ICT 1 Electricity Distribution and Invested Capital Tax Estimated Tax Illinois Form

What is the ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois

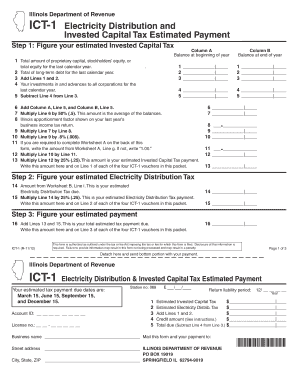

The ICT 1 Electricity Distribution and Invested Capital Tax Estimated Tax in Illinois is a specific tax form that applies to electricity distribution companies operating within the state. This tax is designed to assess the capital invested in infrastructure and the distribution of electricity. It is crucial for companies to accurately estimate their tax obligations to ensure compliance with state regulations. The form captures essential financial data that reflects the company's investment in electricity distribution assets.

Steps to complete the ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois

Completing the ICT 1 form involves several key steps:

- Gather financial records related to electricity distribution investments.

- Calculate the total invested capital in distribution infrastructure.

- Estimate the tax liability based on the calculated capital.

- Fill out the ICT 1 form with accurate financial data.

- Review the form for completeness and accuracy.

- Submit the form by the specified deadline.

Required Documents

To complete the ICT 1 form, certain documents are necessary. These typically include:

- Financial statements that detail the company's assets and liabilities.

- Records of capital expenditures related to electricity distribution.

- Previous tax returns, if applicable, for reference.

- Any supporting documentation that validates the estimated capital.

Filing Deadlines / Important Dates

Filing deadlines for the ICT 1 form are critical to avoid penalties. Generally, the estimated tax must be filed by a specific date each year, often aligned with the state’s tax calendar. Companies should be aware of these dates to ensure timely submission:

- Initial filing deadline for estimated taxes.

- Any extensions that may apply.

- Final submission date for the annual tax return.

Legal use of the ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois

The ICT 1 form must be used in accordance with Illinois state tax laws. It serves as a legal document for reporting estimated taxes related to electricity distribution. Companies are required to adhere to all regulations governing the use of this form, ensuring that all reported figures are accurate and substantiated by proper documentation. Non-compliance can result in penalties or legal repercussions.

Who Issues the Form

The ICT 1 Electricity Distribution and Invested Capital Tax Estimated Tax form is issued by the Illinois Department of Revenue. This department is responsible for administering tax laws and ensuring compliance among businesses operating within the state. Companies should refer to the department's guidelines for any updates or changes to the form or filing procedures.

Quick guide on how to complete ict 1 electricity distribution and invested capital tax estimated tax illinois

Complete [SKS] seamlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without hindrances. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ict 1 electricity distribution and invested capital tax estimated tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois?

ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois refers to the tax obligations related to electricity distribution and invested capital in the state of Illinois. Understanding this tax is crucial for businesses in the energy sector to ensure compliance and optimize their financial strategies.

-

How can airSlate SignNow help with managing ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois?

airSlate SignNow provides an efficient platform for managing documents related to ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois. With our eSigning capabilities, businesses can quickly sign and send tax documents, ensuring timely submissions and compliance with state regulations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois documents. These tools streamline the process, making it easier for businesses to handle their tax obligations efficiently.

-

Is airSlate SignNow cost-effective for small businesses dealing with ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while still accessing essential features.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your ability to manage ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois. This integration ensures that all your documents and data are synchronized, reducing the risk of errors and improving efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois, offers numerous benefits. These include increased efficiency, reduced paperwork, enhanced security, and the ability to track document status in real-time, which simplifies the tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois. Our platform ensures that your data remains confidential and secure throughout the signing process.

Get more for ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois

Find out other ICT 1 Electricity Distribution And Invested Capital Tax Estimated Tax Illinois

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple