Tax Legislation Process Worksheet Form

What is the Tax Legislation Process Worksheet

The Tax Legislation Process Worksheet is a vital document that helps taxpayers understand the steps involved in the formal tax legislation process. It serves as a guide for individuals and businesses to navigate the complexities of tax laws and regulations set forth by the Internal Revenue Service (IRS). This worksheet outlines the procedures for drafting, reviewing, and enacting tax legislation, ensuring that taxpayers are informed about their rights and responsibilities. It is particularly useful for those who wish to comprehend how tax policies evolve and affect their financial obligations.

How to use the Tax Legislation Process Worksheet

Using the Tax Legislation Process Worksheet involves several key steps that facilitate a clear understanding of tax legislation. First, familiarize yourself with the various sections of the worksheet, which detail the stages of the tax legislation process. Next, follow the outlined steps to document your observations and insights regarding proposed tax laws. This may include noting the implications of specific legislation on your tax situation. Additionally, utilize the worksheet to track any changes in tax laws that may affect your financial planning.

Key elements of the Tax Legislation Process Worksheet

The Tax Legislation Process Worksheet includes several essential elements that guide taxpayers through the legislative framework. Key components often include:

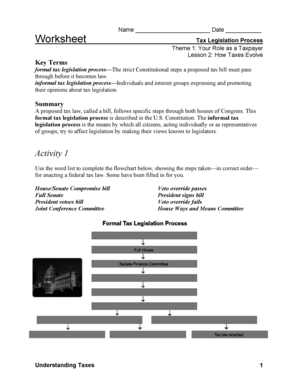

- Legislative Stages: An overview of the various stages of tax legislation, from proposal to enactment.

- Impact Analysis: Sections dedicated to analyzing how specific tax laws affect different taxpayer scenarios.

- Documentation Requirements: Information on the necessary documentation to support your understanding and compliance with tax laws.

- Filing Guidelines: Instructions on how to file any required forms related to new tax legislation.

Steps to complete the Tax Legislation Process Worksheet

Completing the Tax Legislation Process Worksheet involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the current tax legislation relevant to your situation.

- Fill out each section of the worksheet, providing detailed information about the legislation.

- Analyze the potential impact of the legislation on your tax obligations.

- Consult with a tax professional if needed to clarify any complex points.

- Keep the completed worksheet for your records and future reference.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Tax Legislation Process Worksheet. These guidelines ensure that taxpayers understand the legal framework surrounding tax legislation. It is essential to refer to the IRS website or official publications for the most current information on tax laws and any updates to the worksheet. Compliance with IRS guidelines helps prevent errors and ensures that taxpayers are fully informed about their responsibilities under the law.

Filing Deadlines / Important Dates

Filing deadlines and important dates related to the Tax Legislation Process Worksheet are crucial for compliance. Taxpayers should be aware of key dates, such as:

- Annual tax return filing deadlines.

- Deadlines for submitting any forms related to new tax legislation.

- Dates for public comment periods on proposed tax laws.

Staying informed about these dates helps ensure timely compliance and reduces the risk of penalties.

Quick guide on how to complete tax legislation process worksheet

Handle Tax Legislation Process Worksheet easily on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely file it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your paperwork promptly without complications. Manage Tax Legislation Process Worksheet on any system using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign Tax Legislation Process Worksheet effortlessly

- Obtain Tax Legislation Process Worksheet and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Legislation Process Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the tax legislation process and how does it affect my business?

The tax legislation process involves a series of steps through which tax laws are proposed, debated, and enacted. Understanding this process is crucial for businesses as it can impact taxation rates and compliance requirements. airSlate SignNow helps you navigate the impacts of tax legislation by streamlining document management, ensuring compliance.

-

How can airSlate SignNow assist with documents related to the tax legislation process?

airSlate SignNow simplifies the management of important documents throughout the tax legislation process. You can easily send, eSign, and store documents securely, which ensures that you're always compliant with the latest tax laws. This allows you to focus on running your business while we handle the paperwork.

-

What features does airSlate SignNow offer to support compliance during the tax legislation process?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure signing. These features enable businesses to maintain compliance with changes in the tax legislation process efficiently. You can ensure that your documents are signed correctly and stored securely, simplifying your compliance efforts.

-

Is there a cost associated with using airSlate SignNow for managing documents during tax legislation?

Yes, airSlate SignNow offers a cost-effective pricing model designed for businesses of all sizes. Depending on your needs, you can choose from various subscription plans that offer powerful features for managing documents, particularly useful during the tax legislation process. Often, our solutions help save money by minimizing paperwork and errors.

-

Can airSlate SignNow integrate with other software used for tax compliance?

Absolutely! airSlate SignNow integrates smoothly with various software applications, such as accounting systems and tax preparation tools. These integrations streamline your workflow through the tax legislation process, making it easier to manage data and documentation without manual entry.

-

What benefits does eSigning provide during the tax legislation process?

eSigning through airSlate SignNow offers numerous benefits during the tax legislation process, including increased speed and efficiency. Documents can be signed remotely and instantly, eliminating the need for physical paperwork and reducing processing time. This helps ensure that you remain compliant with evolving tax laws without unnecessary delays.

-

How user-friendly is airSlate SignNow for those unfamiliar with eSigning?

airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those new to eSigning. The intuitive interface guides users through the document management and signing process, making it simple to handle documents related to the tax legislation process. Training resources and customer support are also available to assist you.

Get more for Tax Legislation Process Worksheet

Find out other Tax Legislation Process Worksheet

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word