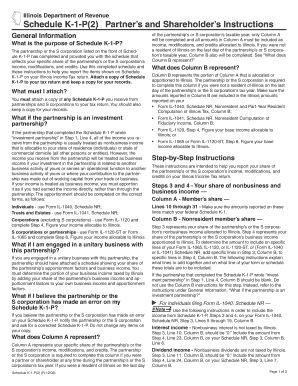

Illinois Department of Revenue Schedule K 1 P2 Partner S and Shareholder S Instructions General Information What is the Purpose

Understanding the Purpose of Schedule K-1 P

The Illinois Department of Revenue Schedule K-1 P is a crucial document used by partnerships and S corporations to report income, deductions, and credits to their partners and shareholders. This form provides detailed information about each partner's or shareholder's share of the entity's income, allowing them to accurately report their earnings on their individual tax returns. The primary purpose of Schedule K-1 P is to ensure transparency and compliance with state tax regulations, facilitating proper tax reporting for all involved parties.

Steps to Complete Schedule K-1 P

Completing the Schedule K-1 P involves several key steps:

- Gather necessary financial information from the partnership or S corporation.

- Fill out the identifying information for the partnership or S corporation, including name, address, and tax identification number.

- Report each partner's or shareholder's share of income, deductions, and credits in the appropriate sections of the form.

- Ensure that all amounts are accurate and reflect the entity's financial records.

- Provide copies of the completed Schedule K-1 P to each partner or shareholder for their tax filing.

Key Elements of Schedule K-1 P

Several key elements are essential when filling out Schedule K-1 P:

- Identifying Information: This includes the name, address, and tax identification number of both the partnership or S corporation and the partner or shareholder.

- Income Reporting: Partners and shareholders must report their share of ordinary business income, rental income, and other types of income.

- Deductions and Credits: The form should detail any deductions and credits allocated to the partner or shareholder, which can affect their overall tax liability.

- Signature: The form must be signed by an authorized representative of the partnership or S corporation, affirming the accuracy of the information provided.

Obtaining Schedule K-1 P

To obtain the Illinois Department of Revenue Schedule K-1 P, individuals can visit the official website of the Illinois Department of Revenue. The form is typically available for download in PDF format. Additionally, partnerships and S corporations may provide copies directly to their partners and shareholders as part of their tax documentation process. It is advisable to ensure that the most current version of the form is used to avoid any compliance issues.

Legal Use of Schedule K-1 P

The legal use of Schedule K-1 P is primarily to report income accurately for tax purposes. Partners and shareholders are required to include the information from this form when filing their individual tax returns. Failure to report this information can lead to penalties and interest on unpaid taxes. It is essential for both the entity and the partners or shareholders to understand their responsibilities regarding this form to maintain compliance with Illinois tax laws.

Filing Deadlines for Schedule K-1 P

Filing deadlines for Schedule K-1 P generally align with the tax filing deadlines for partnerships and S corporations. Typically, partnerships must file their tax returns by the 15th day of the third month following the end of their fiscal year. This means that partners and shareholders should receive their Schedule K-1 P in a timely manner to ensure they can meet their individual tax filing deadlines. It is important to stay informed about any changes to filing deadlines that may occur due to legislative updates or other factors.

Quick guide on how to complete illinois department of revenue schedule k 1 p2 partner s and shareholder s instructions general information what is the purpose

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

A seamless approach to edit and eSign [SKS]

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight signNow sections of your documents or redact sensitive information using features that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign [SKS] and maintain effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Is The Purpose

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule k 1 p2 partner s and shareholder s instructions general information what is the purpose

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions?

The Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions provide essential guidelines for partners and shareholders to report their income accurately. This document outlines the necessary information required for tax filing, ensuring compliance with Illinois tax laws.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Schedule K 1 P2?

airSlate SignNow streamlines the process of preparing and signing the Illinois Department Of Revenue Schedule K 1 P2. Our platform allows users to easily fill out, eSign, and send documents securely, making tax preparation more efficient and less stressful.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Illinois Department Of Revenue Schedule K 1 P2, offers numerous benefits. It provides a user-friendly interface, ensures document security, and allows for quick eSigning, which can save time and reduce errors in tax filing.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that simplify the completion and signing of tax forms, including the Illinois Department Of Revenue Schedule K 1 P2, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows users to manage their documents and the Illinois Department Of Revenue Schedule K 1 P2 efficiently, enhancing productivity and ensuring all data is synchronized.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including templates, automated workflows, and secure cloud storage. These features are particularly useful for managing tax documents like the Illinois Department Of Revenue Schedule K 1 P2, ensuring that all necessary forms are easily accessible and organized.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive tax documents, including the Illinois Department Of Revenue Schedule K 1 P2. Users can trust that their information is safe while using our platform.

Get more for Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Is The Purpose

Find out other Illinois Department Of Revenue Schedule K 1 P2 Partner S And Shareholder S Instructions General Information What Is The Purpose

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online