Schedule UBNLD Income Tax Business Form

What is the Schedule UBNLD Income Tax Business

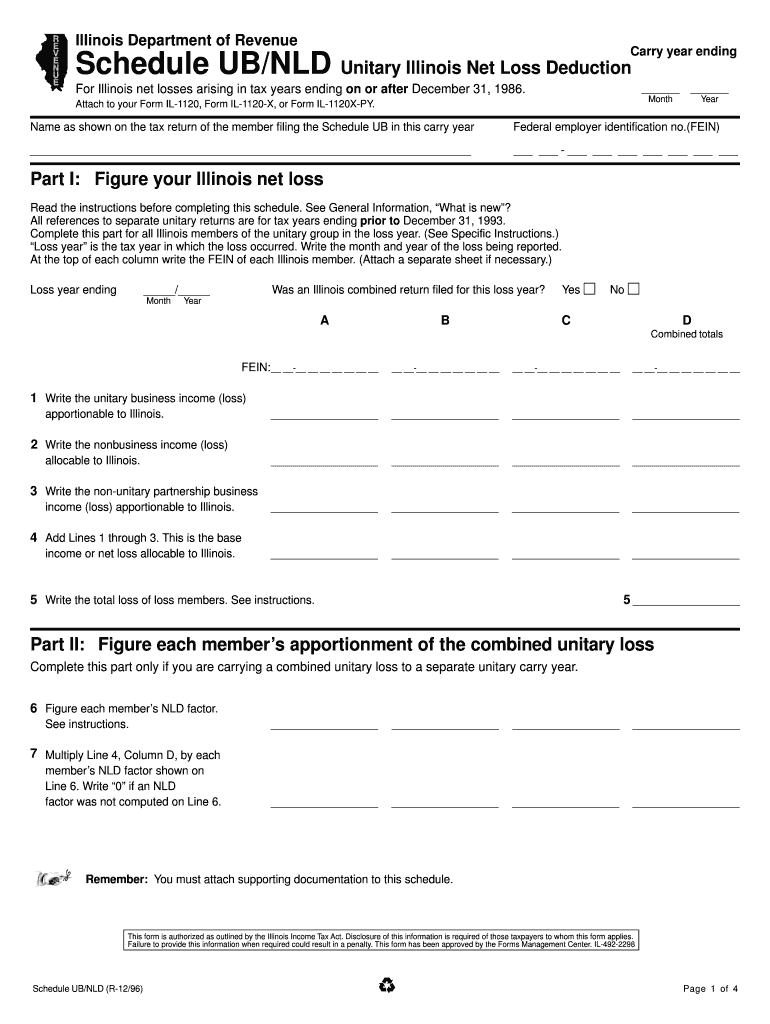

The Schedule UBNLD Income Tax Business is a specific form used by businesses in the United States to report income, deductions, and credits related to their operations. This form is essential for ensuring compliance with federal tax regulations. It is primarily used by various business entities, including sole proprietorships, partnerships, and corporations, to accurately report their earnings and tax obligations. Understanding this form is crucial for business owners to maintain proper financial records and fulfill their tax responsibilities.

How to use the Schedule UBNLD Income Tax Business

Using the Schedule UBNLD Income Tax Business involves several steps that ensure accurate reporting of your business income and expenses. First, gather all necessary financial documents, including income statements, receipts for expenses, and any relevant tax forms. Next, fill out the form by entering your total income, allowable deductions, and any credits you may qualify for. It is important to review the instructions carefully to ensure that all information is reported correctly. Once completed, the form should be submitted along with your main tax return to the IRS.

Steps to complete the Schedule UBNLD Income Tax Business

Completing the Schedule UBNLD Income Tax Business requires a systematic approach:

- Collect all relevant financial documents, such as income statements and expense receipts.

- Determine your total income for the tax year, including all revenue streams.

- Identify and calculate allowable deductions, which can include business expenses and operational costs.

- Fill out the form accurately, ensuring all figures are correct and correspond to your financial records.

- Review the completed form for any errors or omissions.

- Submit the form along with your main tax return by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule UBNLD Income Tax Business. These guidelines include detailed instructions on what qualifies as income, which expenses are deductible, and how to report credits. It is essential to follow these guidelines closely to avoid potential penalties or audits. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule UBNLD Income Tax Business align with the general tax filing deadlines for businesses. Typically, the deadline for submitting your tax return, including this schedule, is April fifteenth of each year. However, if you are unable to meet this deadline, you may file for an extension, which generally grants an additional six months. It is important to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the Schedule UBNLD Income Tax Business, several documents are required. These include:

- Income statements detailing all revenue generated during the tax year.

- Receipts and records of business expenses, including operational costs and deductions.

- Any previous tax returns that may provide context or additional information.

- Supporting documentation for any credits being claimed.

Having these documents organized and readily available will streamline the process of completing the form.

Quick guide on how to complete schedule ubnld income tax business

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule UBNLD Income Tax Business

Create this form in 5 minutes!

How to create an eSignature for the schedule ubnld income tax business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule UBNLD Income Tax Business using airSlate SignNow?

To Schedule UBNLD Income Tax Business with airSlate SignNow, simply create your document, add the necessary fields for signatures, and send it to your clients or team members. The platform allows for easy tracking of document status, ensuring that you can manage your tax scheduling efficiently. With our user-friendly interface, you can complete the process in just a few clicks.

-

What features does airSlate SignNow offer for managing Schedule UBNLD Income Tax Business?

airSlate SignNow provides a range of features tailored for Schedule UBNLD Income Tax Business, including customizable templates, automated reminders, and secure eSigning. These features streamline the tax scheduling process, making it easier for businesses to stay compliant and organized. Additionally, you can integrate with other tools to enhance your workflow.

-

How does airSlate SignNow ensure the security of my Schedule UBNLD Income Tax Business documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Schedule UBNLD Income Tax Business documents. Our platform also complies with industry standards, ensuring that your sensitive information remains confidential and secure.

-

Is there a free trial available for airSlate SignNow to manage Schedule UBNLD Income Tax Business?

Yes, airSlate SignNow offers a free trial that allows you to explore our features for managing Schedule UBNLD Income Tax Business. This trial gives you the opportunity to test the platform's capabilities without any commitment. You can experience firsthand how our solution can simplify your tax scheduling process.

-

What are the pricing options for airSlate SignNow for Schedule UBNLD Income Tax Business?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs for Schedule UBNLD Income Tax Business. Our plans are competitively priced, ensuring that you receive a cost-effective solution without compromising on features. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Schedule UBNLD Income Tax Business?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easy to incorporate into your existing workflow for Schedule UBNLD Income Tax Business. Whether you use CRM systems, accounting software, or other tools, our platform can seamlessly connect to enhance your productivity.

-

What benefits can I expect from using airSlate SignNow for Schedule UBNLD Income Tax Business?

Using airSlate SignNow for Schedule UBNLD Income Tax Business offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform simplifies the document management process, allowing you to focus on your core business activities. Additionally, the ease of eSigning helps expedite transactions and approvals.

Get more for Schedule UBNLD Income Tax Business

- Privacy act form ben cardin cardin senate

- Proforma customer testimonial formdoc

- Public adjusteramp39s retainer agreement lighthouse public adjusters form

- Athletic fundraising bulletin los angeles unified school district form

- Degree plan contract uclaedu ugeducation ucla form

- Arizona aloha festival march 7 8 2015 volunteer application form

- Okaloosa county name change form

- Form le219 release amp discharge relating to consent to disclosure of criminal record information opp orders

Find out other Schedule UBNLD Income Tax Business

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure