IL 990 T X *031801110* Tax Illinois Form

What is the IL 990 T X *031801110* Tax Illinois

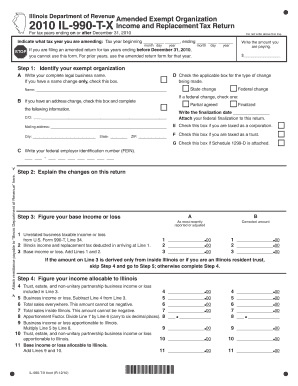

The IL 990 T X *031801110* Tax Illinois form is a state tax return specifically designed for certain organizations that are exempt from federal income tax. This form is utilized by entities such as non-profits, charities, and other tax-exempt organizations to report their unrelated business income to the Illinois Department of Revenue. The primary purpose of the IL 990 T X is to ensure that these organizations comply with state tax regulations while maintaining their tax-exempt status.

Steps to Complete the IL 990 T X *031801110* Tax Illinois

Completing the IL 990 T X involves several key steps to ensure accurate reporting of unrelated business income. Start by gathering all necessary financial documents, including income statements and expense records related to the unrelated business activities. Next, fill out the form by providing details such as the organization's name, address, and federal employer identification number (EIN). Report all sources of unrelated business income and related expenses on the appropriate lines of the form. Finally, review the completed form for accuracy before submitting it to the Illinois Department of Revenue.

Legal Use of the IL 990 T X *031801110* Tax Illinois

The legal use of the IL 990 T X *031801110* Tax Illinois is crucial for maintaining compliance with state tax laws. Organizations that engage in unrelated business activities must file this form to report income generated from those activities. Failure to file can result in penalties and jeopardize the organization’s tax-exempt status. It is important for organizations to understand the legal implications of their unrelated business income and ensure timely and accurate filing of the IL 990 T X.

Filing Deadlines / Important Dates

Filing deadlines for the IL 990 T X *031801110* Tax Illinois are critical for compliance. Typically, the form is due on the 15th day of the fifth month following the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. It is essential for organizations to be aware of these deadlines to avoid late fees and maintain their good standing with the Illinois Department of Revenue.

Required Documents

To successfully complete the IL 990 T X *031801110* Tax Illinois, organizations must gather several required documents. These include:

- Financial statements detailing income and expenses from unrelated business activities.

- Federal tax returns, including any relevant schedules that report unrelated business income.

- Documentation supporting any deductions claimed on the form.

- Any correspondence from the Illinois Department of Revenue regarding previous filings.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Who Issues the Form

The IL 990 T X *031801110* Tax Illinois form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among all taxpayers, including tax-exempt organizations. Organizations must adhere to the guidelines set forth by the Department of Revenue when completing and submitting this form.

Quick guide on how to complete il 990 t x 031801110 tax illinois

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained signNow traction among both businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign [SKS] Without Any Strain

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or mistakes that compel you to print new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 990 T X *031801110* Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 990 t x 031801110 tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 990 T X *031801110* Tax Illinois form?

The IL 990 T X *031801110* Tax Illinois form is used by organizations to report and pay taxes on unrelated business income. This form is essential for non-profits and other entities to ensure compliance with Illinois tax regulations. Understanding how to fill out this form correctly can help avoid penalties and ensure proper tax reporting.

-

How can airSlate SignNow help with the IL 990 T X *031801110* Tax Illinois form?

airSlate SignNow provides an efficient platform for electronically signing and sending the IL 990 T X *031801110* Tax Illinois form. With our user-friendly interface, you can easily manage your tax documents and ensure they are submitted on time. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those needing to manage the IL 990 T X *031801110* Tax Illinois form. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, all of which are beneficial for managing the IL 990 T X *031801110* Tax Illinois form. These features enhance efficiency and ensure that your documents are organized and easily accessible. Additionally, you can track document status in real-time.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various legal and regulatory standards, including those related to the IL 990 T X *031801110* Tax Illinois form. Our platform ensures that your electronic signatures and document submissions meet the necessary compliance requirements. This gives you peace of mind when managing your tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage the IL 990 T X *031801110* Tax Illinois form. This integration allows for seamless data transfer and enhances your overall workflow. You can connect with tools you already use to streamline your tax processes.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the IL 990 T X *031801110* Tax Illinois form, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process and ensures that your documents are stored securely in the cloud. This allows you to focus more on your business and less on administrative tasks.

Get more for IL 990 T X *031801110* Tax Illinois

- Vt advance form

- Contract for deed package vermont form

- Vt advance 497429051 form

- Vermont power attorney form

- Revised uniform anatomical gift act donation vermont

- Employment hiring process package vermont form

- Revocation of anatomical gift donation vermont form

- Employment or job termination package vermont form

Find out other IL 990 T X *031801110* Tax Illinois

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online