GENERAL INFORMATION If You Are Unable to Pay the Full Amount Due with Your Individual Income Tax Return, You May Request an Inst 2021

Understanding the Installment Agreement Request

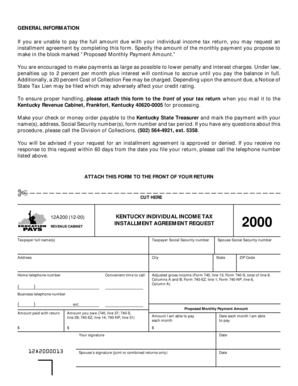

The form titled "GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky" is designed for individuals who find themselves unable to pay their full tax liability when filing their income tax return. This form allows taxpayers to request an installment agreement, enabling them to pay their tax debt over time rather than in a lump sum. Understanding this process is crucial for managing tax obligations effectively.

Steps to Complete the Installment Agreement Request

Completing the request for an installment agreement involves several key steps. First, gather all necessary financial information, including your total tax liability and income details. Next, fill out the form accurately, ensuring that all information is current and complete. After completing the form, review it for any errors before submission. It is important to submit the form to the appropriate revenue office as indicated in the instructions. Keep a copy of the submitted form for your records.

Eligibility Criteria for the Installment Agreement

To qualify for an installment agreement, certain criteria must be met. Taxpayers should have filed all required tax returns and must not have any outstanding tax liens. Additionally, the total amount owed should fall within specific limits set by the revenue department. If you are self-employed or have fluctuating income, you may need to provide additional documentation to support your request. Understanding these criteria can help streamline the application process.

Required Documents for Submission

When submitting the request for an installment agreement, it is essential to include all required documentation. This may include proof of income, such as pay stubs or bank statements, and any other financial records that demonstrate your ability to pay. Providing accurate and complete documentation can facilitate a smoother approval process and help avoid delays in establishing your payment plan.

Form Submission Methods

The completed form can be submitted through various methods. Taxpayers may choose to file the form online, mail it directly to the designated revenue office, or deliver it in person. Each method has its own processing times and requirements, so it is advisable to select the method that best suits your circumstances. Ensure that you follow the submission guidelines carefully to avoid any complications.

Potential Penalties for Non-Compliance

Failure to comply with tax obligations can result in significant penalties. If you do not submit your payment or fail to adhere to the terms of your installment agreement, you may incur additional fees or interest on your outstanding balance. Understanding these potential consequences highlights the importance of timely and accurate submissions, as well as maintaining communication with the revenue department regarding your payment status.

Quick guide on how to complete general information if you are unable to pay the full amount due with your individual income tax return you may request an

Complete GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst effortlessly on any device

Online document management has become increasingly popular with organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst with ease

- Find GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general information if you are unable to pay the full amount due with your individual income tax return you may request an

Create this form in 5 minutes!

How to create an eSignature for the general information if you are unable to pay the full amount due with your individual income tax return you may request an

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for requesting an installment agreement if I cannot pay my full tax amount?

GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky. This process involves filling out the necessary form and submitting it to the appropriate tax authority, allowing you to pay your taxes in manageable installments.

-

Are there any fees associated with setting up an installment agreement?

Yes, there may be fees involved when you request an installment agreement. GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, and it's important to review any associated costs to ensure you understand the financial implications.

-

How long does it take to get approved for an installment agreement?

The approval time for an installment agreement can vary. Generally, after submitting your request, you can expect a response within a few weeks. Remember, GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, so timely submission is crucial.

-

What happens if I miss a payment on my installment agreement?

If you miss a payment on your installment agreement, it could lead to penalties or the cancellation of your agreement. It's essential to stay on track with your payments. GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, which can help you manage your payments effectively.

-

Can I change my installment agreement after it has been set up?

Yes, you can request changes to your installment agreement if your financial situation changes. You will need to contact the tax authority to discuss your options. Remember, GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, which allows for flexibility in managing your tax obligations.

-

What information do I need to provide when requesting an installment agreement?

When requesting an installment agreement, you will need to provide personal information, tax details, and financial information. This helps the tax authority assess your situation. GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, ensuring you have all necessary documentation ready.

-

Is there a minimum payment amount for installment agreements?

Yes, there is typically a minimum payment amount required for installment agreements. This amount can vary based on your total tax liability and financial situation. GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Installment Agreement By Completing This Form Revenue Ky, which outlines the minimum payment requirements.

Get more for GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst

Find out other GENERAL INFORMATION If You Are Unable To Pay The Full Amount Due With Your Individual Income Tax Return, You May Request An Inst

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors