Illinois Department of Revenue Form IL 1000 X Amended Pass through Entity Payment Income Tax Return Write the Amount You Are Pay

What is the Illinois Department Of Revenue Form IL 1000 X Amended Pass Through Entity Payment Income Tax Return?

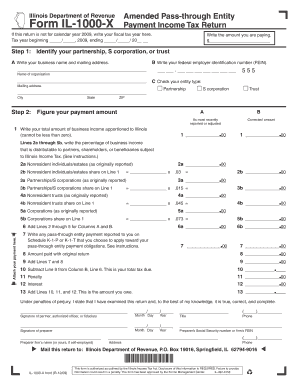

The Illinois Department Of Revenue Form IL 1000 X is used for amending the Pass Through Entity Payment Income Tax Return. This form allows entities such as partnerships and S corporations to report changes to their previously filed tax returns. If there are errors or adjustments needed in the original filing, this form serves as the official method to correct those discrepancies. It is essential for ensuring that the correct tax amount is reported and paid to the state of Illinois.

Steps to Complete the Illinois Department Of Revenue Form IL 1000 X

Completing the IL 1000 X involves several key steps. First, gather all relevant financial documents and details from the original tax return. Next, clearly indicate the changes being made by filling in the appropriate sections of the form. Be sure to write the amount you are paying in the designated area to reflect any additional tax owed. After completing the form, review it for accuracy before submission. Properly signing the form is also crucial, as it verifies the information provided.

How to Obtain the Illinois Department Of Revenue Form IL 1000 X

The IL 1000 X form can be obtained directly from the Illinois Department of Revenue's official website. It is available for download in PDF format, allowing for easy access and printing. Additionally, individuals may request a physical copy by contacting the department directly. Ensuring you have the latest version of the form is important, as tax regulations may change from year to year.

Key Elements of the Illinois Department Of Revenue Form IL 1000 X

Key elements of the IL 1000 X include sections for identifying the entity, detailing the changes being made, and specifying the amount of tax payment. The form requires accurate reporting of prior amounts and adjustments. It also includes a signature section to validate the information provided. Understanding these elements is crucial for proper completion and compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1000 X are typically aligned with the original tax return deadlines. It is important to file the amended return as soon as discrepancies are identified to avoid potential penalties. The Illinois Department of Revenue provides specific dates for each tax year, so checking the official announcements and guidelines is recommended to ensure timely submission.

Penalties for Non-Compliance

Failure to file the IL 1000 X or to pay the correct amount of tax can result in penalties from the Illinois Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential to address any issues with tax filings promptly to minimize the risk of penalties and ensure compliance with state tax laws.

Quick guide on how to complete illinois department of revenue form il 1000 x amended pass through entity payment income tax return write the amount you are

Prepare [SKS] seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, enabling you to acquire the appropriate format and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents rapidly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Adjust and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue form il 1000 x amended pass through entity payment income tax return write the amount you are

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Form IL 1000 X Amended Pass through Entity Payment Income Tax Return?

The Illinois Department Of Revenue Form IL 1000 X Amended Pass through Entity Payment Income Tax Return is a form used by businesses to amend their previously filed income tax returns. This form allows entities to correct errors and report the correct amount of tax owed. It is essential for ensuring compliance with Illinois tax regulations.

-

How do I fill out the Illinois Department Of Revenue Form IL 1000 X?

To fill out the Illinois Department Of Revenue Form IL 1000 X, you need to provide accurate information regarding your entity's income, deductions, and the amount you are paying. Make sure to review your previous filings to ensure all corrections are made. Utilizing airSlate SignNow can simplify this process by allowing you to eSign and send documents securely.

-

What are the benefits of using airSlate SignNow for the Illinois Department Of Revenue Form IL 1000 X?

Using airSlate SignNow for the Illinois Department Of Revenue Form IL 1000 X offers several benefits, including ease of use, cost-effectiveness, and secure document handling. You can quickly eSign and send your amended tax return, ensuring timely submission. This streamlines the process and reduces the risk of errors.

-

Is there a fee for filing the Illinois Department Of Revenue Form IL 1000 X?

Yes, there may be a fee associated with filing the Illinois Department Of Revenue Form IL 1000 X, depending on the amount you are paying. It's important to check the latest guidelines from the Illinois Department of Revenue for any applicable fees. airSlate SignNow can help you manage these payments efficiently.

-

Can I track the status of my Illinois Department Of Revenue Form IL 1000 X submission?

Yes, you can track the status of your Illinois Department Of Revenue Form IL 1000 X submission through the Illinois Department of Revenue's online portal. Additionally, using airSlate SignNow allows you to receive notifications and confirmations once your document has been signed and sent, providing peace of mind.

-

What integrations does airSlate SignNow offer for tax forms like the Illinois Department Of Revenue Form IL 1000 X?

airSlate SignNow offers various integrations with popular accounting and tax software, making it easier to manage your Illinois Department Of Revenue Form IL 1000 X. These integrations streamline data entry and ensure that your documents are always up-to-date. This enhances your overall workflow and efficiency.

-

How can airSlate SignNow help with compliance for the Illinois Department Of Revenue Form IL 1000 X?

airSlate SignNow helps ensure compliance with the Illinois Department Of Revenue Form IL 1000 X by providing templates and reminders for filing deadlines. The platform also allows for secure eSigning, which is crucial for maintaining the integrity of your submissions. This reduces the risk of non-compliance and potential penalties.

Get more for Illinois Department Of Revenue Form IL 1000 X Amended Pass through Entity Payment Income Tax Return Write The Amount You Are Pay

Find out other Illinois Department Of Revenue Form IL 1000 X Amended Pass through Entity Payment Income Tax Return Write The Amount You Are Pay

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe