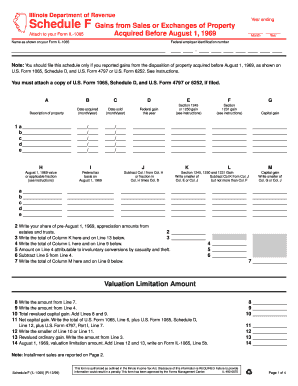

Schedule F Business Income Tax Partnership Tax Illinois Form

What is the Schedule F Business Income Tax Partnership Tax Illinois

The Schedule F Business Income Tax Partnership Tax in Illinois is a tax form used by partnerships to report income, deductions, and credits related to farming activities. This form is essential for partnerships engaged in agricultural operations, allowing them to calculate their taxable income accurately. It is part of the Illinois income tax return process and is specifically designed for those who earn income from farming. Partnerships must ensure they comply with both federal and state tax regulations when completing this form.

How to use the Schedule F Business Income Tax Partnership Tax Illinois

To use the Schedule F Business Income Tax Partnership Tax in Illinois, partnerships need to gather all relevant financial information related to their farming activities. This includes income from sales, expenses for operating the farm, and any applicable deductions. The form is structured to guide users through reporting their income and expenses systematically. Accurate completion ensures that the partnership can claim all eligible deductions, which can significantly reduce the overall tax liability.

Steps to complete the Schedule F Business Income Tax Partnership Tax Illinois

Completing the Schedule F Business Income Tax Partnership Tax involves several key steps:

- Gather financial records, including income statements and expense receipts.

- Fill out the income section, detailing all revenue generated from farming activities.

- Document all allowable expenses, such as equipment costs, seeds, and labor.

- Calculate net profit or loss by subtracting total expenses from total income.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the Schedule F Business Income Tax in Illinois. Typically, the deadline aligns with the federal income tax return due date, which is usually April 15. However, if the partnership operates on a fiscal year basis, the deadline will differ accordingly. It is crucial for partnerships to mark these dates on their calendars to avoid penalties for late filing.

Required Documents

When preparing to file the Schedule F Business Income Tax Partnership Tax, partnerships should have the following documents ready:

- Income statements detailing all revenue from farming activities.

- Expense receipts for all deductible costs related to farming operations.

- Previous tax returns for reference and consistency.

- Any additional documentation required for specific deductions or credits.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule F Business Income Tax Partnership Tax can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits by the state tax authority. Partnerships should ensure that they complete and submit the form accurately and on time to avoid these consequences.

Quick guide on how to complete schedule f business income tax partnership tax illinois

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric operation today.

Effortlessly edit and eSign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule F Business Income Tax Partnership Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule f business income tax partnership tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule F Business Income Tax Partnership Tax Illinois?

Schedule F Business Income Tax Partnership Tax Illinois is a tax form used by partnerships to report income and expenses from farming activities. It helps in calculating the net profit or loss from farming operations, which is essential for accurate tax reporting. Understanding this form is crucial for partnerships engaged in agricultural activities in Illinois.

-

How can airSlate SignNow assist with Schedule F Business Income Tax Partnership Tax Illinois?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to Schedule F Business Income Tax Partnership Tax Illinois. With our solution, you can easily send, sign, and store tax documents securely, ensuring compliance and efficiency. This simplifies the process of handling tax-related paperwork for partnerships.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Schedule F Business Income Tax Partnership Tax Illinois. These features enhance collaboration and ensure that all parties can access and sign documents promptly. Additionally, our platform integrates with various applications to streamline your workflow.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing Schedule F Business Income Tax Partnership Tax Illinois documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your investment. By reducing the time spent on paperwork, you can focus more on your business operations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage Schedule F Business Income Tax Partnership Tax Illinois. This integration allows you to import and export documents effortlessly, ensuring that your tax preparation process is efficient and organized.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for Schedule F Business Income Tax Partnership Tax Illinois offers numerous benefits, including enhanced security, ease of use, and improved collaboration. Our platform ensures that your documents are protected with advanced encryption, while the user-friendly interface allows for quick navigation. This leads to faster turnaround times for tax document processing.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your Schedule F Business Income Tax Partnership Tax Illinois documents by employing industry-standard encryption and secure cloud storage. We also provide audit trails and access controls to ensure that only authorized users can view or edit sensitive information. This commitment to security helps protect your business from data bsignNowes.

Get more for Schedule F Business Income Tax Partnership Tax Illinois

- Winair forms token value list air commercial real estate

- Letter of interest form beacon health strategies

- Conciliation court information sheet yavapai county courts website

- Partnership return form 1065pdf city of lapeer ci lapeer mi

- Confidential assessment form formulaire dvaluation confidentielle

- Mccs lejuene form

- Waiver rule form

- Illinois small form 2015 2019

Find out other Schedule F Business Income Tax Partnership Tax Illinois

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF