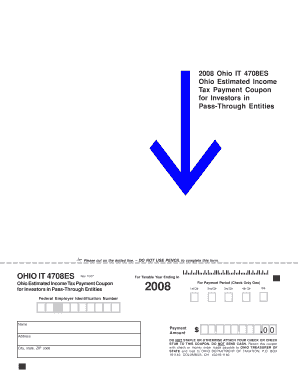

Ohio Estimated Income Tax Payment Coupon for Investors in Pass through Entities Form

What is the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

The Ohio Estimated Income Tax Payment Coupon for Investors in Pass Through Entities is a specific document used by individuals who earn income through entities such as partnerships, S corporations, and limited liability companies. This coupon allows these investors to make estimated tax payments to the state of Ohio. It is essential for ensuring compliance with state tax obligations, as pass-through entities do not pay taxes at the entity level, and instead, the tax responsibility is passed on to individual investors.

How to use the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

To use the Ohio Estimated Income Tax Payment Coupon, investors should first calculate their estimated tax liability based on their expected income from the pass-through entities. Once the amount is determined, the investor fills out the coupon with their personal information, including name, address, and Social Security number. The calculated payment amount should be clearly indicated on the coupon. After completing the form, the investor can submit the coupon along with their payment to the appropriate Ohio tax authority.

Steps to complete the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

Completing the Ohio Estimated Income Tax Payment Coupon involves several steps:

- Gather your financial information, including income from pass-through entities.

- Calculate your estimated tax liability based on your projected income.

- Obtain the coupon from the Ohio Department of Taxation website or through other official channels.

- Fill in your personal details and the calculated payment amount on the coupon.

- Review the completed coupon for accuracy.

- Submit the coupon along with your payment by the due date.

Legal use of the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

The use of the Ohio Estimated Income Tax Payment Coupon is legally mandated for individuals who earn income from pass-through entities. It helps ensure that taxpayers meet their estimated tax obligations as required by Ohio law. Failure to use the coupon appropriately may result in penalties or interest on unpaid taxes. Therefore, understanding the legal requirements surrounding this coupon is crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Estimated Income Tax Payment Coupon are typically aligned with quarterly estimated tax payment schedules. Payments are generally due on the fifteenth day of April, June, September, and January of the following year. It is important for investors to keep track of these dates to avoid late fees and penalties. Marking these deadlines on a calendar can help ensure timely submissions.

Who Issues the Form

The Ohio Department of Taxation is responsible for issuing the Ohio Estimated Income Tax Payment Coupon. This state agency provides the necessary forms and guidance for taxpayers to fulfill their estimated tax payment obligations. Investors should refer to the official Ohio Department of Taxation website for the most current versions of the coupon and any updates regarding tax regulations.

Quick guide on how to complete ohio estimated income tax payment coupon for investors in pass through entities

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

Create this form in 5 minutes!

How to create an eSignature for the ohio estimated income tax payment coupon for investors in pass through entities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities?

The Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities is a document that allows investors in pass-through entities to make estimated tax payments to the state of Ohio. This coupon simplifies the process of fulfilling tax obligations, ensuring compliance and avoiding penalties. By using this coupon, investors can manage their tax payments efficiently.

-

How can airSlate SignNow help with the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities. Our solution ensures that all documents are securely signed and stored, making it easy for investors to manage their tax-related paperwork. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions, with discounts available for longer commitments.

-

Are there any integrations available with airSlate SignNow for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your ability to manage the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities. These integrations allow for automatic data transfer and streamlined workflows, making tax preparation and filing more efficient. You can connect with popular platforms to simplify your processes.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features designed to simplify the management of tax documents, including the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities. Key features include customizable templates, secure eSigning, document tracking, and cloud storage. These tools help ensure that your tax documents are organized and easily accessible.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities. Our platform employs advanced encryption and security protocols to protect your data. Additionally, we comply with industry standards to ensure that your information remains confidential and secure.

-

Can I access airSlate SignNow on mobile devices for tax document management?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage the Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities on the go. Our mobile app provides full functionality, enabling you to create, send, and eSign documents from anywhere. This flexibility ensures that you can stay on top of your tax obligations no matter where you are.

Get more for Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

Find out other Ohio Estimated Income Tax Payment Coupon For Investors In Pass Through Entities

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement