Schedule 4255 Recapture of Investment Tax Credits Illinois Form

What is the Schedule 4255 Recapture Of Investment Tax Credits Illinois

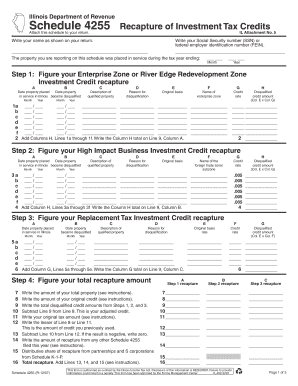

The Schedule 4255 is a tax form used in Illinois to recapture investment tax credits that were previously claimed by a taxpayer. This form is essential for businesses that have benefitted from tax credits related to their investments in qualified property. If a business disposes of the property or fails to meet certain requirements, it may need to repay some or all of the tax credits received. Understanding this form is crucial for compliance and accurate tax reporting.

How to use the Schedule 4255 Recapture Of Investment Tax Credits Illinois

To effectively use the Schedule 4255, a taxpayer must first gather all relevant information regarding the investment tax credits claimed. This includes details about the property, the amount of credit received, and the circumstances that led to the recapture. Once the necessary information is collected, the taxpayer can complete the form by providing accurate figures and explanations for the recapture. It is important to ensure that all calculations are correct to avoid any issues with the Illinois Department of Revenue.

Steps to complete the Schedule 4255 Recapture Of Investment Tax Credits Illinois

Completing the Schedule 4255 involves several key steps:

- Gather documentation related to the investment tax credits claimed.

- Identify the reason for recapture, such as property disposal or failure to meet eligibility criteria.

- Fill out the form accurately, providing all required information and calculations.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate tax authority by the specified deadline.

Key elements of the Schedule 4255 Recapture Of Investment Tax Credits Illinois

Several key elements must be included when filling out the Schedule 4255. These include:

- The taxpayer's identification information, including name and tax identification number.

- Details of the investment property, including its location and description.

- The amount of investment tax credits previously claimed.

- The reason for recapture and any relevant dates associated with the property.

- Calculations showing the amount of tax credits being recaptured.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 4255 are typically aligned with the taxpayer's annual tax return due date. It is essential to file the form by this deadline to avoid penalties. Taxpayers should also be aware of any specific dates related to the recapture of credits, especially if the recapture is triggered by events such as property sale or transfer.

Penalties for Non-Compliance

Failure to file the Schedule 4255 when required can result in significant penalties. These may include fines and interest on any unpaid taxes resulting from the recapture of investment tax credits. It is crucial for taxpayers to understand their obligations and ensure that they comply with all filing requirements to avoid these consequences.

Quick guide on how to complete schedule 4255 recapture of investment tax credits illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Method to Modify and eSign [SKS] Effortlessly

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 4255 Recapture Of Investment Tax Credits Illinois

Create this form in 5 minutes!

How to create an eSignature for the schedule 4255 recapture of investment tax credits illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 4255 Recapture Of Investment Tax Credits Illinois?

Schedule 4255 Recapture Of Investment Tax Credits Illinois is a tax form used by businesses to report the recapture of investment tax credits. This form is essential for ensuring compliance with state tax regulations and accurately reflecting any changes in tax credits received. Understanding this form can help businesses avoid penalties and maintain proper tax records.

-

How can airSlate SignNow help with Schedule 4255 Recapture Of Investment Tax Credits Illinois?

airSlate SignNow provides an efficient platform for businesses to prepare and eSign documents related to Schedule 4255 Recapture Of Investment Tax Credits Illinois. With its user-friendly interface, users can easily fill out the necessary forms and ensure they are submitted on time. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the completion of forms like Schedule 4255 Recapture Of Investment Tax Credits Illinois. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for Schedule 4255 Recapture Of Investment Tax Credits Illinois and secure eSigning capabilities. These features help ensure that your tax documents are organized, easily accessible, and compliant with regulations. This makes managing your tax forms more efficient.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage your tax documents, including Schedule 4255 Recapture Of Investment Tax Credits Illinois. This integration allows for seamless data transfer and enhances your overall workflow, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as Schedule 4255 Recapture Of Investment Tax Credits Illinois, provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, ensuring that your tax forms are processed promptly and securely.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax information, including Schedule 4255 Recapture Of Investment Tax Credits Illinois. The platform employs advanced encryption and security measures to protect your data, ensuring that your documents remain confidential and secure.

Get more for Schedule 4255 Recapture Of Investment Tax Credits Illinois

- Canada imm 5713 form

- All purpose acknowledgement form

- Proof of surviving legal heirs sample how to fill up form

- D20 modern character sheet form

- Daas 6223 interim or quarterly client review adult services interim or quarterly client review info dhhs state nc form

- Vintners wine report kentucky department of revenue ky form

- Disclaimer form

- Table 6 template for cspap implementation plan table 6 template for cspap implementation plan cdc form

Find out other Schedule 4255 Recapture Of Investment Tax Credits Illinois

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF