IL 1065 X Income Tax Business Tax Illinois Form

What is the IL 1065 X Income Tax Business Tax Illinois

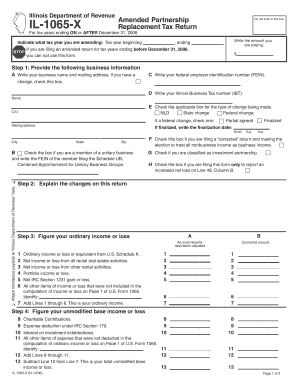

The IL 1065 X form is an amended return for partnerships in Illinois. It is used to correct errors or make changes to previously filed IL 1065 forms. This form is essential for ensuring that the partnership's tax obligations are accurately reported to the Illinois Department of Revenue. By submitting an IL 1065 X, partnerships can rectify mistakes related to income, deductions, or other relevant tax information.

Steps to complete the IL 1065 X Income Tax Business Tax Illinois

Completing the IL 1065 X involves several important steps:

- Gather Information: Collect all relevant financial documents and previous IL 1065 filings to identify the necessary corrections.

- Complete the Form: Fill out the IL 1065 X, ensuring all corrections are clearly indicated. Be thorough to avoid further discrepancies.

- Attach Supporting Documents: Include any necessary documentation that supports the changes made on the form.

- Review and Sign: Carefully review the completed form for accuracy and ensure it is signed by an authorized individual.

- Submit the Form: File the IL 1065 X with the Illinois Department of Revenue through the appropriate submission method.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IL 1065 X. Typically, the amended return must be filed within three years from the original due date of the IL 1065 form. Keeping track of these deadlines helps avoid penalties and ensures compliance with state tax regulations.

Required Documents

When filing the IL 1065 X, certain documents are necessary to support the amendments. These may include:

- Original IL 1065 form that is being amended.

- Any schedules or attachments that were part of the original filing.

- Documentation that substantiates the changes being made, such as corrected financial statements or receipts.

Form Submission Methods

The IL 1065 X can be submitted through various methods, providing flexibility for partnerships. Options include:

- Online Submission: Many partnerships choose to file electronically through the Illinois Department of Revenue's online portal.

- Mail: The form can be printed and mailed to the designated address provided by the Illinois Department of Revenue.

- In-Person: Some partnerships may opt to deliver the form in person at local Department of Revenue offices.

Penalties for Non-Compliance

Failing to file the IL 1065 X or submitting it inaccurately can result in penalties. These may include:

- Monetary fines for late filing or underreporting of income.

- Interest on any unpaid taxes due as a result of the errors.

- Potential audits or additional scrutiny from the Illinois Department of Revenue.

Quick guide on how to complete il 1065 x income tax business tax illinois

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Choose how you wish to send your document, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, laborious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Edit and electronically sign [SKS] and guarantee excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1065 X Income Tax Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1065 x income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1065 X Income Tax Business Tax Illinois?

The IL 1065 X Income Tax Business Tax Illinois is a form used by partnerships to amend their previously filed Illinois income tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. Understanding this form is crucial for businesses to avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow help with IL 1065 X Income Tax Business Tax Illinois filings?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and submit their IL 1065 X Income Tax Business Tax Illinois documents electronically. With its user-friendly interface, businesses can streamline the process of amending tax returns, saving time and reducing the risk of errors. This ensures that your tax documents are handled securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it an affordable solution for managing IL 1065 X Income Tax Business Tax Illinois filings. Plans typically include features such as unlimited document signing, templates, and integrations with other software. You can choose a plan that best fits your business needs and budget.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for IL 1065 X Income Tax Business Tax Illinois documents. These features enhance the efficiency of document management, allowing businesses to easily create, send, and sign tax forms. Additionally, the platform ensures compliance with legal standards for electronic signatures.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive IL 1065 X Income Tax Business Tax Illinois documents. The platform employs advanced encryption and security protocols to protect your data. This ensures that your tax information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other accounting software for tax filing?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, enhancing the workflow for IL 1065 X Income Tax Business Tax Illinois filings. This integration allows businesses to import data directly from their accounting systems, reducing manual entry and minimizing errors. It streamlines the entire process, making tax filing more efficient.

-

What are the benefits of using airSlate SignNow for IL 1065 X Income Tax Business Tax Illinois?

Using airSlate SignNow for IL 1065 X Income Tax Business Tax Illinois offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. The platform simplifies the document signing process, allowing multiple stakeholders to review and sign documents quickly. This leads to faster turnaround times and ensures that your tax filings are submitted on schedule.

Get more for IL 1065 X Income Tax Business Tax Illinois

Find out other IL 1065 X Income Tax Business Tax Illinois

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure