Illinois Department of Revenue IL 2220 Computation of Penalties for Businesses for IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 102 Form

Understanding the Illinois Department Of Revenue IL 2220 Form

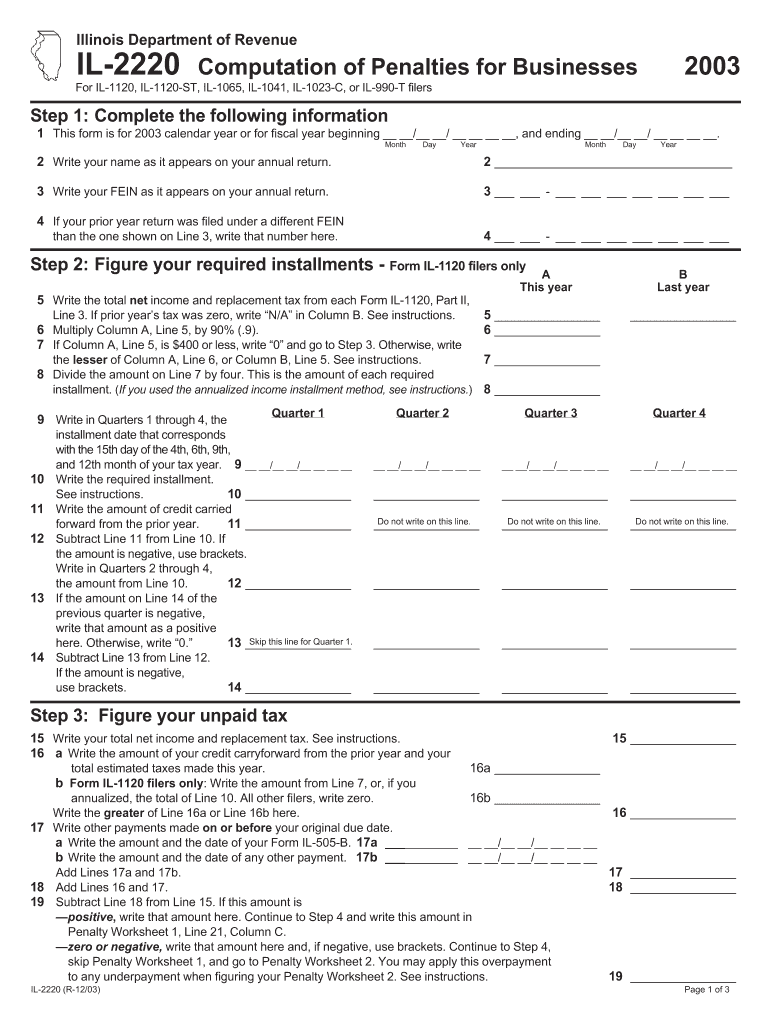

The Illinois Department Of Revenue IL 2220 is a form designed for businesses that need to compute penalties related to various tax filings, including IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, or IL 990 T. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately calculate any penalties that may apply due to underpayment or late payment of taxes. It is specifically tailored for calendar year filers, ensuring that businesses have a clear framework for determining their penalty obligations.

Steps to Complete the Illinois Department Of Revenue IL 2220

Completing the IL 2220 form involves several key steps:

- Begin by gathering all necessary financial documents related to your tax filings for the applicable year.

- Fill in the required information accurately, including business details and tax identification numbers.

- Follow the instructions to calculate any penalties based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the Illinois Department Of Revenue IL 2220

The IL 2220 form serves a legal purpose by documenting the computation of penalties for businesses. It is crucial for maintaining compliance with Illinois tax laws. Proper use of this form can help businesses avoid additional penalties and interest that may accrue from non-compliance. Filing the form correctly and on time is essential to protect the business from legal repercussions.

Key Elements of the Illinois Department Of Revenue IL 2220

Several key elements must be included when filling out the IL 2220 form:

- Identification of the tax year for which penalties are being computed.

- Accurate reporting of income and tax liability.

- Clear calculations of any penalties owed, based on the guidelines provided by the Illinois Department of Revenue.

Filing Deadlines for the Illinois Department Of Revenue IL 2220

It is important to be aware of filing deadlines associated with the IL 2220 form. Typically, the form must be submitted by the due date of the tax return for which penalties are being calculated. Missing this deadline can result in additional penalties and interest, making timely submission critical for compliance.

Examples of Using the Illinois Department Of Revenue IL 2220

Businesses may encounter various scenarios where the IL 2220 form is applicable. For instance, a corporation that underpaid its estimated taxes may need to complete this form to determine the penalty owed. Similarly, partnerships that fail to meet their tax obligations can utilize the IL 2220 to compute their penalties accurately. Each scenario will require careful consideration of the specific tax situation and adherence to the guidelines outlined in the form.

Quick guide on how to complete illinois department of revenue il 2220 computation of penalties for businesses for il 1120 il 1120 st il 1065 il 1041 il 1023 c

Complete [SKS] effortlessly on any device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-centered task today.

The easiest way to alter and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools available from airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form—via email, text message (SMS), an invite link, or download it to your computer.

No more worrying about misplaced or lost files, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow efficiently manages all your document needs in just a few clicks on the device of your choice. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 102

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 2220 computation of penalties for businesses for il 1120 il 1120 st il 1065 il 1041 il 1023 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 2220 Computation Of Penalties for businesses?

The Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or is a form used to calculate penalties for late or incorrect tax filings. It helps businesses understand their obligations and avoid unnecessary penalties.

-

How can airSlate SignNow assist with the IL 2220 form?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or. Our solution streamlines the document process, ensuring accuracy and compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan provides access to features that facilitate the completion of forms like the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time collaboration. These tools are particularly beneficial for completing the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or efficiently and accurately.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing workflow efficiency. This is especially useful for businesses needing to manage the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or alongside their existing tools.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or ensures a streamlined process. It reduces the risk of errors, saves time, and provides a secure way to manage sensitive information.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for new users to navigate. This is particularly beneficial when completing the Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 1023 C, Or IL 990 T Filers Step 1 Complete The Following Information 1 This Form Is For Calendar Year Or.

Get more for Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 102

- Real estate developers errors and omissions hiscox us broker form

- Conway bol 2014 2019 form

- Va 760es voucher 3 2016 form

- Af form 2983

- Layers of the earth printable form

- Ed 900b beneficiary information form apply07 grants

- Ehs application mul chu tha fair gilariver form

- Fixed percentage option election franco signor form

Find out other Illinois Department Of Revenue IL 2220 Computation Of Penalties For Businesses For IL 1120, IL 1120 ST, IL 1065, IL 1041, IL 102

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online