e-filing system. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at local tax offices. Each method has its own guidelines and deadlines, so it is essential to choose the one that best suits your needs.

Quick guide on how to complete ma 355 7004

Complete Ma 355 7004 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Ma 355 7004 on any device with airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

The easiest way to modify and electronically sign Ma 355 7004 effortlessly

- Obtain Ma 355 7004 and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Ma 355 7004 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma 355 7004

Create this form in 5 minutes!

How to create an eSignature for the ma 355 7004

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 355 7004 in airSlate SignNow?

The number 355 7004 is often associated with our customer support line, where users can get assistance with airSlate SignNow. This ensures that you have direct access to help when you need it, making your experience with our eSigning solution seamless and efficient.

-

How does airSlate SignNow compare in pricing to other eSignature solutions?

airSlate SignNow offers competitive pricing that is designed to be cost-effective for businesses of all sizes. With plans starting at affordable rates, you can leverage the power of eSigning without breaking the bank, making it a smart choice compared to other solutions in the market.

-

What features does airSlate SignNow provide for document signing?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing process, ensuring that you can manage your documents efficiently and securely, all while utilizing the benefits of 355 7004.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow offers integrations with numerous software applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and enhance productivity by connecting your existing tools with the capabilities of 355 7004.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. By adopting our solution, you can improve your business processes and save time, all while enjoying the advantages of 355 7004.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. With its user-friendly interface and affordable pricing, small businesses can easily adopt 355 7004 to enhance their document management and signing processes.

-

How secure is the airSlate SignNow platform?

The security of your documents is a top priority for airSlate SignNow. We utilize advanced encryption and compliance with industry standards to ensure that your data remains safe and secure while using 355 7004 for your eSigning needs.

Get more for Ma 355 7004

- Provider interest form umbh university of miami umbh med miami

- U miami transcript request form

- Mihalik group medical necessity form

- Take care communication in english nina ito pdf form

- Lifsonshapira scholarships application form

- Lifson scholarship application form university of minnesota policy umn

- School monitoring format

- Mississippi athletic participation form

Find out other Ma 355 7004

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request