Schedule K 1 T Income Tax Business Tax Illinois Form

What is the Schedule K-1 T Income Tax Business Tax Illinois

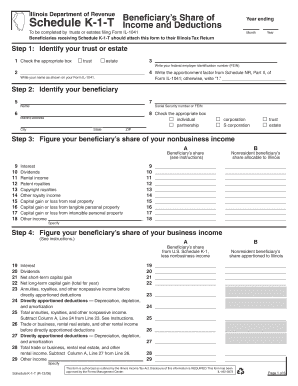

The Schedule K-1 T is a form used in Illinois for reporting income, deductions, and credits from partnerships, S corporations, and certain trusts. This form is essential for taxpayers who receive income from these entities, as it provides detailed information needed to accurately report income on their personal tax returns. The "T" designation indicates that this specific K-1 is tailored for Illinois tax purposes, ensuring compliance with state tax regulations.

How to use the Schedule K-1 T Income Tax Business Tax Illinois

To effectively use the Schedule K-1 T, taxpayers must first receive the form from the entity in which they have an ownership stake. This form will outline the taxpayer's share of income, losses, and other tax-related items. Taxpayers should then transfer this information to their individual income tax returns, ensuring that all figures are accurately reported. It is important to understand the various sections of the K-1 T, as each part provides specific details that may affect the overall tax liability.

Steps to complete the Schedule K-1 T Income Tax Business Tax Illinois

Completing the Schedule K-1 T involves several key steps:

- Review the form received from the partnership or S corporation for accuracy.

- Identify the income, deductions, and credits allocated to you as indicated on the form.

- Transfer the relevant figures to your Illinois individual income tax return, ensuring proper alignment with the corresponding sections.

- Keep a copy of the K-1 T for your records, as it may be needed for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 T align with the overall tax filing deadlines for Illinois. Typically, individual taxpayers must file their state income tax returns by April 15. However, if you are receiving a K-1 T, it is prudent to confirm the specific deadlines set by the issuing entity, as they may impact when you receive your K-1 T and when you can file your taxes. Extensions may be available, but it is essential to understand the implications of filing late.

Who Issues the Form

The Schedule K-1 T is issued by partnerships, S corporations, and certain trusts operating in Illinois. These entities are responsible for preparing and distributing the K-1 T to their partners or shareholders. Each entity must ensure that the information provided on the K-1 T is accurate and reflects the taxpayer's share of income and deductions. It is the responsibility of the recipient to report this information correctly on their tax returns.

Key elements of the Schedule K-1 T Income Tax Business Tax Illinois

Key elements of the Schedule K-1 T include:

- Income Reporting: Details on the taxpayer's share of ordinary business income, rental income, and capital gains.

- Deductions: Information regarding deductions that can be claimed, such as business expenses and losses.

- Credits: Any tax credits that the taxpayer may be eligible for based on their share of the entity's activities.

- Entity Information: Name, address, and identification number of the partnership or S corporation.

Legal use of the Schedule K-1 T Income Tax Business Tax Illinois

The Schedule K-1 T must be used in accordance with Illinois tax laws. Taxpayers are legally obligated to report all income and deductions as outlined on the K-1 T accurately. Failure to do so can result in penalties, interest, or audits by the Illinois Department of Revenue. It is important for taxpayers to understand their rights and responsibilities when using this form to ensure compliance with state regulations.

Quick guide on how to complete schedule k 1 t income tax business tax illinois

Complete [SKS] seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly and without holdup. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to adjust and electronically sign [SKS] without stress

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 T Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 t income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 T Income Tax Business Tax Illinois?

Schedule K 1 T Income Tax Business Tax Illinois is a tax form used by partnerships and S corporations to report income, deductions, and credits to the IRS. It provides detailed information about each partner's share of the business's income and expenses, which is essential for accurate tax reporting.

-

How can airSlate SignNow help with Schedule K 1 T Income Tax Business Tax Illinois?

airSlate SignNow simplifies the process of preparing and signing Schedule K 1 T Income Tax Business Tax Illinois forms. With our eSignature solution, businesses can easily send, sign, and store these important tax documents securely and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing documents, including those related to Schedule K 1 T Income Tax Business Tax Illinois, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, making it ideal for managing Schedule K 1 T Income Tax Business Tax Illinois documents. These features streamline the signing process and enhance collaboration among team members.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is compliant with industry standards and regulations, ensuring that your Schedule K 1 T Income Tax Business Tax Illinois documents are handled securely. Our platform adheres to legal requirements for electronic signatures, providing peace of mind for your business.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, including accounting and tax preparation tools. This allows for seamless management of Schedule K 1 T Income Tax Business Tax Illinois documents alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Schedule K 1 T Income Tax Business Tax Illinois documents offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform helps businesses save time and resources while ensuring compliance with tax regulations.

Get more for Schedule K 1 T Income Tax Business Tax Illinois

- Doj form 127 justice

- Deed non warranty deed north carolina non warranty deed form

- Cash drawer count sheet affordable inns form

- B20a form

- Cooper 22sr ld1 29 c unv l835 cd1 u spec sheet buy the cooper 22sr ld1 29 c unv l835 cd1 u led troffer module low prices and form

- Trailer agreement form

- Dte lsp form

- School awards nomination form pdf more from yimg com

Find out other Schedule K 1 T Income Tax Business Tax Illinois

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure