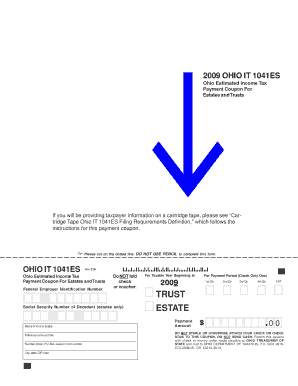

Ohio Estimated Income Tax Payment Coupon for Estates and Trusts Form

What is the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

The Ohio Estimated Income Tax Payment Coupon for Estates and Trusts is a specific form used by estates and trusts to report and pay estimated income tax to the state of Ohio. This coupon is essential for ensuring that estates and trusts meet their tax obligations throughout the year, rather than waiting until the annual tax return is filed. It allows fiduciaries to make timely payments based on the expected income of the estate or trust, helping to avoid penalties for underpayment.

How to use the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

Using the Ohio Estimated Income Tax Payment Coupon involves several straightforward steps. First, the fiduciary must estimate the total income tax liability for the estate or trust for the year. Based on this estimate, the fiduciary can determine the amount to be paid quarterly. The coupon must be filled out with the relevant information, including the name of the estate or trust, the tax identification number, and the payment amount. Once completed, the coupon should be submitted along with the payment to the appropriate Ohio tax authority.

Steps to complete the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

Completing the Ohio Estimated Income Tax Payment Coupon requires attention to detail. The following steps outline the process:

- Gather financial information for the estate or trust to estimate the income tax liability.

- Obtain the coupon form from the Ohio Department of Taxation website or other official sources.

- Fill in the required fields, including the name of the estate or trust and the tax identification number.

- Calculate the estimated payment amount based on the income tax liability.

- Review the completed coupon for accuracy.

- Submit the coupon along with the payment to the designated Ohio tax office.

Filing Deadlines / Important Dates

It is crucial for fiduciaries to be aware of the filing deadlines associated with the Ohio Estimated Income Tax Payment Coupon for Estates and Trusts. Generally, estimated payments are due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. Keeping a calendar of these important dates can help ensure compliance and timely payments.

Required Documents

When using the Ohio Estimated Income Tax Payment Coupon, certain documents may be required to accurately estimate the tax liability. These documents typically include:

- Financial statements for the estate or trust, detailing income and expenses.

- Previous tax returns, if applicable, to help gauge expected income.

- Any relevant tax forms that may influence the estate or trust's tax situation.

Legal use of the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

The Ohio Estimated Income Tax Payment Coupon for Estates and Trusts is legally recognized as a valid method for fulfilling tax obligations. Fiduciaries are legally required to ensure that estimated payments are made on time to avoid penalties. Proper use of this coupon demonstrates compliance with Ohio tax laws and helps maintain the financial integrity of the estate or trust.

Quick guide on how to complete ohio estimated income tax payment coupon for estates and trusts

Complete [SKS] seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your files quickly without interruptions. Manage [SKS] on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

Create this form in 5 minutes!

How to create an eSignature for the ohio estimated income tax payment coupon for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts?

The Ohio Estimated Income Tax Payment Coupon For Estates And Trusts is a form used by estates and trusts to make estimated income tax payments to the state of Ohio. This coupon helps ensure that the tax obligations are met on time, avoiding penalties and interest. It is essential for fiduciaries managing estates and trusts to understand this process.

-

How can airSlate SignNow help with the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts?

airSlate SignNow simplifies the process of preparing and submitting the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts. Our platform allows users to easily fill out, sign, and send the necessary documents electronically. This streamlines the workflow, making it more efficient for estates and trusts.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses managing estates and trusts. Each plan provides access to features that facilitate the completion of the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for managing estate and trust documents?

Yes, airSlate SignNow includes features tailored for managing estate and trust documents, such as templates for the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts. Users can also track document status, set reminders for deadlines, and collaborate with other stakeholders seamlessly. These features enhance the overall efficiency of document management.

-

What benefits does airSlate SignNow provide for estates and trusts?

Using airSlate SignNow for estates and trusts offers numerous benefits, including time savings, reduced paperwork, and enhanced compliance with tax regulations. The platform ensures that the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts is completed accurately and submitted on time. Additionally, electronic signatures provide a secure and legally binding way to finalize documents.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various accounting and tax management software, making it easier to manage the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts alongside other financial documents. This integration helps streamline workflows and ensures that all relevant information is accessible in one place. Users can benefit from a more cohesive tax management experience.

-

Is it easy to use airSlate SignNow for someone unfamiliar with digital tools?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with digital tools. The platform provides intuitive navigation and helpful resources to guide users through the process of completing the Ohio Estimated Income Tax Payment Coupon For Estates And Trusts. Our customer support team is also available to assist with any questions.

Get more for Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

- Snapchat parentlegal guardian account deletion request minor39s bb form

- Career word search form

- Ages and stages questionnaire form

- Greccio housing application form

- Nachweis der personlichen arbeitsbemuhungen form

- Dhr cdc 739 2006 2019 form

- Starbucks order form

- Kandiyohi power charitable trust 8605 47th street ne form

Find out other Ohio Estimated Income Tax Payment Coupon For Estates And Trusts

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free