This Form May Be Used to Release a Refund that Has Been Placed on Hold

Understanding the Purpose of the Form to Release a Refund on Hold

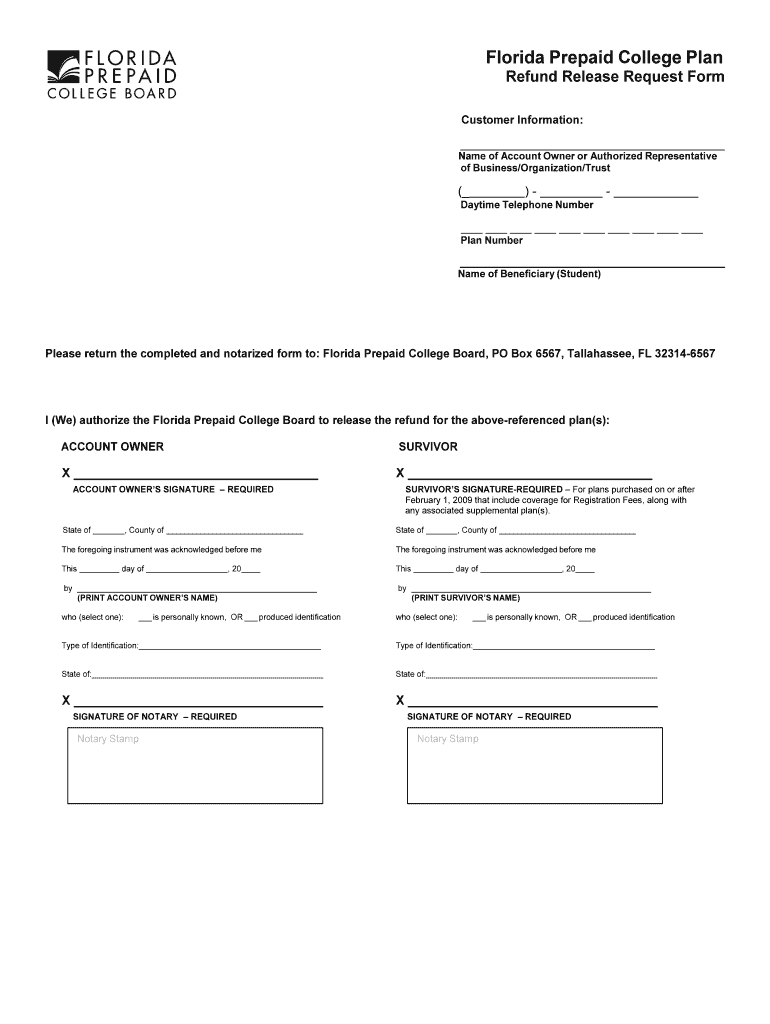

This form is specifically designed to facilitate the release of a refund that has been temporarily placed on hold. It serves as a formal request for the appropriate authorities to review the circumstances surrounding the hold and to take necessary action to release the funds. The reasons for a refund being placed on hold can vary, including discrepancies in tax filings or additional verification requirements from the issuing agency.

Steps to Complete the Refund Release Form

Completing this form requires careful attention to detail to ensure all necessary information is accurately provided. Here are the general steps involved:

- Gather all relevant documentation related to the refund, including any notices received regarding the hold.

- Fill out the form with accurate personal and financial information, ensuring that all fields are completed as required.

- Attach any supporting documents that may help clarify the situation, such as previous tax returns or correspondence with the issuing agency.

- Review the completed form for accuracy and completeness before submission.

Legal Considerations for Using the Refund Release Form

It is essential to understand the legal implications of submitting this form. By filling it out, you are affirming that the information provided is truthful and accurate to the best of your knowledge. Misrepresentation or failure to provide required information can lead to penalties or further delays in processing the refund. Always ensure compliance with relevant laws and guidelines when submitting this form.

Required Documents for Submission

When submitting the form to release a refund that has been placed on hold, certain documents may be required to support your request. These may include:

- A copy of the notice received regarding the hold on the refund.

- Identification documents, such as a driver's license or Social Security card.

- Any relevant tax documents that pertain to the refund in question.

How to Submit the Refund Release Form

The submission of this form can typically be done through various methods, depending on the issuing agency's guidelines. Common submission methods include:

- Online submission through the agency's official website, if available.

- Mailing the completed form and supporting documents to the designated address provided in the instructions.

- In-person submission at local offices, if applicable.

Examples of Situations Requiring the Refund Release Form

This form may be necessary in various scenarios, such as:

- A taxpayer receives a notice indicating that their tax refund is being held due to discrepancies in their filing.

- A business owner encounters a delay in receiving a refund due to additional verification requirements from the IRS.

- Individuals who have recently changed their personal information, such as name or address, may need to use this form to update their records and release their refund.

Quick guide on how to complete this form may be used to release a refund that has been placed on hold

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Alter and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to This Form May Be Used To Release A Refund That Has Been Placed On Hold

Create this form in 5 minutes!

How to create an eSignature for the this form may be used to release a refund that has been placed on hold

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form that releases a refund?

This Form May Be Used To Release A Refund That Has Been Placed On Hold, allowing customers to initiate the refund process efficiently. It ensures that all necessary information is provided to expedite the release of funds. By using this form, you can streamline your refund requests and minimize delays.

-

How do I fill out the refund release form?

To complete the form, simply provide the required details such as your account information and the reason for the refund. This Form May Be Used To Release A Refund That Has Been Placed On Hold, so ensure all fields are accurately filled to avoid processing delays. Once completed, submit the form as instructed.

-

Are there any fees associated with using this form?

There are no additional fees for using This Form May Be Used To Release A Refund That Has Been Placed On Hold. Our goal is to provide a cost-effective solution for managing refunds. However, please check with your financial institution for any potential charges related to the refund process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and secure storage. This Form May Be Used To Release A Refund That Has Been Placed On Hold is just one of the many forms you can manage efficiently. Our platform is designed to simplify document workflows for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. This Form May Be Used To Release A Refund That Has Been Placed On Hold can be easily integrated into your existing systems for seamless processing. Check our integration options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for refunds?

Using airSlate SignNow for refunds provides a streamlined process, reducing the time it takes to release funds. This Form May Be Used To Release A Refund That Has Been Placed On Hold ensures that all necessary steps are followed for a successful refund. Additionally, our platform enhances security and compliance for your transactions.

-

How long does it take to process a refund using this form?

The processing time for refunds can vary, but using This Form May Be Used To Release A Refund That Has Been Placed On Hold typically speeds up the process. Once submitted, your request will be reviewed promptly, and you will be notified of the status. Generally, refunds are processed within a few business days.

Get more for This Form May Be Used To Release A Refund That Has Been Placed On Hold

Find out other This Form May Be Used To Release A Refund That Has Been Placed On Hold

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile