Illinois Department of Revenue of Employer S Securities IL 4644 Gains from SalesQualified Employee Benefit Plan Received from a Form

Understanding the Illinois Department Of Revenue Of Employer S Securities IL 4644

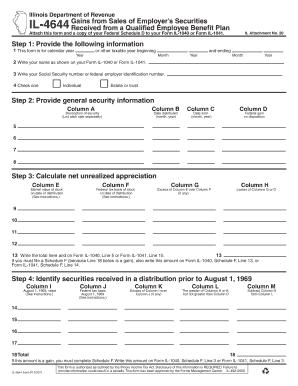

The Illinois Department Of Revenue Of Employer S Securities IL 4644 is a specific tax form used to report gains from sales associated with qualified employee benefit plans. This form is essential for individuals who have received income from such plans and need to report it accurately on their state tax returns. It is crucial for taxpayers to understand the implications of this form, as it directly affects their tax obligations in Illinois.

How to Use the Illinois Department Of Revenue Of Employer S Securities IL 4644

Using the Illinois Department Of Revenue Of Employer S Securities IL 4644 involves several steps. Taxpayers must first ensure they have received the necessary documentation regarding their gains from the qualified employee benefit plan. After gathering this information, they should accurately complete the form, ensuring all required details are filled in correctly. This form must then be attached to the taxpayer's Form IL 1040 or Form IL 1041, along with a copy of the federal Schedule D, which outlines the capital gains and losses.

Steps to Complete the Illinois Department Of Revenue Of Employer S Securities IL 4644

Completing the Illinois Department Of Revenue Of Employer S Securities IL 4644 involves several key steps:

- Gather all relevant documents, including details of the qualified employee benefit plan and any supporting tax documents.

- Fill out the form accurately, ensuring that all information regarding gains from sales is included.

- Attach the completed form to your Form IL 1040 or Form IL 1041.

- Include a copy of your federal Schedule D, which details your capital gains and losses.

- Review all information for accuracy before submitting.

Required Documents for the Illinois Department Of Revenue Of Employer S Securities IL 4644

To complete the Illinois Department Of Revenue Of Employer S Securities IL 4644, taxpayers must have several documents on hand:

- Details of the qualified employee benefit plan, including any statements or reports.

- Federal Schedule D, which outlines capital gains and losses.

- Form IL 1040 or Form IL 1041, which will be submitted alongside the IL 4644.

Filing Deadlines for the Illinois Department Of Revenue Of Employer S Securities IL 4644

It is important for taxpayers to be aware of the filing deadlines associated with the Illinois Department Of Revenue Of Employer S Securities IL 4644. Typically, this form must be submitted by the same deadline as the individual's state tax return, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should always verify current deadlines to ensure timely submission.

Penalties for Non-Compliance with the Illinois Department Of Revenue Of Employer S Securities IL 4644

Failure to comply with the requirements of the Illinois Department Of Revenue Of Employer S Securities IL 4644 can result in penalties. Taxpayers may face fines for late submissions or inaccuracies in reporting. Additionally, the Illinois Department of Revenue may impose interest on any unpaid taxes resulting from errors or omissions related to this form. It is advisable for taxpayers to take care in completing and submitting this form to avoid such penalties.

Quick guide on how to complete illinois department of revenue of employer s securities il 4644 gains from salesqualified employee benefit plan received from a

Complete [SKS] seamlessly on any gadget

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Underline important sections of your documents or obscure private information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet signature.

- Verify all details and click on the Done button to store your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Edit and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Of Employer S Securities IL 4644 Gains From SalesQualified Employee Benefit Plan Received From A

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue of employer s securities il 4644 gains from salesqualified employee benefit plan received from a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Of Employer S Securities IL 4644 Gains From SalesQualified Employee Benefit Plan?

The Illinois Department Of Revenue Of Employer S Securities IL 4644 Gains From SalesQualified Employee Benefit Plan is a form used to report gains from the sale of securities received from a qualified employee benefit plan. This form is essential for accurately reporting your income on your state tax returns, specifically when attaching it to your Form IL 1040 or Form IL 1041.

-

How do I attach the Illinois Department Of Revenue Of Employer S Securities IL 4644 to my tax return?

To attach the Illinois Department Of Revenue Of Employer S Securities IL 4644, simply include it along with a copy of your Federal Schedule D when filing your Form IL 1040 or Form IL 1041. This ensures that all relevant information regarding your gains from sales is properly documented for the Illinois Department of Revenue.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow provides features that simplify the process of sending and eSigning tax documents, including the Illinois Department Of Revenue Of Employer S Securities IL 4644. With an easy-to-use interface, you can quickly prepare, send, and track your documents, ensuring compliance and timely submissions.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By streamlining the document signing process, it helps reduce administrative costs and improve efficiency, making it an ideal choice for managing forms like the Illinois Department Of Revenue Of Employer S Securities IL 4644.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, allowing you to seamlessly manage your documents. This means you can easily incorporate the Illinois Department Of Revenue Of Employer S Securities IL 4644 into your existing workflows, enhancing productivity and accuracy.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the Illinois Department Of Revenue Of Employer S Securities IL 4644, provides numerous benefits. It ensures secure eSigning, reduces paper usage, and allows for easy tracking of document status, which can signNowly streamline your tax filing process.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure cloud storage. This means that your Illinois Department Of Revenue Of Employer S Securities IL 4644 and other sensitive documents are protected against unauthorized access, ensuring your information remains confidential.

Get more for Illinois Department Of Revenue Of Employer S Securities IL 4644 Gains From SalesQualified Employee Benefit Plan Received From A

- American mathematical society cover sheet download form

- Jdf 601 colorado state judicial branch courts state co form

- Ada county endowment board scholarship bapplicationb extension uidaho form

- University of rochester familycommunity recommendation form enrollment rochester

- Download the thailand visa application form

- Da form 31 sep 93

- Form 2181 d 2015

- Organizer questionnaire cover and engagement letter emochila com form

Find out other Illinois Department Of Revenue Of Employer S Securities IL 4644 Gains From SalesQualified Employee Benefit Plan Received From A

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast