Axis Loan Application Form

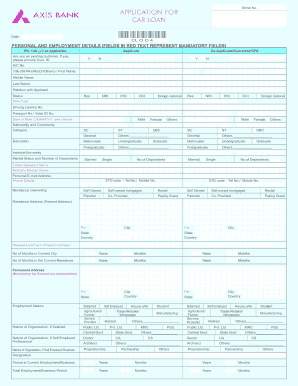

What is the Axis Loan Application Form

The Axis Loan Application Form is a crucial document required for individuals seeking to apply for a Mudra loan online. This form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. It serves as a formal request to the lending institution, allowing them to assess the applicant's eligibility for the loan. Proper completion of this form is vital for a smooth application process.

Steps to Complete the Axis Loan Application Form

Completing the Axis Loan Application Form involves several key steps:

- Gather necessary documents, such as identification, income proof, and business details.

- Fill out personal information accurately, including your name, address, and contact details.

- Provide financial information, including income sources and existing liabilities.

- Specify the loan amount required and the intended use of funds.

- Review the form for accuracy before submission.

Following these steps ensures that your application is complete and reduces the chances of delays.

Eligibility Criteria

To qualify for a Mudra loan, applicants must meet certain eligibility criteria. Typically, these include:

- Being a citizen of the United States.

- Having a viable business plan or project proposal.

- Demonstrating a stable source of income.

- Meeting the age requirement, usually between eighteen and sixty-five years.

Understanding these criteria helps applicants prepare their documents and information accordingly.

Required Documents

When applying for a Mudra loan, several documents are necessary to support your application. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Proof of address, like a utility bill or lease agreement.

- Income statements, including pay stubs or tax returns.

- Business-related documents, such as a business plan or registration certificate.

Having these documents ready can expedite the application process and improve the chances of approval.

Form Submission Methods

The Axis Loan Application Form can be submitted through various methods, including:

- Online submission via the lender's website, which is often the fastest option.

- Mailing a physical copy of the completed form to the lender's address.

- In-person submission at a local branch, if applicable.

Choosing the right submission method can depend on personal preference and urgency.

Legal Use of the Axis Loan Application Form

The Axis Loan Application Form is legally binding once submitted, provided it is completed accurately and honestly. It must comply with relevant lending laws and regulations to ensure that both the applicant and the lender are protected. Misrepresentation or falsification of information can lead to legal consequences, including denial of the loan or potential legal action.

Quick guide on how to complete axis loan application form

Complete Axis Loan Application Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Axis Loan Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to edit and eSign Axis Loan Application Form with ease

- Locate Axis Loan Application Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Axis Loan Application Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mudra loan and how can I apply online?

A Mudra loan is a type of financial support provided by the Government of India for small businesses. To mudra loan apply online, you need to visit the relevant financial institution’s website that offers these loans, fill out the application form, and submit the required documents electronically.

-

What are the eligibility criteria for applying for a Mudra loan online?

To mudra loan apply online, you must be an individual or entrepreneur engaged in a small business. Your business should be in the non-farming sector, and you may need to provide details like your business plan, revenue projections, and personal identification.

-

What documents do I need to submit when I apply online for a Mudra loan?

When you mudra loan apply online, you'll typically need to submit your identity proof, business plan, income proof, and bank account details. Additional documents may include ownership proof of your business premises and quotations for planned purchases.

-

What is the interest rate for a Mudra loan applied online?

The interest rate for a Mudra loan can vary depending on the financial institution you choose. When you mudra loan apply online, it’s essential to check the lender's current rates, which generally range between 8% to 12% per annum based on the type and amount of the loan.

-

How long does it take for the Mudra loan application to be approved online?

The approval time for online Mudra loan applications can vary signNowly. Generally, after you mudra loan apply online, you can expect a response from the lender within a few days to a couple of weeks, depending on the documentation and lender processes.

-

Can I apply for multiple Mudra loans at the same time?

Yes, you can apply for multiple Mudra loans at once. However, when you mudra loan apply online, it's crucial to provide clear reasons for each application and demonstrate your ability to manage multiple loans effectively to the lenders.

-

What are the features of a Mudra loan offered through online applications?

Mudra loans come with several features designed to support small businesses, such as collateral-free loans, flexible repayment periods, and low-interest rates. When you mudra loan apply online, you can also benefit from streamlined processing and quick disbursal of funds.

Get more for Axis Loan Application Form

- Print rent certificate form

- J341 form

- Australian standard transfer form editable

- Plate tectonics crossword puzzle answer key form

- Driver abstract nj form

- Mod form 134

- Fs egov sachsen deformservfindformtax office only for creditor identifier saxony sachsen

- Anlage vereinfachtes ertragswertverfahren zur feststellungserklrung form

Find out other Axis Loan Application Form

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now