IL 2210 Computation of Penalties for Individuals Income Tax Individual Form

What is the IL 2210 Computation Of Penalties For Individuals Income Tax Individual

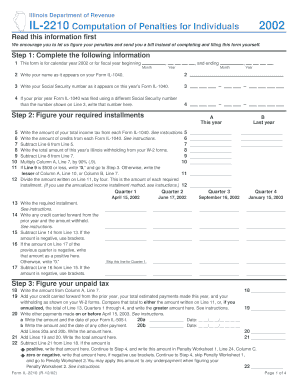

The IL 2210 is a form used by individuals in the state of Illinois to compute penalties related to underpayment of income tax. This form is essential for taxpayers who did not pay enough tax throughout the year, either through withholding or estimated tax payments. The penalties assessed are based on the amount of tax owed and the duration of the underpayment. Understanding this form is crucial for individuals to ensure compliance with state tax laws and avoid additional fines.

How to use the IL 2210 Computation Of Penalties For Individuals Income Tax Individual

Using the IL 2210 involves several steps to accurately calculate any penalties owed. Taxpayers should first gather their income tax information for the year, including total income, withholding amounts, and any estimated tax payments made. Next, they will need to complete the form by providing specific details such as the total tax liability and the amount paid during the year. The form will guide users through the calculation process, ultimately determining if a penalty applies and the amount due.

Steps to complete the IL 2210 Computation Of Penalties For Individuals Income Tax Individual

Completing the IL 2210 involves a systematic approach:

- Gather necessary documents, including your income tax return and records of payments made.

- Calculate your total tax liability for the year.

- Determine the total amount of tax you have paid through withholding and estimated payments.

- Fill out the form, entering the required information in the designated sections.

- Follow the instructions to compute any penalties based on the calculations provided.

- Review your completed form for accuracy before submission.

Key elements of the IL 2210 Computation Of Penalties For Individuals Income Tax Individual

Several key elements are crucial when working with the IL 2210 form:

- Tax Liability: The total amount of tax owed for the year.

- Payments Made: The total of all withholding and estimated payments submitted.

- Underpayment Calculation: The difference between the tax liability and payments made.

- Penalty Rates: The specific rates that apply to the underpayment amount, which can vary based on the duration of the underpayment.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IL 2210. Typically, the form must be filed along with your annual income tax return. For most individuals, the deadline is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Keeping track of these dates is essential to avoid late penalties and ensure compliance with state tax regulations.

Penalties for Non-Compliance

Failure to accurately complete and submit the IL 2210 can result in significant penalties. If an individual underpays their taxes, they may face a penalty based on the amount of underpayment and the length of time the tax remains unpaid. Additionally, late filing can incur further penalties, compounding the financial burden. Understanding these consequences emphasizes the importance of timely and accurate tax reporting.

Quick guide on how to complete il 2210 computation of penalties for individuals income tax individual

Complete [SKS] with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The simplest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Computation Of Penalties For Individuals Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the il 2210 computation of penalties for individuals income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 2210 Computation Of Penalties For Individuals Income Tax Individual?

The IL 2210 Computation Of Penalties For Individuals Income Tax Individual is a form used to calculate penalties for underpayment of Illinois income tax. It helps individuals determine if they owe any penalties due to insufficient tax payments throughout the year. Understanding this form is crucial for accurate tax filing and avoiding unnecessary penalties.

-

How can airSlate SignNow assist with the IL 2210 Computation Of Penalties For Individuals Income Tax Individual?

airSlate SignNow provides an efficient platform for electronically signing and sending tax documents, including the IL 2210 Computation Of Penalties For Individuals Income Tax Individual. Our solution simplifies the process, ensuring that you can complete and submit your tax forms quickly and securely. This helps you stay compliant and avoid penalties.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the IL 2210 Computation Of Penalties For Individuals Income Tax Individual. These features streamline the workflow, making it easier to handle multiple tax forms efficiently. Additionally, our platform ensures that all documents are stored securely.

-

Is airSlate SignNow cost-effective for individuals handling their taxes?

Yes, airSlate SignNow is a cost-effective solution for individuals managing their taxes, including the IL 2210 Computation Of Penalties For Individuals Income Tax Individual. Our pricing plans are designed to fit various budgets, providing essential features without breaking the bank. This makes it an ideal choice for individuals looking to simplify their tax processes.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, enhancing your ability to manage documents like the IL 2210 Computation Of Penalties For Individuals Income Tax Individual. This integration allows for seamless data transfer and document management, making your tax preparation process more efficient. You can easily connect with popular platforms to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IL 2210 Computation Of Penalties For Individuals Income Tax Individual, offers numerous benefits. You gain access to a user-friendly interface, secure eSigning, and the ability to track document status in real-time. These features help ensure that your tax documents are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including the IL 2210 Computation Of Penalties For Individuals Income Tax Individual. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information. This commitment to security ensures that your documents are safe from unauthorized access.

Get more for IL 2210 Computation Of Penalties For Individuals Income Tax Individual

- Dd 2249 fillable form

- Imm5877e form

- Commonwealth of dominica visa application form haiti

- Download the sootheaway migraine diary form

- Gc statement chicago title northwest metro form

- Flight online waiver form

- Movie review graphic organizer form

- Mfl 251 fl case status reportdoc mendocino courts ca form

Find out other IL 2210 Computation Of Penalties For Individuals Income Tax Individual

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later