Schedule M Income Tax Individual Form

What is the Schedule M Income Tax Individual

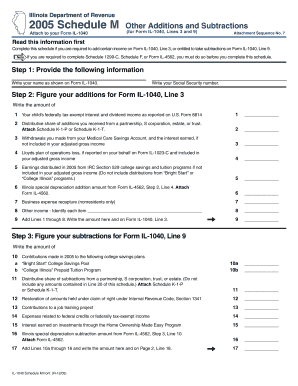

The Schedule M Income Tax Individual is a tax form used by individuals to report specific types of income adjustments on their federal income tax returns. This form is primarily utilized to calculate any adjustments to income that may affect the overall tax liability. It is essential for taxpayers to understand how this form interacts with their primary tax return, as it can significantly impact their taxable income and potential refunds.

How to use the Schedule M Income Tax Individual

To effectively use the Schedule M Income Tax Individual, taxpayers must first gather all relevant financial documentation, including W-2s, 1099s, and any supporting documents for income adjustments. After filling out the form, it should be attached to the main tax return, typically Form 1040. It is crucial to ensure that all entries are accurate and reflect the taxpayer's financial situation to avoid discrepancies with the IRS.

Steps to complete the Schedule M Income Tax Individual

Completing the Schedule M Income Tax Individual involves several key steps:

- Begin by entering personal information, including name and Social Security number.

- Identify the specific income adjustments applicable to your situation, such as educator expenses or student loan interest deductions.

- Carefully calculate each adjustment and enter the totals in the designated fields.

- Review all entries for accuracy and completeness.

- Attach the completed form to your main tax return before submission.

Key elements of the Schedule M Income Tax Individual

The Schedule M Income Tax Individual includes several key elements that taxpayers must be aware of:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Adjustments: Specific lines for various types of income adjustments, which can include deductions for retirement contributions or health savings accounts.

- Total Adjustments: A summary section where all adjustments are totaled to determine the final impact on taxable income.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M Income Tax Individual align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file to delay their submission, but it is important to note that any taxes owed are still due by the original deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M Income Tax Individual. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, allowable deductions, and detailed instructions for each line item. Adhering to these guidelines is crucial for ensuring compliance and avoiding potential penalties.

Quick guide on how to complete schedule m income tax individual

Effortlessly prepare [SKS] on any device

Managing documents online has gained signNow popularity among businesses and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule m income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M Income Tax Individual?

Schedule M Income Tax Individual is a form used by individuals to report certain types of income and deductions on their tax returns. It helps taxpayers understand their tax obligations and ensures they are compliant with IRS regulations. Utilizing airSlate SignNow can simplify the process of signing and submitting these forms electronically.

-

How can airSlate SignNow help with Schedule M Income Tax Individual?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing your Schedule M Income Tax Individual documents. This streamlines the process, reduces paperwork, and ensures that your forms are securely stored and easily accessible. With our solution, you can focus more on your finances and less on administrative tasks.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to features that can assist with managing documents like the Schedule M Income Tax Individual. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically for tax documents like Schedule M Income Tax Individual?

Yes, airSlate SignNow includes features tailored for tax documents, such as templates for Schedule M Income Tax Individual and automated reminders for deadlines. These features help ensure that you never miss an important date and that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage your Schedule M Income Tax Individual documents alongside your other financial tools. This integration enhances your workflow and ensures that all your tax-related documents are in one place.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Schedule M Income Tax Individual documents offers numerous benefits, including enhanced security, ease of use, and time savings. The platform allows for quick electronic signatures and document sharing, making tax season less stressful and more efficient.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive tax information, including your Schedule M Income Tax Individual documents. You can trust that your data is safe while using our platform for electronic signatures and document management.

Get more for Schedule M Income Tax Individual

- Coil construction affidavit of total release and certification of all bills paid affidavit of total release and certification form

- Concession addendum lease bayarearentals form

- Personal history life template form

- Post office savings bank account opening form sample

- Gao w 9 arizonapdffillercom 2015 2019 form

- Privacy act release form filling sample

- Documentation submission cover sheet opdn form

- Amnesty participation form alameda courts ca

Find out other Schedule M Income Tax Individual

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile