Colorado Form 112

What is the Colorado Form 112

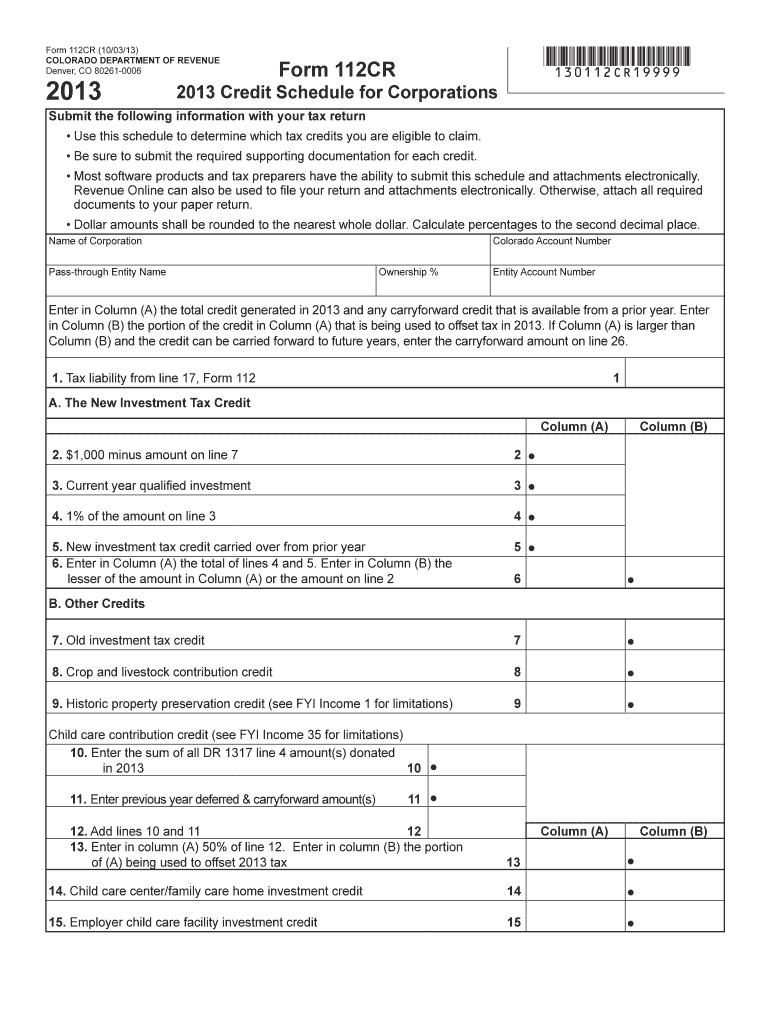

The Colorado Form 112 is a tax form used by individuals and businesses in Colorado to report income and calculate state tax obligations. This form is particularly relevant for those who are self-employed, operate a business, or have income from various sources. Understanding the purpose of Form 112 is essential for compliance with state tax laws and for ensuring accurate reporting of financial information.

Steps to complete the Colorado Form 112

Completing the Colorado Form 112 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and any supporting documentation. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, business income, and other sources.

- Deduct eligible expenses to arrive at your taxable income.

- Calculate your state tax liability based on the provided tax rates.

- Review your form for accuracy before submission.

Legal use of the Colorado Form 112

The Colorado Form 112 must be completed and submitted in accordance with state tax laws to be considered legally binding. Electronic submissions are permitted, provided that they meet the requirements set forth by the state. Utilizing a reliable eSignature solution can enhance the legal validity of the completed form, ensuring compliance with eSignature laws such as ESIGN and UETA.

Required Documents

To successfully complete the Colorado Form 112, certain documents are necessary. These may include:

- Income statements such as W-2s and 1099s.

- Receipts for deductible expenses related to your business.

- Previous tax returns for reference.

- Any additional documentation required by the state for specific deductions or credits.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Colorado Form 112. Typically, the form must be submitted by April 15 of the tax year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Colorado Form 112 on time or inaccuracies in the form can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete colorado form 112

Manage Colorado Form 112 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Colorado Form 112 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Colorado Form 112 without hassle

- Locate Colorado Form 112 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, a process that takes seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the information and click the Done button to store your changes.

- Choose how you want to submit your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Colorado Form 112 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Do I need to fill out Form 112 for a CA Articleship if I have already done B.Com. and CS before starting the CA Articleship?

No, u only need to fill form 112 if you are doing any other course while doing CA.As ur bcom n CS is completed , u need not fill form 112.

-

Do I need to fill out Form 112 of the CA articleship if I had completed BCom’s final year (regular) and only the exams are left?

I am editing this answer because of what I faced recently.I had not filled this form during articleship since nobody ever advised me and I didn’t feel the requirement of doing so as I was doing my BCom from distance education.While applying for membership you will face problem if you haven’t taken permission from your principal for BCom during articleship.You would then be required to pay ₹ 10000 (which is at present ₹ 5000 for some limited period of time) as penalty along with form 112 duly signed by your principal, only then you would be allowed to show your BCom degree officially.So please fill this form asap if you haven’t filled it earlier.

-

Do I need to fill out Form 112 for a CA Articleship if I have already done B.Com. before starting the Articleship?

If you have already completed B.Com, before joining article ship, then you need not intimate the Institute about the same.Having said that, I would recommend you to pursue M.Com through IGNOU (in tie up with ICAI), along with CA. This will help you to become a Post Graduate before you are a Chartered Accountant. If you do that, you need to intimate the Institute, that you are simultaneously pursuing another course, besides CA.The next step will be to clear National Eligibility Test (NET) or State Level Eligibility Test (SLET), and apply for Junior Research Fellowship offered by University Grants Commission (UGC), after you complete your article ship.There after, the next step is to pursue Doctorate (PhD).In the process, you will be eligible to become lecturer in any Indian College / University, if you are passionate about teaching / coaching.Otherwise, you can practice or join industry, in line with your future plans.

-

I am a CA IPCC student. Do I have to fill out form 112, if I am pursuing an MCom distance education under IGNOU University?

HI,U need to fill Form 112 at the time of joining articleship. Must fill form 112 when u join articleship otherwise u will get into trouble while apply to membership.Form 112 is required to be fill for every course pursuing with CA articleship including distance course also.You can also refer my below video for getting more information about form 112.Form 112 ICAI Very Important Information.:-

-

Is it mandatory to fill Form 112 of the CA articleship form if I am doing an M.Com?

The permission of ICAI is required to be obtained in Form 112 by all students who are interested in undertaking another additional course along with Articleship. This permission is required irrespective of whether the student intends to pursue the additional course through correspondence or regular college. This permission in Form 112 is required for both graduation as well as post graduation courses.The permission is required to be obtained either at the time of joining articleship (if the student is already pursuing the course) or after joining articleship (if the student intends to join the additional course after he has already started his articleship).

Create this form in 5 minutes!

How to create an eSignature for the colorado form 112

How to create an electronic signature for the Colorado Form 112 online

How to make an eSignature for the Colorado Form 112 in Chrome

How to generate an electronic signature for putting it on the Colorado Form 112 in Gmail

How to make an eSignature for the Colorado Form 112 from your mobile device

How to create an eSignature for the Colorado Form 112 on iOS

How to generate an eSignature for the Colorado Form 112 on Android

People also ask

-

What is Colorado Form 112 and why is it important?

Colorado Form 112 is a crucial document for businesses operating in Colorado, as it is the state's corporate income tax return. Understanding how to accurately complete Colorado Form 112 is essential for compliance and avoiding penalties, ensuring your business meets its tax obligations.

-

How can airSlate SignNow help with Colorado Form 112?

airSlate SignNow simplifies the process of preparing and signing Colorado Form 112 by allowing you to securely eSign documents online. Our platform ensures that your forms are completed accurately and sent promptly, streamlining your tax filing process.

-

What are the pricing options for using airSlate SignNow for Colorado Form 112?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. Whether you're a small business or a larger organization, our plans are designed to be cost-effective, allowing you to manage Colorado Form 112 and other important documents without breaking the bank.

-

Does airSlate SignNow integrate with other tools for managing Colorado Form 112?

Yes, airSlate SignNow seamlessly integrates with various popular applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily access and manage your Colorado Form 112 alongside your other essential documents, improving your workflow and efficiency.

-

Can I store my Colorado Form 112 securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including Colorado Form 112. Our advanced security features ensure that your sensitive information is protected and accessible only to authorized users.

-

What benefits does eSigning Colorado Form 112 provide?

eSigning Colorado Form 112 with airSlate SignNow offers numerous benefits, including faster processing times and reduced paper use. Our platform enhances collaboration, allowing multiple parties to sign documents from anywhere, which speeds up the tax submission process.

-

Is airSlate SignNow user-friendly for filing Colorado Form 112?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface allows users of all levels to easily navigate the platform and efficiently fill out and eSign Colorado Form 112 without any hassle.

Get more for Colorado Form 112

- Authorization agreement contract mou moa form

- Va form 22 va enrollment certification

- Absa foundation funding application forms

- Brewton parker college transcript request form

- Soft corporate offer sample form

- Solar site survey checklist form

- Deed poll form pdf

- Permission slip st peters youth ministry form

Find out other Colorado Form 112

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe