Insurance Needs Analysis Form

What is the life insurance needs analysis worksheet?

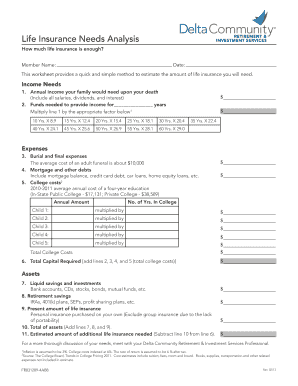

The life insurance needs analysis worksheet is a structured tool designed to help individuals assess their life insurance requirements. This worksheet guides users through evaluating their financial responsibilities, including debts, income replacement needs, and future expenses. By completing this worksheet, individuals can determine the appropriate amount of life insurance coverage necessary to protect their loved ones financially in the event of their passing.

How to use the life insurance needs analysis worksheet

Using the life insurance needs analysis worksheet involves several straightforward steps. First, gather relevant financial information, including current debts, monthly expenses, and any future financial obligations, such as children's education costs. Next, input this data into the worksheet to calculate your total financial needs. The worksheet will typically guide you through various categories, helping you identify how much life insurance coverage is necessary to meet these needs. Finally, review the results to understand your coverage requirements and discuss them with a financial advisor if necessary.

Key elements of the life insurance needs analysis worksheet

The life insurance needs analysis worksheet includes several critical components that contribute to an accurate assessment of coverage needs. Key elements typically consist of:

- Current debts: This includes mortgages, loans, and credit card balances.

- Income replacement: Calculate how much income your family would need to maintain their lifestyle.

- Future expenses: Consider costs like education, healthcare, and retirement savings.

- Existing insurance: Take into account any current life insurance policies and their coverage amounts.

Steps to complete the life insurance needs analysis worksheet

Completing the life insurance needs analysis worksheet involves a series of methodical steps to ensure accuracy. Begin by listing all current debts and financial obligations. Next, estimate your annual income and how long your family would need financial support in your absence. After that, include future expenses, such as college tuition for children or care for dependents. Finally, sum these amounts to arrive at a total coverage need, and subtract any existing life insurance policies to determine the additional coverage required.

Legal use of the life insurance needs analysis worksheet

The life insurance needs analysis worksheet can be legally utilized in the United States as a tool to determine appropriate insurance coverage. It is essential to ensure that the information provided is accurate and up-to-date, as this will affect the validity of any insurance applications submitted based on the worksheet's findings. While the worksheet itself is not a legally binding document, it serves as a valuable resource in discussions with insurance providers and financial advisors.

How to obtain the life insurance needs analysis worksheet

The life insurance needs analysis worksheet can be obtained through various channels. Many insurance companies provide downloadable versions on their websites, often as part of their educational resources. Additionally, financial planning websites and tools may offer templates that can be customized to fit individual needs. Users can also consult with financial advisors who may provide a worksheet as part of their services, ensuring that it is tailored to their specific financial situation.

Quick guide on how to complete insurance needs analysis form

Complete Insurance Needs Analysis Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Insurance Needs Analysis Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Insurance Needs Analysis Form effortlessly

- Obtain Insurance Needs Analysis Form and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from the device of your choice. Edit and eSign Insurance Needs Analysis Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a life insurance needs analysis worksheet?

A life insurance needs analysis worksheet is a tool designed to help individuals assess their financial protection needs. It takes into account various factors such as income, expenses, and future financial obligations to determine the appropriate amount of life insurance coverage. Using this worksheet ensures that you can make informed decisions about life insurance.

-

How can I use the life insurance needs analysis worksheet with airSlate SignNow?

You can easily incorporate the life insurance needs analysis worksheet into your workflow using airSlate SignNow. Simply upload your worksheet as a document, send it out for eSignature, and track the entire process effortlessly. This integration streamlines the lifecycle of your insurance documents.

-

What are the key features of the life insurance needs analysis worksheet?

The key features of the life insurance needs analysis worksheet include a detailed breakdown of income and liabilities, customizable fields to match individual circumstances, and easy-to-understand financial calculations. By utilizing this worksheet, users can improve the accuracy of their life insurance coverage calculations.

-

Is the life insurance needs analysis worksheet suitable for businesses?

Yes, the life insurance needs analysis worksheet is also suitable for businesses, especially for those providing employee benefits. It allows businesses to evaluate their team members’ coverage needs accurately and helps offer tailored insurance solutions. This can enhance employee satisfaction and retention.

-

How much does airSlate SignNow charge for using the life insurance needs analysis worksheet?

airSlate SignNow offers competitive pricing for its services, which includes the use of the life insurance needs analysis worksheet. Pricing typically varies based on the volume of documents and features you choose. You can explore our plans to find the one that best suits your needs.

-

Can I integrate the life insurance needs analysis worksheet with other tools?

Absolutely! The life insurance needs analysis worksheet can be integrated with various business applications and tools through airSlate SignNow. This facilitates a seamless flow of information across your platforms and enhances data accuracy and productivity in managing your insurance processes.

-

What benefits can I expect from using the life insurance needs analysis worksheet?

Using the life insurance needs analysis worksheet provides several benefits, including clarity on how much coverage you genuinely need and peace of mind regarding financial security. Additionally, it saves time during the insurance purchasing process by simplifying the decision-making process based on personalized data.

Get more for Insurance Needs Analysis Form

- Physiotherapy prescription pad form

- Application for increase electricity load form

- The top 101 foods that fight aging form

- Consent and release of liability form regarding training

- Arkansas form 236

- 3rd person singular exercises pdf form

- Critical care customer registration form physician verification

- Authorization for verbal communication uw health form

Find out other Insurance Needs Analysis Form

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template