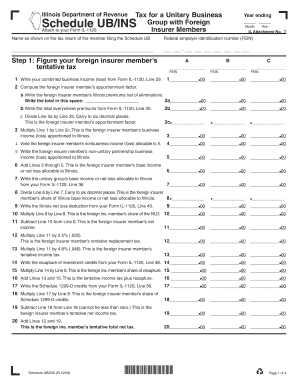

Illinois Department of Revenue Tax for a Unitary Business Group with Foreign Insurer Members Year Ending Schedule UBINS Attach T Form

Understanding the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS

The Illinois Department Of Revenue Tax for a Unitary Business Group with Foreign Insurer Members is a specific tax form designed for businesses operating as unitary groups that include foreign insurance companies. This form, known as Schedule UBINS, is required to report income, deductions, and tax liability associated with the foreign insurer members. It is essential for ensuring compliance with Illinois tax laws and accurately reflecting the financial activities of the unitary business group.

Steps to Complete the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS

Completing Schedule UBINS involves several key steps:

- Gather financial information for the unitary business group, including income and expenses related to foreign insurer members.

- Calculate the total income and deductions applicable to the foreign insurer members.

- Complete each section of Schedule UBINS, ensuring all required information is accurately reported.

- Attach Schedule UBINS to your Form IL-1120, the Illinois Corporation Income and Replacement Tax Return.

- Review the completed form for accuracy before submission.

Key Elements of the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS

Key elements of Schedule UBINS include:

- Identification of the unitary business group and its foreign insurer members.

- Detailed reporting of income generated from foreign operations.

- Documentation of deductions specific to foreign insurer activities.

- Calculation of the tax liability based on the reported figures.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with Schedule UBINS. Typically, the due date aligns with the deadline for filing Form IL-1120. Extensions may be available, but it is important to check the Illinois Department of Revenue's guidelines for specific dates and requirements.

Required Documents for Filing Schedule UBINS

When preparing to file Schedule UBINS, ensure you have the following documents:

- Financial statements for the unitary business group.

- Records of income and expenses related to foreign insurer members.

- Any previous tax returns that may provide context for the current filing.

Penalties for Non-Compliance with Schedule UBINS

Failure to file Schedule UBINS accurately and on time may result in penalties. These can include fines, interest on unpaid taxes, and potential audits. It is important for businesses to understand their obligations and ensure compliance to avoid these consequences.

Quick guide on how to complete illinois department of revenue tax for a unitary business group with foreign insurer members year ending schedule ubins attach

Easily Prepare [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly option to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without hindrances. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign [SKS] Effortlessly

- Obtain [SKS], then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details, and then click the Done button to save your modifications.

- Select your preferred method for sharing your form—by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue tax for a unitary business group with foreign insurer members year ending schedule ubins attach

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS?

The Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS is a specific tax form required for businesses that are part of a unitary group and have foreign insurer members. This schedule must be attached to Form IL 1120 to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS. Our solution simplifies document management, ensuring that all necessary forms are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS. These features help streamline the process and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for businesses handling tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using our platform to manage the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS, businesses can save time and reduce costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS alongside your existing tools. This seamless integration enhances workflow efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS, provides numerous benefits. These include enhanced security, faster processing times, and improved collaboration among team members, ensuring that all tax documents are handled efficiently.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information. When managing documents like the Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS, you can trust that your data is safe and secure.

Get more for Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS Attach T

Find out other Illinois Department Of Revenue Tax For A Unitary Business Group With Foreign Insurer Members Year Ending Schedule UBINS Attach T

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free