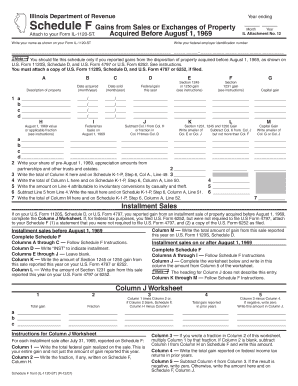

IL 1120 ST Schedule F Illinois Department of Revenue Form

What is the IL 1120 ST Schedule F Illinois Department Of Revenue

The IL 1120 ST Schedule F is a form used by corporations in Illinois to report their income and calculate their tax liability. This schedule is specifically designed for S corporations and is part of the larger IL 1120 ST tax return, which is filed with the Illinois Department of Revenue. The form helps businesses detail their income, deductions, and credits, ensuring compliance with state tax laws. Understanding this form is crucial for S corporations as it directly impacts their tax obligations and overall financial health.

Steps to complete the IL 1120 ST Schedule F Illinois Department Of Revenue

Completing the IL 1120 ST Schedule F involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the basic information section, including the corporation's name, address, and federal identification number.

- Report total income, including sales revenue and other income sources, in the designated sections.

- Detail allowable deductions, such as operating expenses, salaries, and other business-related costs.

- Calculate the net income by subtracting total deductions from total income.

- Complete any additional sections relevant to credits or specific tax situations.

- Review the form for accuracy and completeness before submission.

How to obtain the IL 1120 ST Schedule F Illinois Department Of Revenue

The IL 1120 ST Schedule F can be obtained directly from the Illinois Department of Revenue's website. The form is available for download in PDF format, allowing businesses to print and complete it manually. Alternatively, many tax preparation software programs include the IL 1120 ST Schedule F, enabling users to fill it out digitally. It is important to ensure that the most current version of the form is used, as tax regulations may change annually.

Legal use of the IL 1120 ST Schedule F Illinois Department Of Revenue

The IL 1120 ST Schedule F must be used in accordance with Illinois tax law. S corporations are legally required to file this schedule to report their income and calculate their tax liability accurately. Failure to use the form correctly can lead to penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand the legal implications of the information reported on this form to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1120 ST Schedule F typically align with the federal tax deadlines for S corporations. Generally, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is important for businesses to be aware of these dates to ensure timely filing and avoid penalties.

Key elements of the IL 1120 ST Schedule F Illinois Department Of Revenue

Key elements of the IL 1120 ST Schedule F include:

- Identification information for the corporation, including name and tax ID number.

- Sections for reporting total income and allowable deductions.

- Calculations for net income and any applicable tax credits.

- Signature section for authorized representatives of the corporation.

Understanding these elements is vital for accurate completion and compliance with state tax requirements.

Quick guide on how to complete il 1120 st schedule f illinois department of revenue

Complete [SKS] seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can find the required form and securely store it online. airSlate SignNow provides you with all the functionalities needed to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest method to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a standard wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 ST Schedule F Illinois Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the il 1120 st schedule f illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1120 ST Schedule F for the Illinois Department Of Revenue?

The IL 1120 ST Schedule F is a form used by corporations in Illinois to report their income and calculate their tax liability. It is specifically designed for S corporations and helps ensure compliance with state tax regulations. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the IL 1120 ST Schedule F?

airSlate SignNow provides an efficient platform for eSigning and sending documents, including the IL 1120 ST Schedule F for the Illinois Department Of Revenue. With our user-friendly interface, you can easily prepare and manage your tax documents, ensuring timely submissions and compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large corporation, you can choose a plan that fits your budget while gaining access to features that streamline the completion of forms like the IL 1120 ST Schedule F for the Illinois Department Of Revenue.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly beneficial for managing tax documents like the IL 1120 ST Schedule F for the Illinois Department Of Revenue, ensuring that you can handle your filings efficiently and securely.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various state and federal regulations, including those related to the IL 1120 ST Schedule F for the Illinois Department Of Revenue. Our platform ensures that your documents are handled in accordance with legal standards, providing peace of mind during tax season.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is particularly useful when preparing documents like the IL 1120 ST Schedule F for the Illinois Department Of Revenue, as you can seamlessly connect with accounting and tax software.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the IL 1120 ST Schedule F for the Illinois Department Of Revenue streamlines the signing process, reduces paperwork, and enhances collaboration. Our platform allows for quick edits and secure sharing, making tax season less stressful for businesses.

Get more for IL 1120 ST Schedule F Illinois Department Of Revenue

Find out other IL 1120 ST Schedule F Illinois Department Of Revenue

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word