Illinois Department of Revenue Nonresident Computation of Fiduciary Income Year Ending Schedule NR *IL07638111332* Attach to You Form

What is the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR?

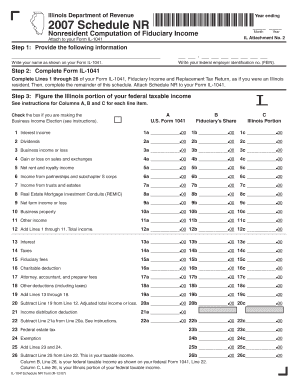

The Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR is a specific tax form designed for nonresident fiduciaries to report income earned in Illinois. This form must be attached to the Form IL-1041, which is the Illinois Income Tax Return for Estates and Trusts. It allows fiduciaries to accurately compute the income tax owed by nonresidents on income sourced from Illinois. The form is essential for compliance with state tax laws and ensures that nonresident fiduciaries fulfill their tax obligations correctly.

How to use the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR

To use the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR, begin by gathering all relevant financial information regarding the estate or trust's income. Complete the form by entering the total income earned in Illinois, along with any applicable deductions. Ensure that the completed schedule is attached to Form IL-1041 when submitting your tax return. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR

Completing the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR involves several key steps:

- Gather all income statements and relevant documentation for the estate or trust.

- Determine the total income earned in Illinois during the tax year.

- Fill out the schedule by entering the income figures and any deductions allowed.

- Review the completed form for accuracy and completeness.

- Attach the schedule to Form IL-1041 before submission.

Key elements of the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR

Key elements of the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR include sections for reporting total income, deductions, and the resulting tax liability. The form requires detailed information about the sources of income, such as dividends, interest, and rental income. Additionally, it may include specific lines for adjustments based on Illinois tax law, ensuring that nonresidents accurately report their taxable income from Illinois sources.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR align with the due date for Form IL-1041. Typically, this deadline is the fifteenth day of the fourth month following the close of the tax year. It is essential to stay informed about any changes to deadlines, as late submissions may incur penalties or interest on unpaid taxes.

Legal use of the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR

The legal use of the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR is mandated by Illinois tax law for nonresident fiduciaries. Proper completion and submission of this form are necessary to comply with state regulations regarding income taxation for nonresidents. Failure to use the form correctly can result in legal repercussions, including fines and increased scrutiny from tax authorities.

Quick guide on how to complete illinois department of revenue nonresident computation of fiduciary income year ending schedule nr il07638111332 attach to your

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] from any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring reprints of new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choosing. Edit and electronically sign [SKS] to ensure excellent communication during every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332* Attach To You

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue nonresident computation of fiduciary income year ending schedule nr il07638111332 attach to your

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332*?

The Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332* is a form used to report the income of nonresident fiduciaries in Illinois. It is essential for accurately calculating tax obligations for nonresident estates and trusts. Completing this schedule ensures compliance with Illinois tax laws.

-

How do I attach the Schedule NR *IL07638111332* to my Form IL 1041?

To attach the Schedule NR *IL07638111332* to your Form IL 1041, simply include it as a supplementary document when filing your tax return. Ensure that all required information is filled out correctly to avoid delays in processing. This attachment is crucial for the accurate assessment of your fiduciary income tax.

-

What are the benefits of using airSlate SignNow for submitting my Illinois Department Of Revenue forms?

Using airSlate SignNow streamlines the process of submitting your Illinois Department Of Revenue forms, including the Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332*. It offers an easy-to-use interface for eSigning and sending documents securely. This efficiency can save you time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for tax document submissions?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and reflects the value of a secure, efficient platform for managing your Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332*. You can choose a plan that best fits your volume of document handling.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This integration allows you to manage your Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332* alongside other financial documents, making the process more efficient.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and secure cloud storage. These features are designed to simplify the management of your Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332*. You can easily track document status and ensure compliance with tax regulations.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your sensitive information, including the Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332*. You can trust that your data is safe while using our services.

Get more for Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332* Attach To You

- Landlord tenant sublease package virginia form

- Buy sell agreement package virginia form

- Option to purchase package virginia form

- Amendment of lease package virginia form

- Annual financial checkup package virginia form

- Va bill sale template form

- Living wills and health care package virginia form

- Virginia will 497428479 form

Find out other Illinois Department Of Revenue Nonresident Computation Of Fiduciary Income Year Ending Schedule NR *IL07638111332* Attach To You

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself