FF 086 0 1T NFIP Flood Insurance Application, May Form

Understanding the NFIP Flood Insurance Application

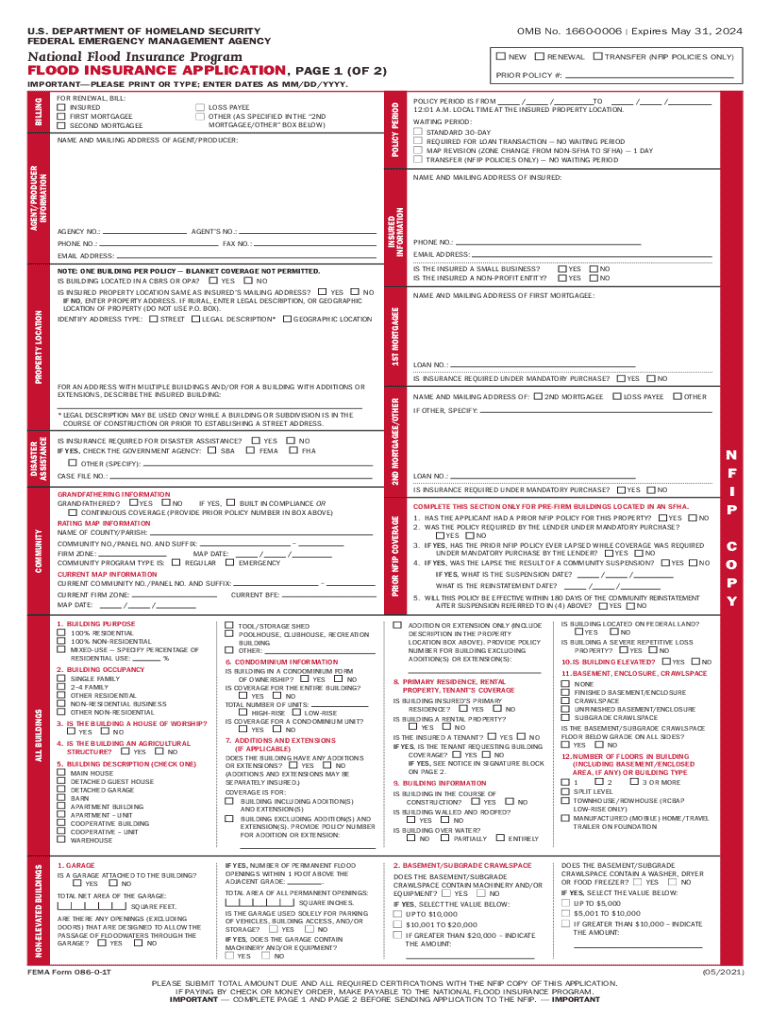

The NFIP Flood Insurance Application, specifically the FF 086 0 1T form, is essential for individuals and businesses seeking to obtain flood insurance through the National Flood Insurance Program (NFIP). This application is designed to collect necessary information about the property and the applicant to assess eligibility for coverage. It includes sections for personal details, property information, and coverage preferences, ensuring that applicants provide comprehensive data to support their request.

Steps to Complete the NFIP Flood Insurance Application

Completing the FF 086 0 1T NFIP Flood Insurance Application involves several key steps:

- Gather necessary documents, including proof of ownership and property details.

- Fill out the application form accurately, ensuring all sections are completed.

- Review the application for any errors or omissions before submission.

- Submit the application through the preferred method, whether online or via mail.

Taking the time to carefully complete each step helps streamline the approval process and increases the likelihood of receiving coverage.

Eligibility Criteria for the NFIP Flood Insurance Application

To qualify for flood insurance through the NFIP, applicants must meet specific eligibility criteria. These include:

- Properties located in participating communities within the NFIP.

- Compliance with local floodplain management regulations.

- Providing accurate information about the property, including its flood zone designation.

Understanding these criteria is crucial for applicants to ensure they meet the necessary requirements before submitting their application.

Required Documents for the NFIP Flood Insurance Application

When filling out the FF 086 0 1T form, applicants need to provide several documents to support their application. These typically include:

- Proof of property ownership, such as a deed or title.

- Details regarding the property's location and flood zone classification.

- Any previous flood insurance policy documents, if applicable.

Having these documents ready can expedite the application process and help ensure that all necessary information is submitted.

Form Submission Methods for the NFIP Flood Insurance Application

The FF 086 0 1T NFIP Flood Insurance Application can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through approved NFIP agents or websites.

- Mailing the completed form to the designated NFIP address.

- In-person submission at local NFIP offices or authorized agents.

Choosing the right submission method can depend on the applicant's preferences and the urgency of obtaining coverage.

Key Elements of the NFIP Flood Insurance Application

The FF 086 0 1T form contains several key elements that are crucial for a successful application. These include:

- Applicant information, such as name, address, and contact details.

- Property details, including the address, type of structure, and flood zone.

- Coverage options, allowing applicants to select their desired policy limits and deductibles.

Understanding these elements can help applicants provide the necessary information and make informed decisions about their coverage options.

Quick guide on how to complete ff 086 0 1t nfip flood insurance application may

Prepare FF 086 0 1T NFIP Flood Insurance Application, May effortlessly on any gadget

Web-based document handling has gained traction among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the proper form and securely keep it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents rapidly without delays. Manage FF 086 0 1T NFIP Flood Insurance Application, May on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign FF 086 0 1T NFIP Flood Insurance Application, May with ease

- Find FF 086 0 1T NFIP Flood Insurance Application, May and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign FF 086 0 1T NFIP Flood Insurance Application, May and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ff 086 0 1t nfip flood insurance application may

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to fill out the form flood insurance application using airSlate SignNow?

Filling out the form flood insurance application with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures and information, and share it with the relevant parties. Our platform ensures that the process is seamless and user-friendly.

-

How much does it cost to use airSlate SignNow for the form flood insurance application?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget, and the cost of using our service for the form flood insurance application is designed to be cost-effective. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow offer for the form flood insurance application?

Our platform provides a range of features for the form flood insurance application, including customizable templates, electronic signatures, and real-time tracking. These features enhance the efficiency of your document management process, making it easier to complete applications quickly and securely.

-

Can I integrate airSlate SignNow with other applications for the form flood insurance application?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow. You can connect with CRM systems, cloud storage services, and other tools to enhance the process of managing your form flood insurance application. This integration capability helps you maintain a cohesive workflow.

-

What are the benefits of using airSlate SignNow for the form flood insurance application?

Using airSlate SignNow for the form flood insurance application provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete applications faster while ensuring that all data is securely stored and easily accessible.

-

Is airSlate SignNow secure for handling the form flood insurance application?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your form flood insurance application is handled with the utmost care. We utilize advanced encryption and security protocols to protect your sensitive information throughout the signing process.

-

How can I track the status of my form flood insurance application in airSlate SignNow?

You can easily track the status of your form flood insurance application through the airSlate SignNow dashboard. Our platform provides real-time updates on document status, so you can see when it has been viewed, signed, or completed, allowing for better management of your applications.

Get more for FF 086 0 1T NFIP Flood Insurance Application, May

- U s fish and wildlife service form 3 2392 operatorauthorization test heavy equipment fws

- Sanlam besonderhede van afhanklikes aftree pensioenfondse in english downloud the form in english please

- U s air force form af60 download

- Copyright transfer form pdf spie spie

- Cube that is fillable form

- Certificate of real estate value sdcl 7 9 74 minnehahacounty form

- Form ct 245 iinstructions for form ct 245 maintenance fee tax ny

- 5001en calculation of withholding tax on dividend form

Find out other FF 086 0 1T NFIP Flood Insurance Application, May

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online