Who is Eligible Disability Tax Credit DTC Form

Eligibility Criteria for the Disability Tax Credit

The Disability Tax Credit (DTC) is designed to assist individuals with disabilities by reducing their tax burden. To qualify for the DTC, applicants must meet specific criteria outlined by the IRS. Generally, individuals must demonstrate that they have a physical or mental impairment that significantly restricts their ability to perform basic daily activities. This includes tasks such as walking, seeing, hearing, and performing routine activities. Additionally, the impairment must be expected to last for at least twelve months.

In some cases, the impairment may be less visible, such as chronic pain or mental health conditions. It is essential to provide comprehensive medical documentation to support the application. This documentation should detail the nature of the disability, its impact on daily life, and any treatments or therapies being pursued.

Required Documents for the Disability Tax Credit Application

When applying for the Disability Tax Credit, specific documents are necessary to support the application. These documents typically include:

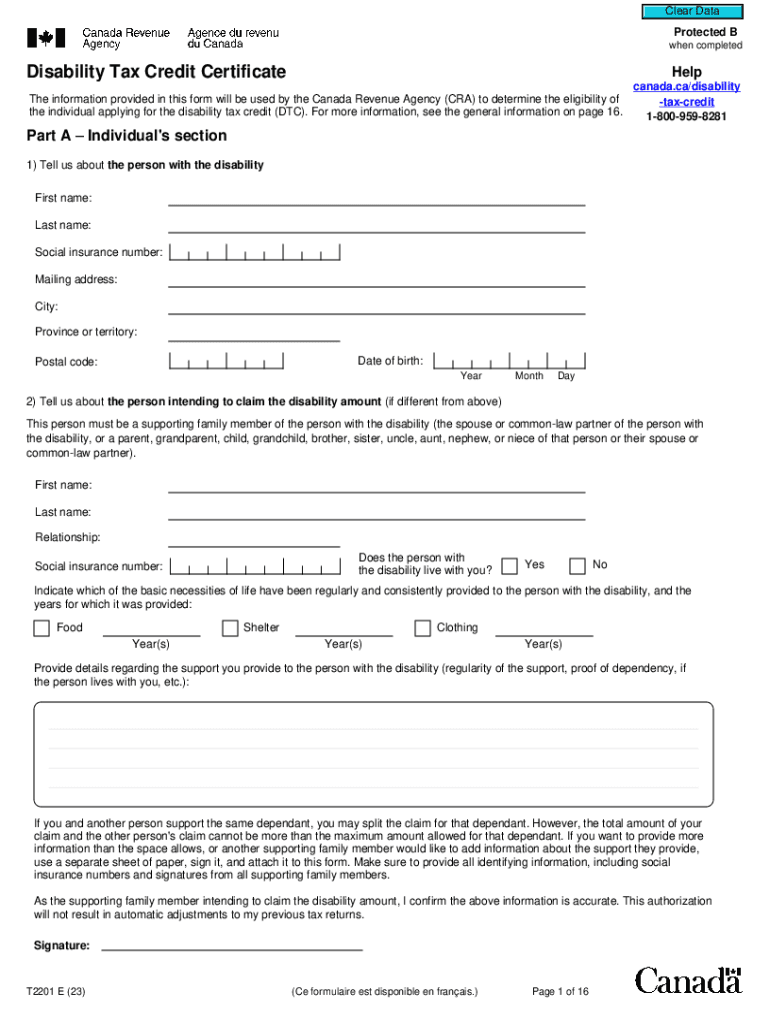

- Form T2201: This is the Disability Tax Credit Certificate, which must be completed by a qualified medical practitioner. It certifies the nature and extent of the disability.

- Medical Records: Detailed medical records that outline the diagnosis, treatment history, and the impact of the disability on daily living activities.

- Personal Identification: A valid form of identification, such as a driver's license or Social Security card, may be required to verify identity.

- Tax Returns: Previous tax returns may be requested to assess eligibility based on income levels.

Gathering these documents ahead of time can streamline the application process and ensure that all necessary information is submitted for review.

Steps to Complete the Disability Tax Credit Application

Completing the Disability Tax Credit application involves several key steps to ensure accuracy and compliance with IRS regulations. Here is a structured approach:

- Gather Required Documents: Collect all necessary documentation, including Form T2201, medical records, and personal identification.

- Complete Form T2201: Fill out the Disability Tax Credit Certificate, ensuring that a qualified medical practitioner completes the relevant sections.

- Review the Application: Double-check all information for accuracy, ensuring that all fields are filled out correctly and that documents are attached.

- Submit the Application: Send the completed application and supporting documents to the appropriate IRS address, or submit electronically if applicable.

- Monitor the Application Status: Keep track of the application status by checking with the IRS or through any provided tracking methods.

Following these steps can help ensure a smooth application process and increase the likelihood of approval.

Form Submission Methods for the Disability Tax Credit Application

Applicants have several options for submitting their Disability Tax Credit application. Each method has its advantages, depending on personal preferences and circumstances:

- Online Submission: If eligible, applicants can submit their application electronically through the IRS website, which can expedite processing times.

- Mail Submission: Applications can be sent via traditional mail to the designated IRS address. It is advisable to use a trackable mailing option to confirm delivery.

- In-Person Submission: Some applicants may prefer to submit their forms in person at a local IRS office. This option allows for immediate confirmation of receipt.

Choosing the right submission method can help ensure that the application is processed efficiently and without delays.

Application Process & Approval Time for the Disability Tax Credit

The application process for the Disability Tax Credit can vary in duration based on several factors, including the completeness of the application and the volume of submissions received by the IRS. After submitting the application, it typically takes several weeks to a few months for the IRS to process it.

During this time, the IRS may reach out for additional information or clarification. It is crucial for applicants to respond promptly to any inquiries to avoid delays. Once the application is approved, the IRS will issue a Disability Tax Credit certificate, which can be used to claim the credit on future tax returns.

Staying informed about the application status and understanding the expected timeline can help manage expectations throughout the process.

Quick guide on how to complete who is eligible disability tax credit dtc

Complete Who Is Eligible Disability Tax Credit DTC seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Manage Who Is Eligible Disability Tax Credit DTC on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Who Is Eligible Disability Tax Credit DTC effortlessly

- Find Who Is Eligible Disability Tax Credit DTC and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Who Is Eligible Disability Tax Credit DTC and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the who is eligible disability tax credit dtc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the disability tax credit application process?

The disability tax credit application process involves filling out the necessary forms to determine eligibility for the credit. You can complete the application online or through paper forms, ensuring you provide all required medical and personal information. Using airSlate SignNow can simplify this process by allowing you to eSign documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for the disability tax credit application?

airSlate SignNow offers a cost-effective solution for managing your disability tax credit application. Pricing varies based on the plan you choose, but it generally includes features that streamline document management and eSigning. You can explore different pricing tiers to find the best fit for your needs.

-

What features does airSlate SignNow offer for the disability tax credit application?

airSlate SignNow provides a range of features designed to enhance your disability tax credit application experience. These include customizable templates, secure eSigning, and document tracking, which help ensure that your application is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other applications for my disability tax credit application?

Yes, airSlate SignNow offers integrations with various applications that can assist in your disability tax credit application process. This includes popular tools for document management and customer relationship management (CRM), allowing you to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my disability tax credit application?

Using airSlate SignNow for your disability tax credit application provides numerous benefits, including time savings and enhanced security. The platform allows you to eSign documents quickly and track their status, ensuring that your application is processed without unnecessary delays.

-

Is airSlate SignNow user-friendly for completing a disability tax credit application?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the disability tax credit application process. The intuitive interface allows users to complete and eSign documents without any technical expertise.

-

How can I ensure my disability tax credit application is secure with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your disability tax credit application. You can rest assured that your personal and financial information is safe while using the platform for eSigning and document management.

Get more for Who Is Eligible Disability Tax Credit DTC

Find out other Who Is Eligible Disability Tax Credit DTC

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free