Illinois Department of Revenue Fiduciary Income and Replacement Tax Return Due on or Before the 15th Day of the 4th Month Follow Form

Understanding the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return

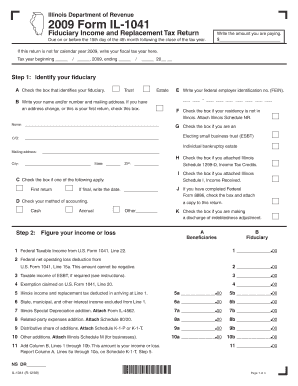

The Illinois Department of Revenue Fiduciary Income and Replacement Tax Return is a specific tax document required for fiduciaries managing estates or trusts in Illinois. This return must be filed annually, and it is due on or before the 15th day of the fourth month following the close of the tax year. For example, if the tax year ends on December 31, the return is due by April 15 of the following year. This form is essential for reporting income earned by the estate or trust and for calculating any taxes owed to the state.

Steps to Complete the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return

Completing the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and any prior tax returns related to the estate or trust.

- Fill out the form accurately, ensuring that all income sources and deductions are reported. Pay close attention to the specific sections that pertain to fiduciary income.

- Calculate the total tax liability based on the income reported. This may involve applying specific tax rates applicable to fiduciary income in Illinois.

- Review the completed return for accuracy and completeness before submission.

- Submit the return either electronically or by mail, following the guidelines provided by the Illinois Department of Revenue.

Filing Deadlines and Important Dates

It is crucial to adhere to the filing deadlines for the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return. The return is due on or before the 15th day of the fourth month after the end of the tax year. Missing this deadline can result in penalties and interest on any unpaid taxes. Taxpayers should also be aware of any extensions that may be available, as well as the implications of filing late.

Required Documents for Filing

To successfully file the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return, certain documents are necessary:

- Income statements for the estate or trust, including interest, dividends, and rental income.

- Records of any deductions that the fiduciary intends to claim, such as administrative expenses or distributions to beneficiaries.

- Prior year tax returns, if applicable, to provide context for the current filing.

- Any additional documentation that supports the income and deductions reported on the return.

Penalties for Non-Compliance

Failure to file the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return on time can lead to significant penalties. These may include late filing fees and interest on unpaid taxes. It is important for fiduciaries to understand their responsibilities and ensure timely compliance to avoid these consequences. Additionally, repeated non-compliance may result in more severe penalties, including audits or increased scrutiny from tax authorities.

Digital Submission Methods

Fiduciaries have the option to submit the Illinois Department of Revenue Fiduciary Income and Replacement Tax Return digitally. Electronic filing is often encouraged as it can streamline the submission process and reduce the likelihood of errors. Taxpayers can use approved software or online platforms that facilitate electronic filing, ensuring that all information is securely transmitted to the Illinois Department of Revenue.

Quick guide on how to complete illinois department of revenue fiduciary income and replacement tax return due on or before the 15th day of the 4th month

Complete [SKS] seamlessly on any gadget

Digital document management has become increasingly favored by enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Obtain Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Finished button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Follow

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue fiduciary income and replacement tax return due on or before the 15th day of the 4th month

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return?

The Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return is a tax form that fiduciaries must file for income generated by estates or trusts. This return is due on or before the 15th day of the 4th month following the close of the tax year. Understanding this requirement is crucial for compliance and avoiding penalties.

-

When is the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return due?

The Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return is due on or before the 15th day of the 4th month following the close of the tax year. For example, if your tax year ends on December 31, the return would be due by April 15 of the following year. Timely filing is essential to avoid late fees and interest.

-

How can airSlate SignNow help with filing the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return?

airSlate SignNow provides an easy-to-use platform for preparing and eSigning the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return. Our solution streamlines the document management process, ensuring that you can complete your tax return efficiently and accurately. This can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return. These features enhance collaboration and ensure that all parties can access and sign documents easily. Additionally, our platform is designed to keep your data secure.

-

Is airSlate SignNow cost-effective for small businesses handling tax returns?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing tax returns, including the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return. Our pricing plans are designed to fit various budgets, allowing businesses to access essential features without breaking the bank. This affordability makes it easier for small businesses to stay compliant with tax regulations.

-

Can airSlate SignNow integrate with accounting software for tax filing?

Absolutely! airSlate SignNow can integrate with various accounting software, making it easier to manage your tax filings, including the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return. This integration allows for seamless data transfer and helps ensure that all financial information is accurate and up-to-date. Streamlining your workflow can save you time and reduce errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return, offers numerous benefits. These include enhanced security, ease of use, and the ability to track document status in real-time. Our platform simplifies the eSigning process, ensuring that you can focus on your business while staying compliant with tax obligations.

Get more for Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Follow

Find out other Illinois Department Of Revenue Fiduciary Income And Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Follow

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free