IL 4644 Income Tax Individual Form

What is the IL 4644 Income Tax Individual

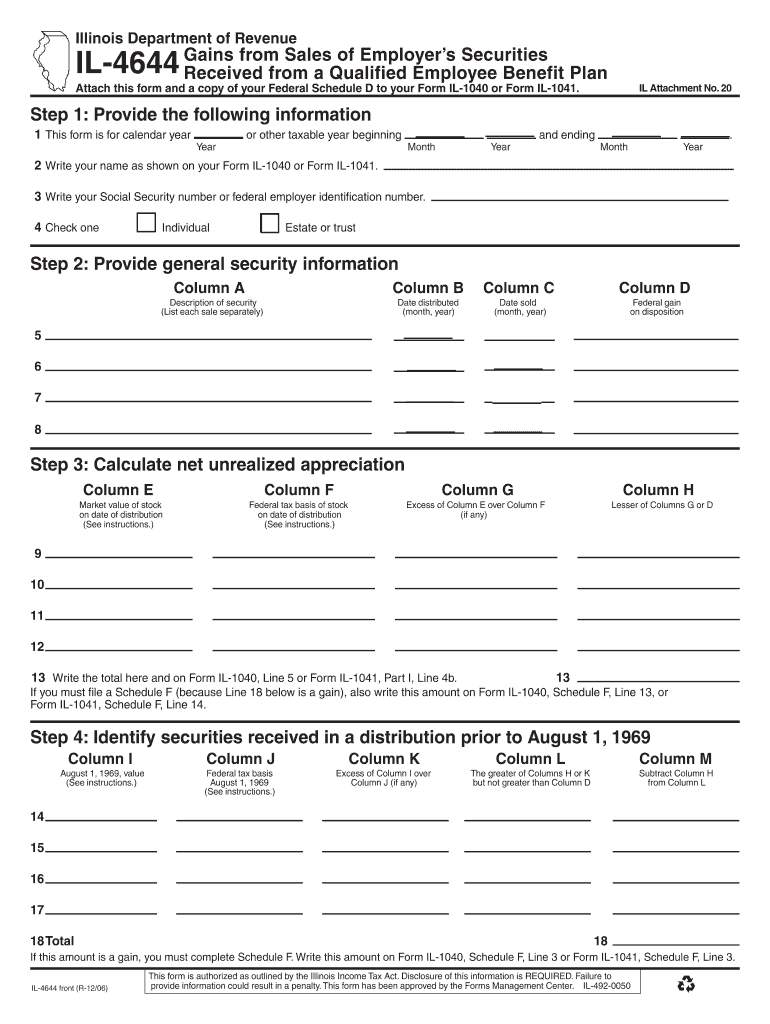

The IL 4644 Income Tax Individual form is a state tax document used by residents of Illinois to report their individual income tax obligations. This form is essential for individuals to accurately declare their earnings and calculate the amount of tax owed to the state. The IL 4644 is specifically designed for individual taxpayers, including those who may have multiple sources of income or specific deductions that need to be reported. Understanding this form is crucial for compliance with state tax laws and for ensuring that taxpayers fulfill their financial responsibilities.

Steps to complete the IL 4644 Income Tax Individual

Completing the IL 4644 Income Tax Individual form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter your total income from all sources, ensuring you include wages, interest, dividends, and any other earnings.

- Claim deductions: Identify and list any eligible deductions that can reduce your taxable income, such as retirement contributions or education expenses.

- Calculate tax owed: Use the provided tax tables or calculators to determine the amount of tax you owe based on your taxable income.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it before submission.

How to obtain the IL 4644 Income Tax Individual

The IL 4644 Income Tax Individual form can be obtained through several methods:

- Online: Visit the Illinois Department of Revenue website to download a printable version of the form.

- Local offices: Obtain a physical copy at local tax offices or government buildings throughout Illinois.

- Tax preparation services: Many tax professionals and software programs include the IL 4644 form as part of their services, making it accessible during the tax preparation process.

Form Submission Methods

Once the IL 4644 Income Tax Individual form is completed, it can be submitted in various ways:

- Online filing: Utilize the Illinois Department of Revenue's online filing system for a quick and efficient submission.

- Mail: Send the completed form via postal mail to the address specified in the instructions. Ensure it is postmarked by the filing deadline.

- In-person: Deliver the form directly to a local tax office if preferred, allowing for immediate confirmation of receipt.

Key elements of the IL 4644 Income Tax Individual

The IL 4644 Income Tax Individual form includes several key elements that taxpayers must be aware of:

- Personal information: Essential details such as name, address, and Social Security number.

- Income reporting: Sections for reporting various types of income, including wages, interest, and dividends.

- Deductions: Areas to claim eligible deductions that can lower taxable income.

- Tax calculation: A section for calculating the total tax owed based on reported income and deductions.

- Signature line: A requirement for the taxpayer's signature, affirming the accuracy of the information provided.

Quick guide on how to complete il 4644 income tax individual

Effortlessly prepare [SKS] on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and seamlessly. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to adjust and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact confidential details with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Adjust and electronically sign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 4644 Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the il 4644 income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 4644 Income Tax Individual form?

The IL 4644 Income Tax Individual form is a tax document used by individuals in Illinois to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws and can impact your overall tax refund or amount owed.

-

How can airSlate SignNow help with the IL 4644 Income Tax Individual form?

airSlate SignNow provides a seamless platform for electronically signing and sending the IL 4644 Income Tax Individual form. This simplifies the process, allowing you to complete your tax documentation quickly and securely, ensuring timely submission.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options for individuals handling the IL 4644 Income Tax Individual form. Each plan provides access to essential features, making it a cost-effective solution for managing your tax documents.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage, all of which are beneficial for managing the IL 4644 Income Tax Individual form. These tools streamline the process, making it easier to prepare and submit your tax documents.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IL 4644 Income Tax Individual form and other sensitive documents are protected. The platform uses encryption and secure access protocols to safeguard your information throughout the signing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, enhancing your ability to manage the IL 4644 Income Tax Individual form efficiently. This connectivity allows for a smoother workflow and better organization of your tax documents.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the IL 4644 Income Tax Individual form, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced accuracy. The platform simplifies the signing process, allowing you to focus on maximizing your tax return.

Get more for IL 4644 Income Tax Individual

- Affidavit for us citizen of pakistan origin form

- Affidavit for us citizens of pakistan orign form

- Eoir ij benchbook tools c w f bond questionnaire worksheet justice form

- Ncdva 23b 3 form

- Zambia catholic university application form

- Excess dirt request galveston county form

- Form 7b defence

- Nsw ucpr form 77 notice of change or appointment of solicitor

Find out other IL 4644 Income Tax Individual

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document