Illinois Department of Revenue Schedule M Other Additions and Subtractions for Individuals Attach to Your Form IL 1040 IL

Understanding the Illinois Department Of Revenue Schedule M

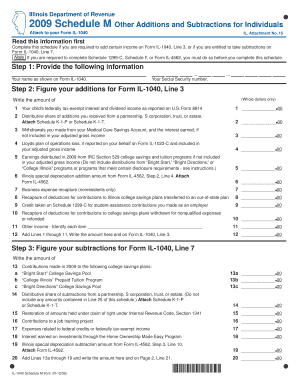

The Illinois Department Of Revenue Schedule M is a crucial form for individuals filing their state income tax returns. This form is specifically designed to report other additions and subtractions that affect the calculation of taxable income. It is essential for accurately reflecting any adjustments that may not be included in the standard Form IL-1040. By utilizing Schedule M, taxpayers can ensure they are compliant with state tax regulations while maximizing their potential deductions.

How to Use Schedule M for Your IL-1040

Using Schedule M involves several key steps. First, gather all relevant financial documents, including income statements and records of any deductions or credits you plan to claim. Next, carefully fill out the form, ensuring that you accurately report any additions and subtractions to your income. Once completed, attach Schedule M to your Form IL-1040 before submitting your tax return. This attachment is necessary for the Illinois Department of Revenue to process your return correctly and assess your tax liability.

Steps to Complete Schedule M

Completing Schedule M requires attention to detail. Begin by entering your name and Social Security number at the top of the form. Then, follow these steps:

- Identify any additions to your income, such as interest from state or municipal bonds.

- List any subtractions, including qualifying retirement income or other allowable deductions.

- Calculate the total additions and subtractions to determine your adjusted income.

- Double-check all entries for accuracy before finalizing the form.

After completing these steps, attach Schedule M to your Form IL-1040 and ensure both forms are submitted by the filing deadline.

Legal Use of Schedule M

Schedule M is legally required for Illinois taxpayers who need to report specific income adjustments. Failure to include this form when necessary can lead to complications with the Illinois Department of Revenue, including potential penalties or delays in processing your tax return. It is important to understand the legal implications of your tax filings and ensure compliance with state laws to avoid any issues.

Key Elements of Schedule M

Several key elements are essential to understand when completing Schedule M:

- Additions: These include items that increase your taxable income, such as certain types of interest income.

- Subtractions: These are deductions that reduce your taxable income, such as retirement income or specific tax credits.

- Calculation Section: This section is where you compute the total adjustments to your income, which is vital for determining your tax liability.

Understanding these elements will help ensure that you accurately report your income and comply with state tax regulations.

Filing Deadlines for Schedule M

It is important to be aware of the filing deadlines associated with Schedule M. Typically, the deadline for submitting your Illinois state tax return, including Form IL-1040 and Schedule M, is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should always verify the specific deadlines for the tax year they are filing to ensure timely submission.

Quick guide on how to complete illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 il 10998630

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without holdups. Handle [SKS] on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specially offers for such tasks.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that require printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule m other additions and subtractions for individuals attach to your form il 1040 il 10998630

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals?

The Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals is a form that allows taxpayers to report specific additions and subtractions to their income when filing Form IL 1040 IL. This form is essential for accurately calculating your taxable income and ensuring compliance with state tax regulations.

-

How do I attach the Schedule M to my Form IL 1040 IL?

To attach the Schedule M to your Form IL 1040 IL, simply include it as a supplementary document when submitting your tax return. Ensure that all relevant additions and subtractions are clearly detailed on the Schedule M to avoid any processing delays or issues with the Illinois Department of Revenue.

-

What are the benefits of using airSlate SignNow for submitting my Schedule M?

Using airSlate SignNow to submit your Schedule M provides a streamlined, efficient process for eSigning and sending your documents. Our platform ensures that your forms are securely transmitted and easily accessible, making it simpler to manage your tax filings, including the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs, including options for individuals and businesses. Our cost-effective solutions provide great value for securely managing and eSigning important documents like the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This integration allows you to easily manage your documents, including the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals, alongside your other tax-related tasks.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including eSigning, document templates, and secure storage. These features simplify the process of preparing and submitting forms like the Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals, ensuring you can focus on your tax strategy.

-

How can airSlate SignNow help me stay compliant with Illinois tax regulations?

airSlate SignNow helps you stay compliant with Illinois tax regulations by providing a secure platform for managing your tax documents. By using our service to submit your Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals, you can ensure that your filings are accurate and timely, reducing the risk of penalties.

Get more for Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

Find out other Illinois Department Of Revenue Schedule M Other Additions And Subtractions For Individuals Attach To Your Form IL 1040 IL

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF