For Illinois Net Losses Arising in Illinois Department of Revenue Tax Years Ending on or After December 31, 1986 Form

Understanding the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

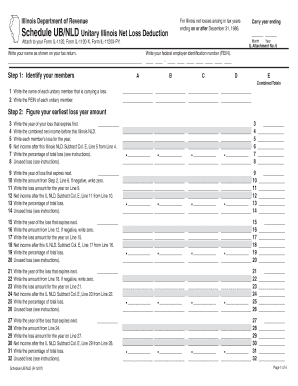

The form for Illinois net losses is designed for taxpayers who have incurred losses in Illinois during specified tax years. This form allows individuals and businesses to report losses that can be utilized to offset taxable income in future years. Understanding the specific provisions of this form is crucial for maximizing tax benefits and ensuring compliance with state tax regulations.

How to Use the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Using this form involves several steps to accurately report losses. Taxpayers must first gather all necessary financial documentation, including income statements and records of losses incurred. Once the relevant information is compiled, the form should be filled out with precise details regarding the nature and amount of the losses. It is essential to follow the instructions carefully to ensure that the form is completed correctly, as errors can lead to delays or penalties.

Key Elements of the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Key elements of this form include the identification of the taxpayer, the tax year in which the losses occurred, and a detailed account of the losses being claimed. Additionally, taxpayers must provide supporting documentation that substantiates the reported losses. This may include financial statements, tax returns from previous years, and any other relevant records that demonstrate the legitimacy of the losses.

Eligibility Criteria for the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Eligibility for using this form typically requires that the taxpayer has incurred a net loss during the specified tax years. Both individuals and various business entities, such as corporations and partnerships, may qualify. It is important for taxpayers to review the specific criteria set forth by the Illinois Department of Revenue to ensure they meet all requirements before filing.

Steps to Complete the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Completing this form involves a series of methodical steps:

- Gather all relevant financial documents.

- Identify the tax year in which the losses occurred.

- Detail the nature and amount of the losses on the form.

- Attach any necessary supporting documentation.

- Review the completed form for accuracy.

- Submit the form to the Illinois Department of Revenue by the required deadline.

Filing Deadlines for the For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Filing deadlines for this form are typically aligned with the annual tax filing schedule. It is crucial for taxpayers to be aware of these deadlines to avoid penalties. Generally, forms should be submitted by the due date of the tax return for the year in which the losses occurred. Late submissions may result in the inability to claim the losses for that tax year.

Quick guide on how to complete for illinois net losses arising in illinois department of revenue tax years ending on or after december 31 1986

Complete [SKS] with ease on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

Create this form in 5 minutes!

How to create an eSignature for the for illinois net losses arising in illinois department of revenue tax years ending on or after december 31 1986

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986'?

The phrase 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986' refers to specific tax regulations that impact how businesses can report and utilize net losses. Understanding this can help businesses optimize their tax filings and potentially recover funds.

-

How can airSlate SignNow assist with tax documentation related to Illinois net losses?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning tax documents. This is particularly useful for managing paperwork related to 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986', ensuring compliance and accuracy in submissions.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are essential for efficiently handling documents related to 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986', making the process faster and more reliable.

-

Is airSlate SignNow cost-effective for small businesses dealing with Illinois tax issues?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By simplifying the document management process related to 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986', small businesses can save both time and money.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This is particularly beneficial for managing documents related to 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986', ensuring a seamless workflow.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including enhanced security, improved efficiency, and reduced errors. This is crucial when dealing with complex regulations like 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986'.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive tax documents. This is vital for maintaining compliance and confidentiality when handling information related to 'For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986'.

Get more for For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

- Discretionary contracts disclosure bformb the city of san antonio hemisfair

- Informational statement for louisiana residential southern title

- Fairfield county bar association closing customs form

- Miss texas teen usa form

- A short guide to referencing the standards form

- Multiple listing service office exclusive winzone realty inc form

- Exit ticket slope intercept form

- Macomb county timesheet stuart wilson cpa pc form

Find out other For Illinois Net Losses Arising In Illinois Department Of Revenue Tax Years Ending On Or After December 31, 1986

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document