Illinois Department of Revenue Schedule UBINS Attach to Your Form IL 1120

What is the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

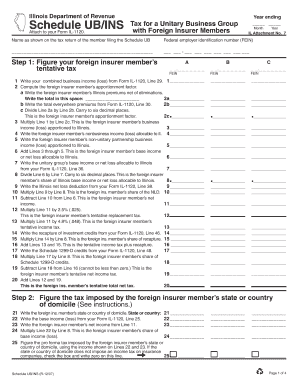

The Illinois Department Of Revenue Schedule UBINS is a crucial document that businesses must attach to their Form IL 1120 when filing their state tax returns. This schedule is specifically designed for corporations that need to report Unrelated Business Income (UBI) derived from activities not substantially related to their exempt purposes. Understanding this form is essential for compliance with Illinois tax laws and ensuring accurate reporting of income.

How to use the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

Using the Schedule UBINS involves several steps. First, gather all necessary financial information related to your corporation's unrelated business activities. Next, complete the schedule by providing details about the income generated and the expenses incurred from these activities. Once the schedule is filled out, it must be attached to your Form IL 1120 before submission. This ensures that the Illinois Department of Revenue has all relevant information for accurate processing of your tax return.

Steps to complete the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

Completing the Schedule UBINS requires careful attention to detail. Follow these steps:

- Identify all sources of unrelated business income for the tax year.

- Document the gross income from these sources, including any related expenses.

- Fill out the schedule, ensuring that all figures are accurate and reflect the business activities.

- Review the completed schedule for any errors or omissions.

- Attach the Schedule UBINS to your completed Form IL 1120.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Schedule UBINS and Form IL 1120. Typically, the due date for filing is the 15th day of the third month following the end of your corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is March 15. Late submissions may incur penalties, so timely filing is essential for compliance.

Required Documents

To complete the Schedule UBINS, you will need several documents, including:

- Financial statements detailing income and expenses.

- Records of all unrelated business activities.

- Previous tax returns, if applicable, for reference.

Having these documents ready will facilitate a smoother completion of the schedule and ensure that all information is accurate and comprehensive.

Penalties for Non-Compliance

Failure to accurately complete and attach the Schedule UBINS to your Form IL 1120 can result in penalties. The Illinois Department of Revenue may impose fines for late filing, inaccuracies, or failure to report unrelated business income. It is crucial to ensure that all information is correct and submitted on time to avoid these penalties and maintain compliance with state tax regulations.

Quick guide on how to complete illinois department of revenue schedule ubins attach to your form il 1120

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device utilizing the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] smoothly

- Find [SKS] and click Get Form to begin.

- Make use of the tools we offer to fulfill your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule ubins attach to your form il 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120?

The Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120 is a required document for businesses filing their corporate income tax returns in Illinois. It provides detailed information about business income and deductions. Properly completing this schedule is essential for compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120?

airSlate SignNow simplifies the process of preparing and submitting the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120 by allowing users to eSign and send documents securely. Our platform ensures that all necessary forms are completed accurately and efficiently. This reduces the risk of errors and helps businesses stay compliant.

-

Is there a cost associated with using airSlate SignNow for the Illinois Department Of Revenue Schedule UBINS?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that facilitate the completion and submission of the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120. We recommend reviewing our pricing page to find the best option for your organization.

-

What features does airSlate SignNow offer for managing the Illinois Department Of Revenue Schedule UBINS?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools streamline the process of managing the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120, making it easier to collaborate with team members and ensure timely submissions. Additionally, our platform allows for easy tracking of document status.

-

Can I integrate airSlate SignNow with other software for filing the Illinois Department Of Revenue Schedule UBINS?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software solutions. This allows users to seamlessly manage their documents and data when preparing the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120. Integrating with your existing tools enhances efficiency and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the Illinois Department Of Revenue Schedule UBINS?

Using airSlate SignNow for the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which speeds up the filing process. Additionally, our compliance features help ensure that your submissions meet state requirements.

-

How secure is airSlate SignNow when handling the Illinois Department Of Revenue Schedule UBINS?

airSlate SignNow prioritizes security and compliance, employing advanced encryption and secure access protocols. When handling the Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120, you can trust that your sensitive information is protected. Our platform is designed to meet industry standards for data security and privacy.

Get more for Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

- Application for psja echs quarterback club scholarships form

- Business license application city of milton west virginia form

- Unenrolling from plano isd form

- Declaration form form gpml1 ecitizen ecitizen gov

- Rahmani 30 online application form 2018

- At4930 alberta consent form alberta finance and enterprise

- Individual health care plan bformb eec little treasures schoolhouse

- This form may be used to release a refund that has been placed on hold

Find out other Illinois Department Of Revenue Schedule UBINS Attach To Your Form IL 1120

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer