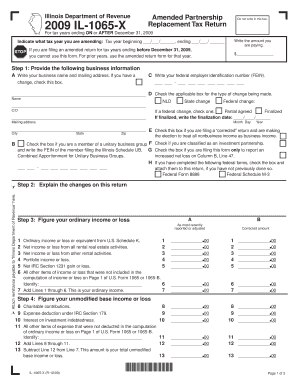

For Tax Years Ending on or AFTER December 31, Write the Amount You Are Paying Form

Understanding the Form for Tax Years Ending ON Or AFTER December 31

The form for tax years ending on or after December 31 is a crucial document for taxpayers in the United States. It is used to report the amount you are paying for taxes owed for the specified tax year. This form helps ensure compliance with IRS regulations and provides a clear record of your tax obligations. Understanding this form is essential for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Form for Tax Years Ending ON Or AFTER December 31

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, accurately fill in the amount you are paying, ensuring it aligns with your financial records. Double-check all entries for accuracy before submission. Finally, choose your preferred submission method, whether online, by mail, or in person, to ensure timely processing by the IRS.

IRS Guidelines for the Form for Tax Years Ending ON Or AFTER December 31

The IRS provides specific guidelines for filling out this form, which are essential for compliance. Taxpayers should refer to the IRS publication relevant to their tax year for detailed instructions. These guidelines outline how to report income, deductions, and credits accurately. Following these instructions helps avoid errors that could lead to audits or penalties.

Filing Deadlines for the Form for Tax Years Ending ON Or AFTER December 31

Filing deadlines for this form are critical for taxpayers. Typically, the deadline for submitting tax forms is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of these dates to avoid late fees or penalties. Additionally, taxpayers may request an extension if needed, but they must still pay any owed taxes by the original deadline.

Required Documents for the Form for Tax Years Ending ON Or AFTER December 31

To complete the form accurately, several documents are required. These typically include W-2 forms from employers, 1099 forms for other income, and records of any deductions or credits. Having these documents ready ensures that the information reported is complete and accurate, minimizing the risk of errors during the filing process.

Examples of Using the Form for Tax Years Ending ON Or AFTER December 31

Understanding how to use the form can be enhanced through examples. For instance, if a taxpayer earned a total of fifty thousand dollars in a tax year and has deductions amounting to ten thousand dollars, they would report the net amount of forty thousand dollars as their taxable income. This practical application helps clarify how to report amounts accurately and comply with tax regulations.

Quick guide on how to complete for tax years ending on or after december 31 write the amount you are paying 66712156

Prepare [SKS] effortlessly on any device

The management of documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional paper documents that are printed and signed, as you can locate the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to alter and electronically sign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

Create this form in 5 minutes!

How to create an eSignature for the for tax years ending on or after december 31 write the amount you are paying 66712156

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying'?

The phrase 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' is crucial for ensuring accurate tax reporting. It helps businesses determine their tax obligations based on the specific tax year. Understanding this can streamline your financial processes and ensure compliance.

-

How does airSlate SignNow assist with tax document management?

airSlate SignNow simplifies tax document management by allowing users to eSign and send documents securely. This ensures that all necessary forms related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' are handled efficiently. Our platform enhances organization and reduces the risk of errors in tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while ensuring you can manage documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' effectively.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software. This integration allows you to manage documents related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' alongside your financial records. This ensures a streamlined workflow and enhances productivity.

-

What features does airSlate SignNow offer for document security?

airSlate SignNow prioritizes document security with features like encryption, secure access, and audit trails. These features ensure that all documents, especially those related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying', are protected from unauthorized access. You can trust that your sensitive information is safe.

-

How can airSlate SignNow improve my business's efficiency?

By using airSlate SignNow, businesses can signNowly improve efficiency through automated workflows and quick document turnaround. This is particularly beneficial for managing tax-related documents, such as those for 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying'. Streamlined processes lead to faster decision-making and reduced administrative burdens.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any queries or issues. Whether you need help with features related to 'For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying' or general inquiries, our support team is ready to help you maximize your experience.

Get more for For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

Find out other For Tax Years Ending ON Or AFTER December 31, Write The Amount You Are Paying

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online