Schedule INS Income Tax Corporate Form

What is the Schedule INS Income Tax Corporate

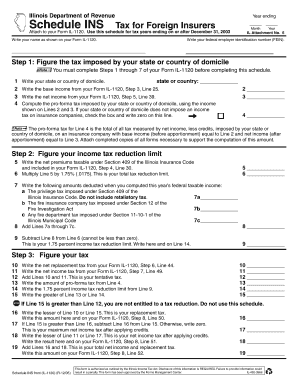

The Schedule INS Income Tax Corporate is a specific form used by corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is typically filed alongside the corporation's main tax return. It provides a detailed overview of the corporation's financial activities, allowing the IRS to assess the tax liabilities accurately.

How to use the Schedule INS Income Tax Corporate

To use the Schedule INS Income Tax Corporate, corporations must first gather all relevant financial information, including income statements, expense reports, and any applicable deductions. The form requires detailed entries about various income sources and expenses. After completing the form, it should be attached to the main corporate tax return and submitted to the IRS by the designated deadline.

Steps to complete the Schedule INS Income Tax Corporate

Completing the Schedule INS Income Tax Corporate involves several key steps:

- Collect all necessary financial documents, including income statements and expense records.

- Fill in the corporation's identification information at the top of the form.

- Report total income, including sales and other revenue sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete any additional sections relevant to specific credits or adjustments.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The filing deadline for the Schedule INS Income Tax Corporate generally aligns with the corporate tax return due date, which is typically the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April fifteenth. It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents

When preparing to file the Schedule INS Income Tax Corporate, corporations should have the following documents ready:

- Income statements detailing revenue and sales.

- Expense reports outlining operational costs.

- Documentation for any deductions claimed, such as receipts and invoices.

- Prior year tax returns for reference and comparison.

Penalties for Non-Compliance

Failure to file the Schedule INS Income Tax Corporate on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines based on the amount of tax owed or the duration of the delay. Additionally, interest may accrue on any unpaid taxes, increasing the overall financial burden on the corporation. It is essential to ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete schedule ins income tax corporate

Complete [SKS] seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without unnecessary delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes only seconds and holds the same legal equivalence as a conventional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule INS Income Tax Corporate

Create this form in 5 minutes!

How to create an eSignature for the schedule ins income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule INS Income Tax Corporate?

Schedule INS Income Tax Corporate is a specific form used by corporations to report their income tax obligations. It helps businesses accurately calculate their tax liabilities and ensures compliance with tax regulations. Utilizing airSlate SignNow can streamline the process of completing and submitting this form.

-

How can airSlate SignNow help with Schedule INS Income Tax Corporate?

airSlate SignNow provides an easy-to-use platform for businesses to prepare, sign, and send their Schedule INS Income Tax Corporate documents. With features like eSignature and document templates, it simplifies the tax filing process. This ensures that your corporate tax submissions are both efficient and compliant.

-

What are the pricing options for using airSlate SignNow for Schedule INS Income Tax Corporate?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger corporations. Each plan provides access to essential features for managing Schedule INS Income Tax Corporate documents. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for Schedule INS Income Tax Corporate with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Schedule INS Income Tax Corporate filings. These integrations allow for automatic data transfer and reduce the risk of errors. This enhances your overall workflow and efficiency.

-

What are the benefits of using airSlate SignNow for corporate tax documents?

Using airSlate SignNow for your Schedule INS Income Tax Corporate documents offers numerous benefits, including time savings and improved accuracy. The platform's eSignature feature ensures that documents are signed quickly and securely. Additionally, it provides a centralized location for all your tax-related documents.

-

Is airSlate SignNow secure for handling Schedule INS Income Tax Corporate documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your Schedule INS Income Tax Corporate documents. This includes encryption and secure cloud storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my Schedule INS Income Tax Corporate documents with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Schedule INS Income Tax Corporate documents in real-time. You can see when documents are sent, viewed, and signed, providing you with complete visibility throughout the process. This feature helps you stay organized and informed.

Get more for Schedule INS Income Tax Corporate

- Strategy lifecycle form

- Indiana laborers fringe benefit funds form

- Answer sheet to nova video questions hunting the elements form

- The jean keating transcript freedom school form

- Crescent lodge scholarship application form

- Wahealthplanfinder paper application form

- Annual high schools that work staff development conference publications sreb form

- Transportation order los angeles unified school district form

Find out other Schedule INS Income Tax Corporate

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now