Power Social Charitable Trust Form

What is the Power Social Charitable Trust

The Power Social Charitable Trust is a legal entity designed to manage and distribute funds for charitable purposes. This trust allows individuals or organizations to contribute assets that can be used to support various charitable activities. The trust operates under specific regulations that ensure compliance with federal and state laws, making it a reliable option for philanthropic endeavors. Establishing a charitable trust can provide tax benefits and a structured approach to giving.

How to use the Power Social Charitable Trust

Using the Power Social Charitable Trust involves several steps. First, individuals or organizations must determine their charitable goals and the types of activities they wish to support. Next, they should consult with legal and financial advisors to draft the trust document, outlining the terms and conditions of the trust. Once established, the trust can receive contributions, which are then managed according to the guidelines set forth in the trust agreement. Regular reporting and compliance with IRS regulations are essential to maintain the trust's status.

Steps to complete the Power Social Charitable Trust

Completing the Power Social Charitable Trust requires careful planning and execution. The following steps outline the process:

- Define the charitable purpose and objectives of the trust.

- Consult with legal and financial professionals to draft the trust document.

- File the necessary paperwork with state authorities to establish the trust.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Set up a bank account for the trust to manage contributions and disbursements.

- Regularly review and comply with reporting requirements to maintain tax-exempt status.

Legal use of the Power Social Charitable Trust

The legal use of the Power Social Charitable Trust is governed by both federal and state laws. It is essential to comply with the Internal Revenue Service (IRS) guidelines regarding charitable trusts to ensure that contributions are tax-deductible for donors. Additionally, the trust must adhere to state regulations regarding the management and distribution of funds. Regular audits and compliance checks can help maintain the trust's legal standing and ensure that it operates within the law.

IRS Guidelines

The IRS provides specific guidelines for charitable trusts, including the requirements for tax-exempt status. To qualify, the trust must operate exclusively for charitable purposes and meet the criteria outlined in Section 501(c)(3) of the Internal Revenue Code. The trust must also refrain from engaging in political activities and must ensure that its earnings do not benefit private individuals. Adhering to these guidelines is crucial for maintaining the trust's tax-exempt status and ensuring compliance with federal regulations.

Required Documents

Establishing the Power Social Charitable Trust requires several key documents, including:

- The trust agreement, which outlines the terms and conditions of the trust.

- IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3).

- State-specific forms for establishing a charitable trust.

- Financial statements and a budget for the trust's operations.

Form Submission Methods (Online / Mail / In-Person)

Submitting the necessary forms to establish the Power Social Charitable Trust can be done through various methods. Many states allow online submissions, which can expedite the process. Alternatively, forms can be mailed to the appropriate state agency. In some cases, individuals may need to submit documents in person, particularly when dealing with local regulations. It is important to check the specific submission requirements for the state where the trust is being established.

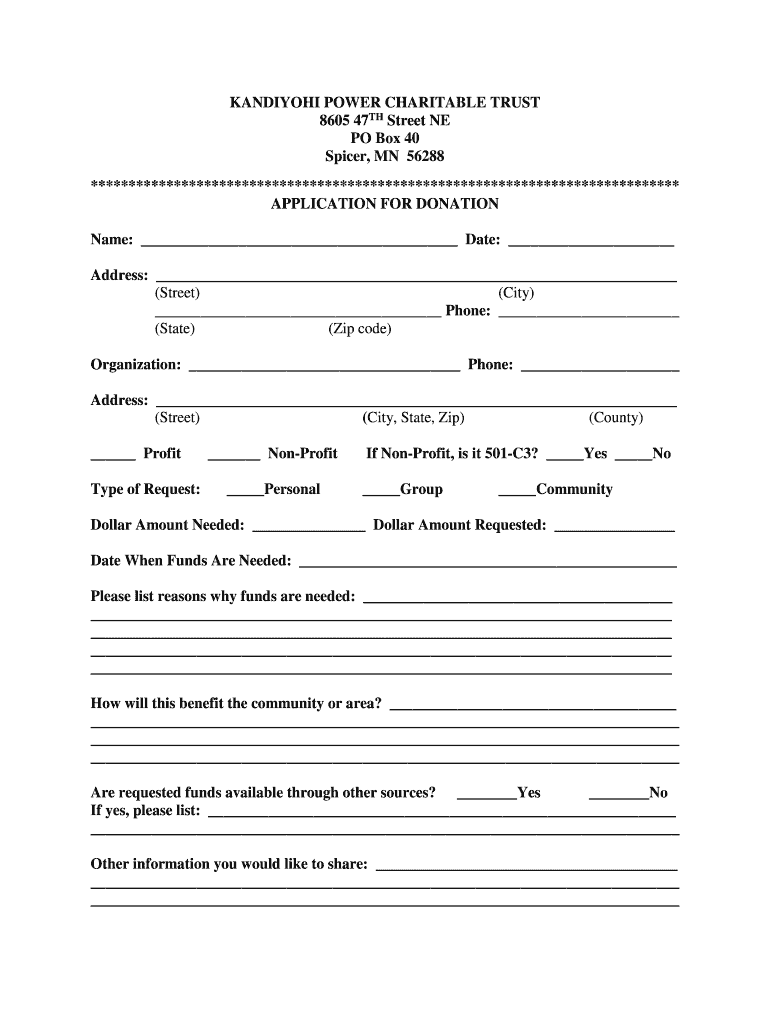

Quick guide on how to complete kandiyohi power charitable trust 8605 47th street ne

Discover how to smoothly navigate the Power Social Charitable Trust completion with this simple guide

Electronic filing and document completion is becoming more prevalent and the preferred choice for many users. It provides numerous advantages over traditional printed forms, such as convenience, time savings, enhanced precision, and safety.

With platforms like airSlate SignNow, you can locate, edit, authorize, enhance, and dispatch your Power Social Charitable Trust without the hassle of endless printing and scanning. Follow this concise guide to begin and finalize your document.

Utilize these steps to obtain and complete Power Social Charitable Trust

- Commence by clicking on the Get Form button to access your form in our editor.

- Adhere to the green indicator on the left that highlights required fields to ensure you don’t leave any out.

- Take advantage of our premium features to annotate, edit, sign, secure, and enhance your form.

- Safeguard your document or convert it into an interactive form using the tools on the right panel.

- Review the form and inspect it for errors or inconsistencies.

- Click on DONE to complete the editing process.

- Rename your document or keep it as is.

- Select the storage option you wish to use for saving your form, send it via USPS, or click the Download Now button to save your file.

If Power Social Charitable Trust is not what you needed, you can explore our extensive library of pre-loaded templates that can be completed with ease. Experience our solution today!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kandiyohi power charitable trust 8605 47th street ne

How to generate an electronic signature for your Kandiyohi Power Charitable Trust 8605 47th Street Ne online

How to generate an electronic signature for your Kandiyohi Power Charitable Trust 8605 47th Street Ne in Chrome

How to make an electronic signature for signing the Kandiyohi Power Charitable Trust 8605 47th Street Ne in Gmail

How to create an eSignature for the Kandiyohi Power Charitable Trust 8605 47th Street Ne from your mobile device

How to generate an eSignature for the Kandiyohi Power Charitable Trust 8605 47th Street Ne on iOS devices

How to make an eSignature for the Kandiyohi Power Charitable Trust 8605 47th Street Ne on Android

People also ask

-

What is a charitable 56288 printable?

A charitable 56288 printable is a specific form used for reporting charitable contributions for tax purposes. This document helps taxpayers deduct their charitable donations, ensuring they comply with IRS requirements. airSlate SignNow makes it easy to create, send, and eSign this essential document quickly.

-

How can I obtain a charitable 56288 printable using airSlate SignNow?

You can obtain a charitable 56288 printable by signing up for an airSlate SignNow account. After logging in, you can easily access templates, create new documents, and customize the charitable 56288 printable as per your needs. The user-friendly interface streamlines the document preparation process.

-

Are there any costs associated with using airSlate SignNow for charitable 56288 printables?

airSlate SignNow offers various pricing plans, including options tailored for individuals and businesses that may need to handle charitable 56288 printables. The plans are designed to be cost-effective, with flexible features that grow with your documentation needs. You can start with a free trial to explore the platform.

-

What features does airSlate SignNow offer for managing charitable 56288 printables?

airSlate SignNow includes features like customizable templates, electronic signatures, and secure document storage for managing charitable 56288 printables. The ability to collaborate in real-time with team members and track document status ensures a seamless experience. These features enhance efficiency and reduce paperwork.

-

Can I integrate airSlate SignNow with other applications for charitable 56288 printables?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, making it easy to manage and share your charitable 56288 printables across platforms. These integrations help streamline workflows and improve collaboration with various tools you may already be using.

-

What are the benefits of using airSlate SignNow for charitable 56288 printable documents?

Using airSlate SignNow for charitable 56288 printables enhances efficiency and saves time by allowing you to create and send documents electronically. The platform's security features protect sensitive information, and the ability to eSign ensures a legally binding agreement. Benefit from improved organization and easier access to documents.

-

Is support available if I have questions about charitable 56288 printables?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any inquiries regarding charitable 56288 printables. You can access resources, tutorials, and live help to ensure you can effectively use the platform to meet your document needs.

Get more for Power Social Charitable Trust

- Business debit card ampamp employee debit cards from bank of america form

- This will certify that has performed community service

- Tropical smoothie application pdf form

- Electrical contractor no fee form

- Form register

- 301 alaska form 452348499

- Illinois immunization form health

- Ohio statement continued existence form

Find out other Power Social Charitable Trust

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document