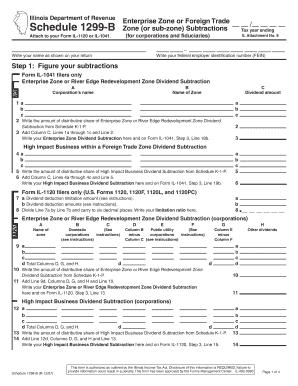

Illinois Department of Revenue Schedule 1299 B Attach to Your Form IL 1120 or IL 1041

Understanding the Illinois Department Of Revenue Schedule 1299 B

The Illinois Department Of Revenue Schedule 1299 B is a critical form that taxpayers must attach to their Form IL-1120 or IL-1041. This schedule is specifically designed for corporations and trusts that are claiming a credit for tax paid to other states. It ensures that taxpayers receive appropriate credits for taxes paid outside of Illinois, helping to prevent double taxation on income. Understanding this form is essential for accurate tax reporting and compliance with Illinois tax laws.

Steps to Complete the Illinois Department Of Revenue Schedule 1299 B

Completing the Schedule 1299 B involves several key steps:

- Gather necessary documentation, including details of taxes paid to other states.

- Fill out the required sections of the form, ensuring all income and tax amounts are accurately reported.

- Calculate the credit amount based on the taxes paid to other states and the corresponding Illinois tax liability.

- Attach the completed Schedule 1299 B to your Form IL-1120 or IL-1041 before submission.

It is important to review the form for accuracy to avoid delays or issues with your tax return.

Obtaining the Illinois Department Of Revenue Schedule 1299 B

The Schedule 1299 B can be obtained through the Illinois Department of Revenue's official website. Taxpayers can download the form in PDF format, which can be printed and filled out manually. Additionally, many tax preparation software programs include this form, allowing for easier completion and submission. Ensure you have the most current version of the form to comply with the latest tax regulations.

Key Elements of the Illinois Department Of Revenue Schedule 1299 B

The Schedule 1299 B includes several important elements that taxpayers need to be aware of:

- Identification Information: This section requires the taxpayer's name, address, and identification number.

- Income Details: Taxpayers must report total income earned and specify the income sourced from other states.

- Credit Calculation: This section outlines how to calculate the credit for taxes paid to other states.

- Signature and Date: A signature is required to validate the information provided on the form.

Filing Deadlines for the Illinois Department Of Revenue Schedule 1299 B

It is crucial to be aware of the filing deadlines for the Schedule 1299 B to avoid penalties. Generally, the Schedule must be submitted along with Form IL-1120 or IL-1041 by the due date of the respective tax return. For most taxpayers, this deadline is typically the fifteenth day of the fourth month following the end of the tax year. However, extensions may be available, so checking the Illinois Department of Revenue's guidelines is advisable.

Legal Use of the Illinois Department Of Revenue Schedule 1299 B

The Schedule 1299 B is legally required for any corporation or trust claiming a credit for taxes paid to other states. Failing to include this form when necessary may result in the denial of the credit and potential penalties. It is essential for taxpayers to understand their obligations under Illinois tax law and ensure compliance to avoid legal issues.

Quick guide on how to complete illinois department of revenue schedule 1299 b attach to your form il 1120 or il 1041

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule 1299 B Attach To Your Form IL 1120 Or IL 1041

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule 1299 b attach to your form il 1120 or il 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule 1299 B?

The Illinois Department Of Revenue Schedule 1299 B is a form that businesses must attach to their Form IL 1120 or IL 1041 to report certain tax credits. This form helps ensure compliance with state tax regulations and allows for the proper calculation of tax liabilities.

-

How do I attach the Schedule 1299 B to my Form IL 1120 or IL 1041?

To attach the Illinois Department Of Revenue Schedule 1299 B to your Form IL 1120 or IL 1041, simply include it as an additional document when submitting your tax return. Ensure that all required information is filled out accurately to avoid delays in processing.

-

What features does airSlate SignNow offer for eSigning tax documents?

airSlate SignNow provides a user-friendly platform that allows you to eSign the Illinois Department Of Revenue Schedule 1299 B and other tax documents securely. With features like templates, reminders, and real-time tracking, you can streamline your document signing process efficiently.

-

Is airSlate SignNow cost-effective for small businesses needing to file tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their tax documents, including the Illinois Department Of Revenue Schedule 1299 B. Our pricing plans are designed to fit various budgets while providing essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage your tax documents, including the Illinois Department Of Revenue Schedule 1299 B, alongside your financial records. This integration helps streamline your workflow and ensures all documents are in one place.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the Illinois Department Of Revenue Schedule 1299 B, offers numerous benefits such as enhanced security, ease of use, and time savings. Our platform simplifies the signing process, allowing you to focus on your business rather than paperwork.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax documents, including the Illinois Department Of Revenue Schedule 1299 B. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for Illinois Department Of Revenue Schedule 1299 B Attach To Your Form IL 1120 Or IL 1041

Find out other Illinois Department Of Revenue Schedule 1299 B Attach To Your Form IL 1120 Or IL 1041

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free