Illinois Department of Revenue Schedule NLD Illinois NetDecember 31, 1986 Form

Understanding the Illinois Department Of Revenue Schedule NLD

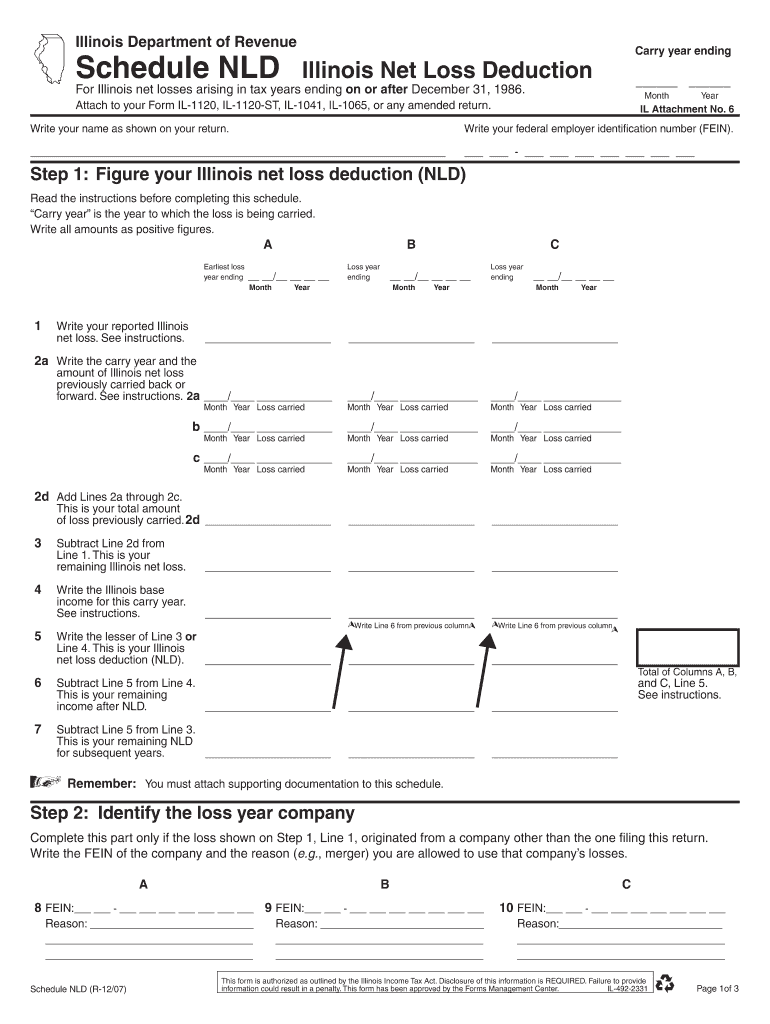

The Illinois Department Of Revenue Schedule NLD is a specific form used for reporting net income for certain tax purposes. This form is particularly relevant for businesses and individuals who need to declare income that is not subject to Illinois income tax. It serves as a crucial document for ensuring compliance with state tax regulations.

Primarily, the Schedule NLD is utilized by taxpayers who have income sourced from outside Illinois or from non-taxable entities. Understanding the purpose and requirements of this form can help in accurately reporting income and avoiding potential penalties.

Steps to Complete the Illinois Department Of Revenue Schedule NLD

Completing the Illinois Department Of Revenue Schedule NLD involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, fill out the form by entering your total income, specifying the sources of this income, and detailing any deductions or adjustments applicable to your situation.

It is essential to double-check all entries for accuracy before submission. Any discrepancies could lead to delays or issues with your tax return. Once completed, ensure you sign and date the form to validate your submission.

Obtaining the Illinois Department Of Revenue Schedule NLD

The Illinois Department Of Revenue Schedule NLD can be obtained directly from the Illinois Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, taxpayers may also find the form at various tax preparation offices or through certified tax professionals.

For those who prefer digital solutions, the form may also be available through tax software that supports Illinois tax filings, streamlining the process of completion and submission.

Legal Use of the Illinois Department Of Revenue Schedule NLD

Legally, the Illinois Department Of Revenue Schedule NLD must be used by individuals and businesses who meet specific criteria regarding their income sources. It is important to understand the legal implications of using this form, as incorrect or fraudulent reporting can result in penalties and legal consequences.

Taxpayers should familiarize themselves with the guidelines provided by the Illinois Department of Revenue to ensure compliance. This includes understanding what qualifies as non-taxable income and the necessary documentation required to support claims made on the form.

Key Elements of the Illinois Department Of Revenue Schedule NLD

Key elements of the Illinois Department Of Revenue Schedule NLD include sections for reporting total income, identifying sources of income, and detailing any adjustments or deductions. Each section is designed to capture specific information that the Illinois Department of Revenue requires for accurate tax assessment.

Additionally, the form may include instructions for calculating non-taxable income and guidelines for providing supporting documentation. Familiarizing oneself with these elements is crucial for ensuring a complete and accurate submission.

Filing Deadlines for the Illinois Department Of Revenue Schedule NLD

Filing deadlines for the Illinois Department Of Revenue Schedule NLD align with the general tax filing deadlines set by the state. Typically, individuals and businesses must submit their tax returns, including the Schedule NLD, by April 15 of each year. However, it is advisable to check for any updates or changes to deadlines that may occur due to specific circumstances or legislative changes.

Being aware of these deadlines helps taxpayers avoid late filing penalties and ensures compliance with state tax laws.

Quick guide on how to complete illinois department of revenue schedule nld illinois netdecember 31 1986

Effortlessly Handle [SKS] on Any Device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with every tool required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign [SKS] seamlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule nld illinois netdecember 31 1986

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986?

The Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986 is a tax form used by businesses to report net income and deductions. This schedule helps ensure compliance with state tax regulations and provides a clear overview of a business's financial standing as of the specified date.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986?

airSlate SignNow streamlines the process of preparing and submitting the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986 by allowing users to easily eSign and send documents. This simplifies compliance and ensures that all necessary forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can help with the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986. These tools enhance efficiency and ensure that all documents are handled securely and professionally.

-

Can airSlate SignNow integrate with accounting software for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage tax filings, including the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986. This integration allows for a smoother workflow and ensures that all financial data is accurately reflected in your tax documents.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By simplifying the process of completing the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986, businesses can focus more on their core operations while ensuring compliance with state regulations.

-

Is airSlate SignNow suitable for small businesses handling tax documents?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses managing tax documents like the Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986. Its features cater to the needs of smaller operations, ensuring they can efficiently handle their documentation.

Get more for Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986

- Download a reference form gamma phi beta gammaphibeta

- Base your answers to the following questions on the topographic map below form

- Tlis core reading guide for the great fire the learning institute form

- Solicitud beneficios por incapacidad sinot triple s vida form

- Wioa program alabama form

- Dhs form 3090 1

- N2 rent increase form

- Fbc change of address form pdf

Find out other Illinois Department Of Revenue Schedule NLD Illinois NetDecember 31, 1986

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe