IL 1120 Tax Illinois Form

Understanding the IL 1120 Tax Illinois

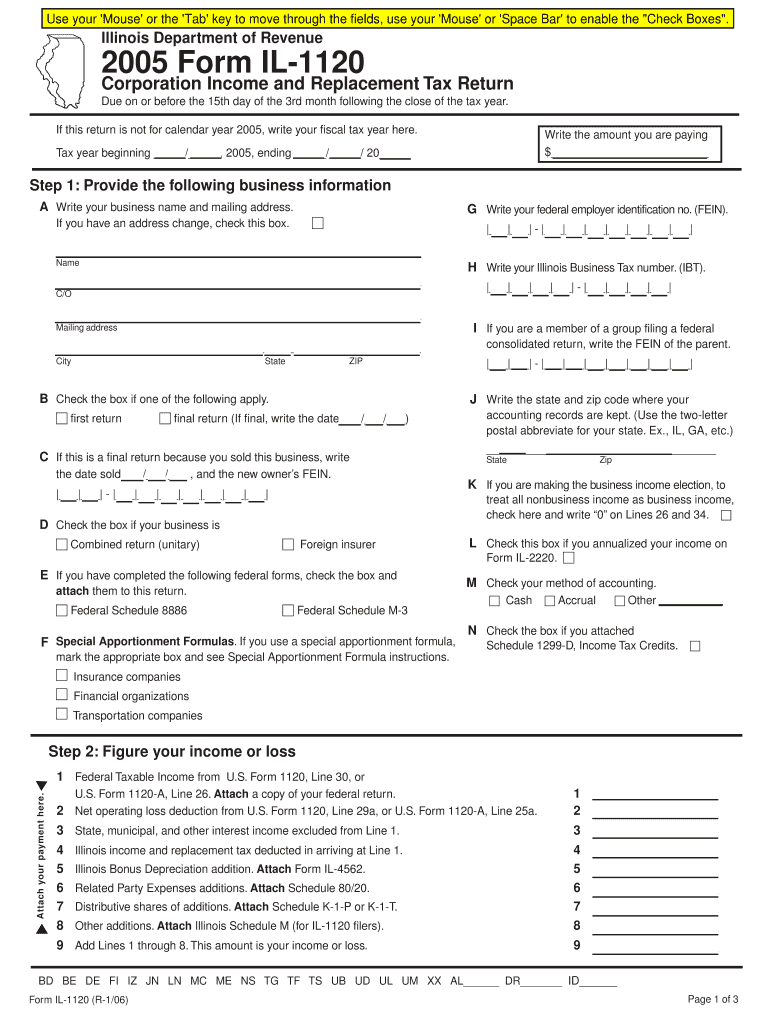

The IL 1120 is the corporate income tax return form used by corporations operating in Illinois. This form is essential for reporting income, deductions, and credits, ensuring compliance with state tax regulations. Corporations must file this form annually to determine their tax liability based on their net income earned within the state. The IL 1120 is specifically designed for C corporations, which are taxed separately from their owners, unlike S corporations or partnerships.

Steps to Complete the IL 1120 Tax Illinois

Completing the IL 1120 involves several key steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, balance sheets, and records of deductions.

- Fill Out the Form: Begin by entering your corporation's identifying information, such as the name, address, and federal employer identification number (FEIN).

- Report Income: Detail all sources of income, including sales revenue and other earnings.

- Claim Deductions: List eligible deductions, which may include business expenses, depreciation, and other allowable costs.

- Calculate Tax Liability: Use the provided tax tables to determine the amount owed based on your net income.

- Review and Sign: Ensure all information is accurate before signing and dating the form.

Filing Deadlines for the IL 1120 Tax Illinois

Corporations must file the IL 1120 by the 15th day of the third month following the end of their fiscal year. For corporations operating on a calendar year, this means the due date is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents for the IL 1120 Tax Illinois

When preparing to file the IL 1120, certain documents are necessary:

- Financial Statements: Include complete income statements and balance sheets for the tax year.

- Federal Tax Return: A copy of the federal corporate tax return (Form 1120) should be attached.

- Supporting Schedules: Any additional schedules that provide details on income, deductions, and credits must be included.

- Documentation for Deductions: Keep records of expenses claimed as deductions, such as receipts and invoices.

Penalties for Non-Compliance with the IL 1120 Tax Illinois

Failure to file the IL 1120 on time can result in significant penalties. These may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the return is late.

- Interest Charges: Interest accrues on any unpaid tax from the due date until the tax is paid in full.

- Potential Legal Actions: Continued non-compliance may lead to legal actions or further enforcement measures by the state.

Digital Submission Methods for the IL 1120 Tax Illinois

Corporations have the option to submit the IL 1120 electronically or via mail. Electronic filing is encouraged for its efficiency and speed. The Illinois Department of Revenue provides a secure online portal for filing. Alternatively, corporations can print the completed form and mail it to the appropriate address listed in the instructions. Regardless of the method chosen, ensure that all information is accurate and complete to avoid delays in processing.

Quick guide on how to complete il 1120 tax illinois

Complete [SKS] smoothly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without holdups. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1120 tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1120 Tax Illinois form?

The IL 1120 Tax Illinois form is used by corporations to report their income and calculate their tax liability in the state of Illinois. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately report their earnings.

-

How can airSlate SignNow help with IL 1120 Tax Illinois filing?

airSlate SignNow streamlines the process of preparing and submitting the IL 1120 Tax Illinois form by allowing users to eSign documents securely and efficiently. This reduces the time spent on paperwork and ensures that all necessary signatures are obtained promptly.

-

What are the pricing options for using airSlate SignNow for IL 1120 Tax Illinois?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for managing IL 1120 Tax Illinois filings. Each plan includes features that enhance document management and eSigning capabilities, ensuring you get the best value.

-

What features does airSlate SignNow provide for IL 1120 Tax Illinois preparation?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and automated workflows specifically designed for IL 1120 Tax Illinois preparation. These tools help simplify the filing process and ensure that all documents are organized and easily accessible.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with Illinois tax regulations, including those related to the IL 1120 Tax Illinois form. This compliance ensures that your eSigned documents are legally binding and meet all necessary state requirements.

-

Can I integrate airSlate SignNow with other accounting software for IL 1120 Tax Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your IL 1120 Tax Illinois filings. This integration allows for efficient data transfer and helps maintain accurate financial records.

-

What are the benefits of using airSlate SignNow for IL 1120 Tax Illinois?

Using airSlate SignNow for IL 1120 Tax Illinois offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. The platform's user-friendly interface makes it easy for businesses to manage their tax filings without hassle.

Get more for IL 1120 Tax Illinois

- Attending physicians statement form c max life insurance

- Self assessed function form

- Pro rodeo permit application form

- Police officer tax deduction worksheet cyndie barone form

- My science 8 lab safety form

- Tulsa model systems personal development plan and follow up tulsaschools form

- City of tupelo contractors application tupeloms form

- Imm 1294b application for a study permit made outside of canada form

Find out other IL 1120 Tax Illinois

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT