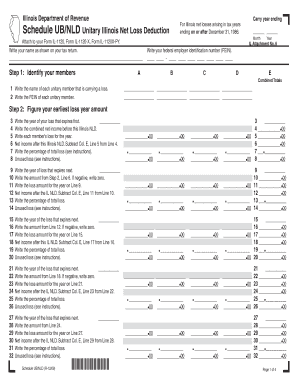

Illinois Department of Revenue Carry Year Ending for Illinois Net Losses Arising in Tax Years Ending on or After December 31, 19 Form

Understanding the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses

The Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986 is a provision that allows taxpayers to carry forward net losses incurred in eligible tax years. This means that if a business or individual experiences a loss, they may be able to offset future taxable income with that loss, thus reducing their tax liability in subsequent years. The ability to carry forward these losses can provide significant financial relief and aid in cash flow management for businesses and individuals alike.

Steps to Complete the Illinois Department Of Revenue Carry Year Ending Form

Completing the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant financial documents, including prior year tax returns and any documentation supporting the net loss.

- Determine the amount of net loss to be carried forward, ensuring it meets the eligibility criteria set by the Illinois Department of Revenue.

- Complete the appropriate tax forms, ensuring that the carryforward amount is accurately reported.

- Double-check all entries for accuracy and completeness before submission.

- Submit the completed forms by the specified deadline, either electronically or by mail, as per the guidelines.

Key Elements of the Illinois Department Of Revenue Carry Year Ending Form

When dealing with the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses, several key elements must be understood:

- Eligibility Criteria: Not all losses qualify for carryforward. Familiarize yourself with the specific requirements.

- Filing Deadlines: Adhere to the deadlines to ensure compliance and avoid penalties.

- Documentation: Maintain thorough records to substantiate the losses claimed for future reference.

- Calculation Methods: Understand how to calculate the allowable carryforward amount accurately.

Legal Use of the Illinois Department Of Revenue Carry Year Ending Form

The legal framework surrounding the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses is critical for compliance. Taxpayers must ensure that they are following the state laws and regulations regarding loss carryforwards. This includes understanding how to apply the losses correctly on tax returns and ensuring that all claims are substantiated with appropriate documentation. Failure to comply with these legal requirements can result in penalties or disallowance of the carried losses.

Examples of Using the Illinois Department Of Revenue Carry Year Ending Form

Practical examples can help clarify how the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses works. For instance:

- A small business that incurs a loss of $10,000 in 2022 can carry this loss forward to offset taxable income in 2023, potentially reducing their tax bill.

- An individual taxpayer who reports a net loss from self-employment may carry this loss forward to reduce their taxable income in future years, allowing for better financial planning.

Filing Methods for the Illinois Department Of Revenue Carry Year Ending Form

Taxpayers have several options for submitting the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses. These methods include:

- Online Submission: Many taxpayers prefer to file electronically through the Illinois Department of Revenue's online portal, which can streamline the process.

- Mail: Taxpayers can also print the completed forms and send them via postal mail to the appropriate address provided by the department.

- In-Person Submission: For those who prefer face-to-face interaction, visiting a local Illinois Department of Revenue office may be an option.

Quick guide on how to complete illinois department of revenue carry year ending for illinois net losses arising in tax years ending on or after december 31

Accomplish [SKS] seamlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers a flawless environmentally friendly substitute to traditional printed and signed documents, as you can obtain the proper template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without hold-ups. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centered task today.

The easiest method to modify and eSign [SKS] effortlessly

- Acquire [SKS] and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign [SKS] to ensure outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 19

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue carry year ending for illinois net losses arising in tax years ending on or after december 31

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986?

The Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 1986, refers to the regulations that allow businesses to carry forward net losses to offset future taxable income. This provision is crucial for companies looking to manage their tax liabilities effectively.

-

How can airSlate SignNow assist with the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses?

airSlate SignNow provides a streamlined platform for businesses to manage their documentation related to the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses. With our eSigning capabilities, you can quickly sign and send necessary forms, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents. These features help ensure that your submissions related to the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses are accurate and timely.

-

Is airSlate SignNow cost-effective for small businesses dealing with Illinois tax regulations?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your needs while ensuring you can efficiently handle the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your tax documents. This integration is particularly beneficial for handling the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses, as it streamlines your workflow.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including enhanced security, ease of use, and improved compliance. These advantages are particularly relevant when dealing with the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses, ensuring your documents are handled correctly.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your tax documents. This is crucial when managing sensitive information related to the Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses.

Get more for Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 19

Find out other Illinois Department Of Revenue Carry Year Ending For Illinois Net Losses Arising In Tax Years Ending On Or After December 31, 19

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online