Nevada Use Tax Return 2016-2026

What is the Nevada Use Tax Return

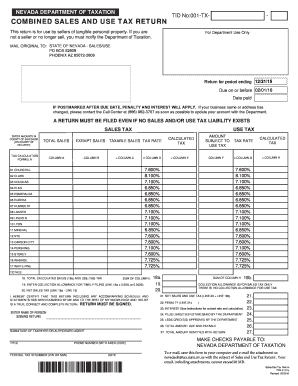

The Nevada Use Tax Return is a document that businesses and individuals use to report and pay use tax on items purchased for use in Nevada. This tax applies to goods purchased outside of Nevada that are brought into the state for consumption, storage, or use. The purpose of the use tax is to ensure that local businesses are not disadvantaged by out-of-state purchases. It is essential for residents and businesses to understand their obligations under Nevada tax law to remain compliant.

Steps to complete the Nevada Use Tax Return

Completing the Nevada Use Tax Return involves several key steps:

- Gather relevant purchase information, including dates, amounts, and descriptions of items.

- Determine the applicable use tax rate based on the type of goods purchased.

- Fill out the form accurately, providing all required details to avoid delays.

- Calculate the total use tax owed based on your purchases.

- Submit the completed return by the specified deadline.

How to obtain the Nevada Use Tax Return

The Nevada Use Tax Return can be obtained through the Nevada Department of Taxation's website or by contacting their office directly. The form is available in both digital and paper formats, allowing taxpayers to choose their preferred method of completion. It is advisable to download the most recent version of the form to ensure compliance with current tax regulations.

Legal use of the Nevada Use Tax Return

To ensure the legal use of the Nevada Use Tax Return, taxpayers must adhere to specific regulations set forth by the state. This includes accurately reporting all taxable purchases and submitting the return by the due date. Failure to comply with these legal requirements can result in penalties and interest on unpaid taxes. Utilizing a secure and compliant platform for eSigning and submitting documents can enhance the legitimacy of the process.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Use Tax Return are typically aligned with the state's tax calendar. Taxpayers should be aware of the specific due dates to avoid late fees. Generally, returns are due quarterly or annually, depending on the volume of taxable purchases. Keeping a calendar of these important dates can help ensure timely compliance.

Penalties for Non-Compliance

Non-compliance with the Nevada Use Tax Return requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses to understand the consequences of failing to file or pay the use tax to avoid unnecessary financial burdens.

Quick guide on how to complete nevada use tax return

Complete Nevada Use Tax Return seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Nevada Use Tax Return on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Nevada Use Tax Return effortlessly

- Find Nevada Use Tax Return and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Nevada Use Tax Return to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada use tax return

Create this form in 5 minutes!

People also ask

-

What is the purpose of the Nevada sales tax in relation to electronic signatures?

The Nevada sales tax is critical for businesses operating within the state, especially when handling transactions that involve electronic signatures. Using airSlate SignNow allows you to manage documents electronically while ensuring compliance with local tax regulations, including the Nevada sales tax.

-

How can airSlate SignNow help me manage my Nevada sales tax documents?

airSlate SignNow offers features that streamline the signing and storing of documents related to Nevada sales tax. With easy access to templates and an organized filing system, you can ensure that your sales tax documentation is always up to date and compliant.

-

Is airSlate SignNow cost-effective for handling Nevada sales tax compliance?

Yes, airSlate SignNow is a cost-effective solution for managing your Nevada sales tax compliance needs. Our pricing model allows businesses of all sizes to access essential tools without breaking the bank, making it a smart choice for tax season.

-

What features does airSlate SignNow offer for handling Nevada sales tax forms?

Our platform provides a range of features tailored for handling Nevada sales tax forms, including easy document uploads, customizable templates, and secure electronic signatures. These features ensure that you can quickly process and manage sales tax forms efficiently.

-

Can I integrate airSlate SignNow with my accounting software for Nevada sales tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, which helps streamline your Nevada sales tax filings. This integration ensures that your documents and financial data work together, minimizing errors and saving you time.

-

What benefits does airSlate SignNow provide for businesses in Nevada regarding sales tax?

Using airSlate SignNow can signNowly simplify the sales tax process for businesses in Nevada. By enabling electronic signatures and offering secure document management, businesses can ensure efficient compliance with Nevada sales tax regulations while saving valuable time and resources.

-

How does electronic signing affect Nevada sales tax records?

Electronic signing via airSlate SignNow enhances the reliability and security of Nevada sales tax records. Our platform keeps a secure audit trail for all signed documents, making it easy to maintain compliance and revisit records when needed for tax audits.

Get more for Nevada Use Tax Return

Find out other Nevada Use Tax Return

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement