Form SE Serial

What is the Form SE Serial

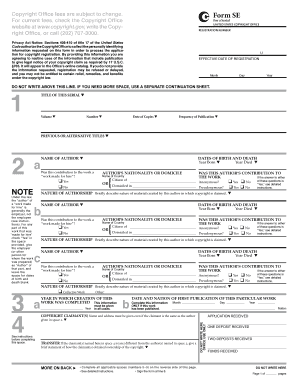

The Form SE Serial is a crucial document used by self-employed individuals to calculate their self-employment tax. This form is part of the U.S. federal tax system and is essential for reporting income earned from self-employment. It helps determine the amount owed for Social Security and Medicare taxes based on net earnings. Understanding this form is vital for compliance with IRS regulations.

How to use the Form SE Serial

Using the Form SE Serial involves several steps. First, gather all relevant financial information, including total income and business expenses. Next, calculate your net earnings by subtracting expenses from your total income. Then, complete the form by entering the calculated net earnings and following the instructions provided. Finally, ensure the form is submitted along with your annual tax return, typically by April 15.

Steps to complete the Form SE Serial

Completing the Form SE Serial requires careful attention to detail. Start by filling out your personal information at the top of the form. Next, report your net earnings from self-employment. This involves using Schedule C or Schedule F to determine your business income and expenses. After calculating your self-employment tax, transfer the amount to your tax return. Review the form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Form SE Serial. These guidelines include instructions on how to calculate net earnings, the applicable tax rates, and eligibility criteria for self-employment tax. It is important to consult the latest IRS publications or the official IRS website for any updates or changes to the form and its requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form SE Serial coincide with the annual tax return deadlines. Typically, self-employed individuals must submit their tax returns, including the Form SE Serial, by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be adjusted. It is essential to stay informed about these dates to avoid penalties.

Required Documents

To complete the Form SE Serial, certain documents are required. These include your income statements, such as 1099 forms, and records of any business expenses. Keeping accurate financial records throughout the year will facilitate the completion of the form and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form SE Serial or inaccuracies in reporting can lead to penalties from the IRS. These may include fines and interest on any unpaid taxes. It is crucial to adhere to filing requirements and deadlines to avoid these consequences. Maintaining accurate records and seeking assistance when needed can help mitigate risks associated with non-compliance.

Quick guide on how to complete form se serial

Effortlessly Prepare [SKS] on Any Device

Digital document management has become widely adopted by companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive data using the tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form SE Serial

Create this form in 5 minutes!

How to create an eSignature for the form se serial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form SE Serial and how does it work with airSlate SignNow?

Form SE Serial is a specific document format that allows users to efficiently manage serial numbers in their forms. With airSlate SignNow, you can easily create, send, and eSign Form SE Serial documents, ensuring that all necessary information is captured accurately and securely.

-

How can I integrate Form SE Serial with other applications?

airSlate SignNow offers seamless integrations with various applications, allowing you to connect Form SE Serial with your existing workflows. You can integrate with CRM systems, cloud storage services, and more, enhancing your document management process.

-

What are the pricing options for using Form SE Serial with airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that includes features for managing Form SE Serial documents at a competitive price.

-

What features does airSlate SignNow offer for managing Form SE Serial?

With airSlate SignNow, you can utilize features such as customizable templates, automated workflows, and real-time tracking for Form SE Serial documents. These features streamline the signing process and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for Form SE Serial?

Using airSlate SignNow for Form SE Serial offers numerous benefits, including improved accuracy, faster turnaround times, and enhanced security. This solution empowers businesses to manage their documents more effectively while reducing the risk of errors.

-

Is it easy to eSign Form SE Serial documents with airSlate SignNow?

Yes, eSigning Form SE Serial documents with airSlate SignNow is straightforward and user-friendly. The platform allows users to sign documents electronically in just a few clicks, making the process quick and efficient.

-

Can I track the status of my Form SE Serial documents?

Absolutely! airSlate SignNow provides real-time tracking for all your Form SE Serial documents. You can easily monitor the status of each document, ensuring that you stay informed throughout the signing process.

Get more for Form SE Serial

- Form imm 5257 application for a temporary resident visa cdc

- General daily progress report ftp02 portlandoregon form

- Witness subpoena form

- Form rd 4280 3a

- Unit clarification or placement perb new york state perb ny form

- Congressman scott rigells privacy release form rigell house

- Cdph 278b form

- State of iowa creditorassignee notification form

Find out other Form SE Serial

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast