Schedule NLD Income Tax Business Tax Illinois Form

What is the Schedule NLD Income Tax Business Tax Illinois

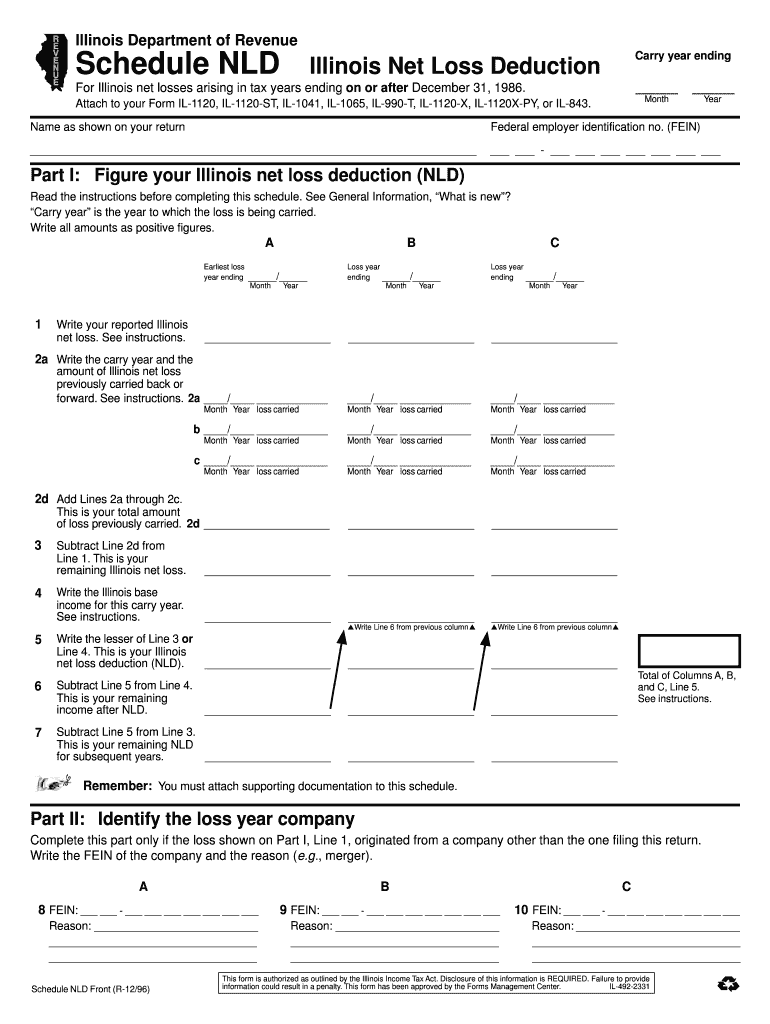

The Schedule NLD Income Tax Business Tax Illinois is a specific form used by businesses operating in Illinois to report income and calculate tax liabilities. This form is essential for corporations, partnerships, and limited liability companies that need to declare their non-business income. Understanding this form is crucial for compliance with state tax regulations and for ensuring accurate reporting of financial activities.

How to use the Schedule NLD Income Tax Business Tax Illinois

Using the Schedule NLD involves several steps that ensure accurate reporting. First, gather all necessary financial records, including income statements and expense reports. Next, complete the form by providing detailed information about your business's non-business income. Be sure to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form should be submitted along with your Illinois income tax return.

Steps to complete the Schedule NLD Income Tax Business Tax Illinois

Completing the Schedule NLD requires a systematic approach:

- Collect financial documents, including your income statement and any relevant tax documents.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check the calculations to confirm that the reported income matches your records.

- Submit the completed form with your Illinois income tax return by the designated deadline.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Schedule NLD. Typically, the deadline coincides with the due date for your Illinois income tax return, which is usually April 15 for most businesses. However, if you are unable to meet this deadline, you may need to file for an extension. Always check for any updates or changes to deadlines that may occur due to state regulations.

Required Documents

To accurately complete the Schedule NLD, several documents are necessary:

- Financial statements that detail your business's income and expenses.

- Previous tax returns for reference and consistency.

- Any supporting documentation related to non-business income, such as interest or dividends.

Penalties for Non-Compliance

Failing to file the Schedule NLD or submitting inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the Illinois Department of Revenue. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete schedule nld income tax business tax illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] across any platform using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign [SKS] with Minimal Effort

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your device of choice. Edit and electronically sign [SKS] to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NLD Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule nld income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NLD Income Tax Business Tax Illinois?

Schedule NLD Income Tax Business Tax Illinois is a form used by businesses in Illinois to report their non-resident income. It helps ensure compliance with state tax regulations while allowing businesses to accurately calculate their tax liabilities. Understanding this form is crucial for any business operating in Illinois.

-

How can airSlate SignNow help with Schedule NLD Income Tax Business Tax Illinois?

airSlate SignNow provides a streamlined solution for businesses to eSign and send documents related to Schedule NLD Income Tax Business Tax Illinois. Our platform simplifies the document management process, ensuring that all necessary forms are completed and submitted efficiently. This helps businesses save time and reduce errors in their tax filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of documents related to Schedule NLD Income Tax Business Tax Illinois, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing Schedule NLD Income Tax Business Tax Illinois. These tools enhance efficiency and ensure that your tax documents are handled securely and professionally. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows businesses to manage their Schedule NLD Income Tax Business Tax Illinois documents alongside their financial data. By connecting these tools, you can streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including Schedule NLD Income Tax Business Tax Illinois, offers numerous benefits. You can enhance document security, reduce processing time, and ensure compliance with state regulations. Our platform also provides a reliable audit trail, giving you peace of mind during tax season.

-

Is airSlate SignNow suitable for small businesses handling tax documents?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing Schedule NLD Income Tax Business Tax Illinois. Our cost-effective solution allows small businesses to access powerful document management tools without breaking the bank. This makes it easier for them to stay compliant and organized.

Get more for Schedule NLD Income Tax Business Tax Illinois

- Professional opinion letter form

- Backflow test report city of waxahachie form

- Sample letter selective service form

- Employer quarterly gross earnings report directors guild of dga form

- English language reference form general medical council gmc uk

- Bob and wheel handout edsitement form

- Form v2013 christchurch china consulate

- Animal registration application councillor helen abrahams form

Find out other Schedule NLD Income Tax Business Tax Illinois

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form