Illinois Department of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write in This Box Tax Illinois Form

Understanding the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

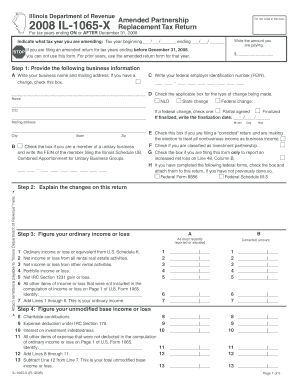

The Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return is a crucial form for partnerships in Illinois that need to amend their previously filed tax returns. This form allows partnerships to correct errors or make necessary adjustments to their tax filings, ensuring compliance with state tax laws. It is specifically designed for partnerships that are subject to the replacement tax, which is a tax imposed on partnerships and certain other pass-through entities in Illinois.

Steps to Complete the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

Completing the IL 1065 X form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including the original IL 1065 return and any supporting schedules.

- Clearly indicate the specific changes being made on the form. This may include adjustments to income, deductions, or credits.

- Complete all required sections of the form, ensuring accuracy in reporting figures.

- Sign and date the form, as required, to validate the submission.

- Submit the amended return by the appropriate deadline, either electronically or via mail.

Key Elements of the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X form includes several key elements that are essential for proper completion:

- Identification Information: This section requires the partnership's name, address, and federal employer identification number (FEIN).

- Amendment Details: Clearly specify the reasons for amending the return and the specific line items that are being changed.

- Signature Section: A designated area for the authorized partner to sign and date the return, confirming its accuracy.

Filing Deadlines for the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

Filing deadlines for the IL 1065 X form are critical to avoid penalties. Generally, amended returns must be filed within three years of the original due date. It is advisable to check for any specific extensions or changes in deadlines that may apply to your situation. Timely submission ensures compliance with Illinois tax regulations and helps avoid unnecessary complications.

Form Submission Methods for the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X form can be submitted through various methods:

- Online Submission: Partnerships can file electronically through the Illinois Department of Revenue's e-filing system.

- Mail: Printed forms can be sent to the appropriate address as specified by the Illinois Department of Revenue.

- In-Person: Some partnerships may choose to deliver their forms directly to a local Department of Revenue office.

Legal Use of the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X form serves a legal purpose by allowing partnerships to amend their tax filings in accordance with Illinois law. It is essential for partnerships to use this form to rectify any discrepancies in their tax returns to maintain compliance and avoid potential legal issues. Proper use of the form ensures that all financial information is accurately reported to the state, which is crucial for tax liability determination.

Quick guide on how to complete illinois department of revenue il 1065 x amended partnership replacement tax return do not write in this box tax illinois

Effortlessly Complete [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow furnishes you with all the tools required to rapidly create, edit, and eSign your documents without any delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue il 1065 x amended partnership replacement tax return do not write in this box tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois?

The Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois is a form used by partnerships to amend their previously filed tax returns. This form allows businesses to correct errors or make changes to their tax information, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois?

airSlate SignNow provides a streamlined platform for businesses to prepare, sign, and submit the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois. Our solution simplifies document management, making it easy to ensure all necessary forms are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution allows you to manage documents like the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois without breaking the bank, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois. These features help streamline the process, reduce errors, and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, allowing you to seamlessly manage the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois alongside your existing tools. This integration enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my partnership tax returns?

Using airSlate SignNow for your partnership tax returns, including the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois, provides numerous benefits. These include faster processing times, enhanced security for sensitive documents, and the ability to track the status of your submissions in real-time.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, such as the Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois, are protected. Our platform uses advanced encryption and security protocols to safeguard your information.

Get more for Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois

Find out other Illinois Department Of Revenue IL 1065 X Amended Partnership Replacement Tax Return Do Not Write In This Box Tax Illinois

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form