12A200 Kentucky Income Tax Installment Agreement Request 2017

What is the 12A200 Kentucky Income Tax Installment Agreement Request

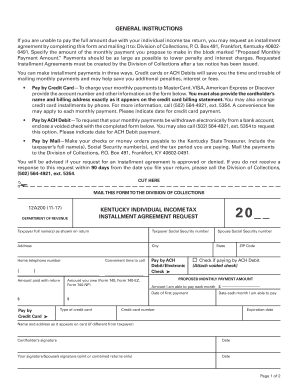

The 12A200 Kentucky Income Tax Installment Agreement Request is a form used by taxpayers in Kentucky to request a payment plan for their state income tax obligations. This form is particularly useful for individuals or businesses that are unable to pay their full tax liability by the due date. By submitting this request, taxpayers can propose a structured plan to pay off their debts over time, ensuring compliance with state tax regulations while managing their financial responsibilities.

How to use the 12A200 Kentucky Income Tax Installment Agreement Request

To effectively use the 12A200 Kentucky Income Tax Installment Agreement Request, taxpayers should first gather all necessary financial information, including income, expenses, and the total amount owed. Once this information is compiled, the taxpayer can fill out the form, detailing their proposed payment plan. It is essential to provide accurate and complete information to avoid delays in processing. After completing the form, it should be submitted according to the specified methods, ensuring that it is sent to the appropriate Kentucky Department of Revenue address.

Steps to complete the 12A200 Kentucky Income Tax Installment Agreement Request

Completing the 12A200 Kentucky Income Tax Installment Agreement Request involves several key steps:

- Gather all relevant financial documents, including income statements and tax returns.

- Calculate the total tax liability and determine an affordable monthly payment amount.

- Fill out the 12A200 form accurately, including personal information and payment proposal.

- Review the form for completeness and accuracy before submission.

- Submit the form via the designated method, whether online, by mail, or in person.

Eligibility Criteria

To qualify for the 12A200 Kentucky Income Tax Installment Agreement, taxpayers must meet specific eligibility criteria. Generally, individuals or businesses must have a valid tax liability with the Kentucky Department of Revenue and demonstrate an inability to pay the full amount due. Additionally, the proposed payment plan must be reasonable based on the taxpayer's financial situation. It is important to note that previous compliance with tax obligations may also be considered in the approval process.

Required Documents

When submitting the 12A200 Kentucky Income Tax Installment Agreement Request, taxpayers should include several key documents to support their application. These may include:

- Recent tax returns to verify income and tax liability.

- Proof of income, such as pay stubs or bank statements.

- Documentation of monthly expenses to demonstrate financial need.

- Any previous correspondence with the Kentucky Department of Revenue regarding tax liabilities.

Form Submission Methods

The 12A200 Kentucky Income Tax Installment Agreement Request can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online via the Kentucky Department of Revenue's website, mail it to the appropriate address, or deliver it in person at a local office. Each method has its own processing times, so taxpayers should consider their circumstances when selecting a submission method.

Quick guide on how to complete 12a200 kentucky income tax installment agreement request

Effortlessly Prepare 12A200 Kentucky Income Tax Installment Agreement Request on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without any holdups. Handle 12A200 Kentucky Income Tax Installment Agreement Request on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign 12A200 Kentucky Income Tax Installment Agreement Request without Difficulty

- Find 12A200 Kentucky Income Tax Installment Agreement Request and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 12A200 Kentucky Income Tax Installment Agreement Request to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 12a200 kentucky income tax installment agreement request

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

Create this form in 5 minutes!

How to create an eSignature for the 12a200 kentucky income tax installment agreement request

How to create an electronic signature for the 12a200 Kentucky Income Tax Installment Agreement Request online

How to create an eSignature for the 12a200 Kentucky Income Tax Installment Agreement Request in Chrome

How to make an electronic signature for putting it on the 12a200 Kentucky Income Tax Installment Agreement Request in Gmail

How to make an electronic signature for the 12a200 Kentucky Income Tax Installment Agreement Request straight from your mobile device

How to make an eSignature for the 12a200 Kentucky Income Tax Installment Agreement Request on iOS

How to generate an electronic signature for the 12a200 Kentucky Income Tax Installment Agreement Request on Android devices

People also ask

-

What is the 12A200 Kentucky Income Tax Installment Agreement Request?

The 12A200 Kentucky Income Tax Installment Agreement Request is a form used by taxpayers in Kentucky to request a payment plan for their state income taxes. This agreement allows individuals to pay their tax liabilities in manageable installments, rather than as a lump sum. Utilizing airSlate SignNow simplifies the process of completing and submitting the 12A200 Kentucky Income Tax Installment Agreement Request electronically.

-

How can airSlate SignNow help me with the 12A200 Kentucky Income Tax Installment Agreement Request?

airSlate SignNow provides a user-friendly platform that allows you to complete and eSign the 12A200 Kentucky Income Tax Installment Agreement Request quickly and securely. With our electronic signature capabilities, you can ensure that your request is submitted without delays. Our solution makes it convenient to manage tax forms and agreements from anywhere, anytime.

-

Is there a fee for using airSlate SignNow to submit the 12A200 Kentucky Income Tax Installment Agreement Request?

The pricing for using airSlate SignNow varies based on the subscription plan you choose. However, our service is designed to be cost-effective, especially when compared to traditional methods of document handling. By using airSlate SignNow for your 12A200 Kentucky Income Tax Installment Agreement Request, you save time and resources.

-

What features does airSlate SignNow offer for the 12A200 Kentucky Income Tax Installment Agreement Request?

With airSlate SignNow, you can easily fill out the 12A200 Kentucky Income Tax Installment Agreement Request, add signatures, and send it directly to the relevant tax authorities. Our platform includes features such as document templates, reminders, and tracking, ensuring you stay organized throughout the process. These features streamline your tax management experience.

-

Can I integrate airSlate SignNow with other applications for the 12A200 Kentucky Income Tax Installment Agreement Request?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and Zapier, making it easier to manage your documents related to the 12A200 Kentucky Income Tax Installment Agreement Request. This integration capability allows for a seamless transition between your tax preparation and document management.

-

What are the benefits of using airSlate SignNow for the 12A200 Kentucky Income Tax Installment Agreement Request?

Using airSlate SignNow for the 12A200 Kentucky Income Tax Installment Agreement Request provides you with a hassle-free way to manage your tax obligations. The electronic signing feature saves time compared to traditional methods, and the secure storage of your documents ensures confidentiality. Additionally, our platform is designed to simplify the tax agreement process for all users.

-

How secure is my information when using airSlate SignNow for the 12A200 Kentucky Income Tax Installment Agreement Request?

airSlate SignNow prioritizes your security by employing advanced encryption and security measures to protect your information. When you submit the 12A200 Kentucky Income Tax Installment Agreement Request through our platform, you can trust that your data remains confidential and secure. We adhere to industry standards to ensure the safety of your personal and financial information.

Get more for 12A200 Kentucky Income Tax Installment Agreement Request

- Alaska work permit form

- Pg 640 form

- State of alaska bidders registration 2012 form

- Retiree beneficiary designation form 02 822a doa alaska

- Certificate of election to dissolve commerce commerce alaska form

- Physician assistant collaborative plan 2014 form

- Form pit x new mexico personal income tax amended

- Form it 209 claim for noncustodial parent new york state earned income credit tax year 794836070

Find out other 12A200 Kentucky Income Tax Installment Agreement Request

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure