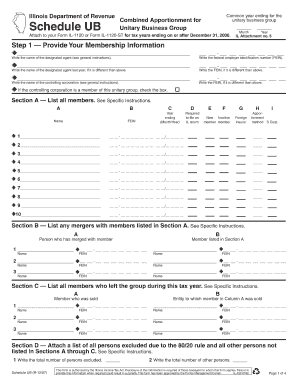

Illinois Department of Revenue Combined Apportionment for Unitary Business Group Common Year Ending for the Unitary Business Gro Form

Understanding the Combined Apportionment for Unitary Business Groups

The Illinois Department of Revenue Combined Apportionment for Unitary Business Groups pertains to the allocation of income among members of a unitary business group. This schedule is essential for businesses operating in multiple states, as it helps determine the correct amount of income to report for tax purposes. The Combined Apportionment is particularly relevant for tax years ending on or after a specified date, and it must be attached to Form IL-1120 or Form IL-1120 ST. This process ensures compliance with state tax regulations and accurate reporting of income across jurisdictions.

Steps to Complete the Combined Apportionment Schedule

Completing the Combined Apportionment for Unitary Business Groups involves several key steps:

- Gather financial statements and relevant tax documents for each entity within the unitary business group.

- Determine the apportionment factors, including property, payroll, and sales, for each member of the group.

- Calculate the combined apportionment percentage based on the gathered data.

- Fill out the Unitary Business Group Schedule UB with the calculated figures.

- Attach the completed schedule to either Form IL-1120 or Form IL-1120 ST, ensuring all information is accurate and complete.

Required Documents for Filing

To successfully file the Combined Apportionment for Unitary Business Groups, several documents are necessary:

- Financial statements for each member of the unitary business group.

- Previous tax returns, if applicable, to provide context and continuity.

- Documentation supporting the apportionment factors used in calculations.

- Any additional forms required by the Illinois Department of Revenue.

Legal Considerations for Compliance

Understanding the legal framework surrounding the Combined Apportionment is crucial for compliance. Businesses must adhere to the Illinois tax code and any relevant federal regulations. Failure to accurately report income or to comply with apportionment rules can result in penalties. It is advisable for businesses to consult with tax professionals to ensure all legal requirements are met.

Filing Methods for the Combined Apportionment

Businesses have various options for submitting the Combined Apportionment for Unitary Business Groups. These include:

- Online filing through the Illinois Department of Revenue's e-filing system.

- Mailing paper forms to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Each method has its own advantages, and businesses should choose the one that best fits their operational needs and capabilities.

Common Scenarios for Taxpayers

Different types of businesses may encounter unique scenarios when dealing with the Combined Apportionment. For instance:

- Corporations operating in multiple states may need to navigate complex apportionment rules.

- Partnerships may have different reporting requirements compared to corporations.

- Self-employed individuals might need to consider their own income sources when filing.

Understanding these scenarios can help taxpayers prepare more effectively and avoid common pitfalls in the filing process.

Quick guide on how to complete illinois department of revenue combined apportionment for unitary business group common year ending for the unitary business

Finalize [SKS] effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Combined Apportionment For Unitary Business Group Common Year Ending For The Unitary Business Gro

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue combined apportionment for unitary business group common year ending for the unitary business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group?

The Illinois Department Of Revenue Combined Apportionment for Unitary Business Group refers to the method used to allocate income among members of a unitary business group for tax purposes. This process is essential for accurately completing the Unitary Business Group Schedule UB, which must be attached to your Form IL 1120 or Form IL 1120 ST for tax years ending on or after the specified date.

-

How does airSlate SignNow assist with the Illinois Department Of Revenue Combined Apportionment process?

airSlate SignNow streamlines the process of preparing and submitting documents related to the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group. Our platform allows users to easily eSign and send necessary forms, ensuring compliance and efficiency in handling the Unitary Business Group Schedule UB.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features for tax document management, including customizable templates, secure eSigning, and document tracking. These features are particularly beneficial for managing the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group Common Year Ending documentation, making it easier to attach to your Form IL 1120 or Form IL 1120 ST.

-

Is airSlate SignNow cost-effective for small businesses handling tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By simplifying the process of managing the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group documentation, it helps save time and reduce costs associated with tax compliance.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow when dealing with the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group. This integration allows for easy data transfer and ensures that all necessary documents are readily available for your Form IL 1120 or Form IL 1120 ST.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Specifically, it simplifies the process of preparing the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group documentation, ensuring that you meet all requirements for your tax filings.

-

How can I ensure my documents are secure when using airSlate SignNow?

airSlate SignNow prioritizes document security by employing advanced encryption and secure access protocols. This ensures that all documents related to the Illinois Department Of Revenue Combined Apportionment for Unitary Business Group are protected, giving you peace of mind when attaching them to your Form IL 1120 or Form IL 1120 ST.

Get more for Illinois Department Of Revenue Combined Apportionment For Unitary Business Group Common Year Ending For The Unitary Business Gro

- Rx pay card brochure ihc health solutions form

- Diocese of orange minor permission medication notification and bb st timsrc form

- Sprinkler disclosure form

- Operating agreement october 1 b2015b strategic holdings form

- Afloat self assessment checksheet mob d asa 1 dcfpnavymil form

- Donation request bformb cincinnati opera cincinnatiopera

- South africa form appeal

- Word time sampling data sheet form

Find out other Illinois Department Of Revenue Combined Apportionment For Unitary Business Group Common Year Ending For The Unitary Business Gro

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document