Illinois Department of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment for Cooperatives Month Attach to Your Form

Understanding the Illinois Department Of Revenue Schedule INL

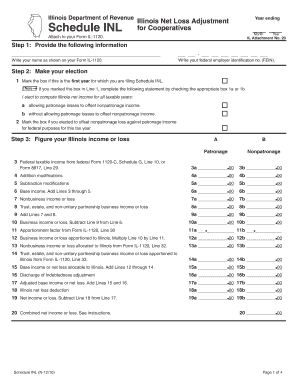

The Illinois Department Of Revenue Schedule INL is a crucial form for cooperatives that need to report their net loss adjustments. This form is specifically designed for the year ending and must be attached to Form IL-1120. It allows cooperatives to adjust their taxable income based on losses incurred during the fiscal year, ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete the Schedule INL

Completing the Schedule INL involves several key steps:

- Gather financial records, including income statements and balance sheets for the year.

- Calculate the total net loss for the cooperative, ensuring all relevant deductions and expenses are accounted for.

- Fill out the Schedule INL form with the calculated net loss, following the instructions provided by the Illinois Department of Revenue.

- Attach the completed Schedule INL to your Form IL-1120 before submission.

Eligibility Criteria for Using Schedule INL

To use the Illinois Department Of Revenue Schedule INL, cooperatives must meet specific eligibility criteria. These include being recognized as a cooperative under Illinois law and having incurred a net loss during the reporting year. Additionally, the cooperative must file Form IL-1120 to report its income and tax obligations.

Required Documents for Filing

When preparing to file the Schedule INL, cooperatives should have the following documents ready:

- Financial statements for the year, including profit and loss statements.

- Tax returns from previous years, if applicable.

- Any supporting documentation for deductions claimed.

Filing Deadlines for Schedule INL

It is essential to be aware of the filing deadlines for the Schedule INL. The form must be submitted along with Form IL-1120 by the due date established by the Illinois Department of Revenue. Typically, this deadline aligns with the federal tax filing deadline, but it is advisable to verify specific dates each tax year.

Legal Use of Schedule INL

The Schedule INL serves a legal purpose, allowing cooperatives to report their financial status accurately to the state. Properly completing and submitting this form can help avoid penalties and ensure compliance with Illinois tax laws. It is crucial for cooperatives to understand their legal obligations when using this form.

Quick guide on how to complete illinois department of revenue schedule inl year ending illinois net loss adjustment for cooperatives month attach to your form

Effortlessly prepare [SKS] on any gadget

The management of online documents has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically available through airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Modify and eSign [SKS] and guarantee effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue schedule inl year ending illinois net loss adjustment for cooperatives month attach to your form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month?

The Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month is a form used by cooperatives to report their net loss adjustments for the tax year. This schedule helps ensure that cooperatives accurately reflect their financial status when filing Form IL 1120.

-

How do I attach the Schedule INL to my Form IL 1120?

To attach the Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month to your Form IL 1120, simply include it as a supporting document when submitting your tax return. Ensure that all relevant information is filled out correctly to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for submitting my Schedule INL?

Using airSlate SignNow allows you to easily eSign and send your Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month securely and efficiently. Our platform streamlines the document submission process, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our cost-effective solutions provide you with the tools necessary to manage your Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month and other documents efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to manage your Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month alongside your other financial documents. This integration enhances your workflow and simplifies the filing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and secure cloud storage, making it easy to manage your Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month. These tools help ensure that your documents are organized and accessible whenever you need them.

-

How can I ensure my Schedule INL is filed correctly?

To ensure your Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month is filed correctly, double-check all entries for accuracy and completeness. Utilizing airSlate SignNow's document management features can help you keep track of your submissions and any required attachments.

Get more for Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month Attach To Your Form

Find out other Illinois Department Of Revenue Schedule INL Year Ending Illinois Net Loss Adjustment For Cooperatives Month Attach To Your Form

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer